Latest Version

11.32.0

September 10, 2024

NerdWallet

Finance

Android

0

Free

com.mobilecreditcards

Report a Problem

More About NerdWallet: Manage Your Money

Unlock Your Financial Potential with Our Free Personal Finance Tracking App

Managing your finances can be a daunting task, but with our free personal finance tracking app, you can take control of your financial journey effortlessly. This comprehensive tool is designed to help you understand your cash flow, monitor your net worth, and build your credit, all while making smart financial decisions. Let’s dive into how our app can transform your financial management experience.

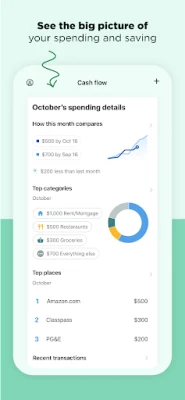

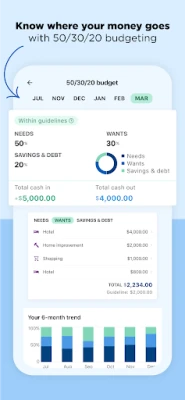

Understand Your Cash Flow

One of the key features of our app is its ability to help you track your spending across multiple cards. This means you can easily see where your money is going, allowing you to make informed decisions about your budget. Here’s how it works:

- Comprehensive Spending Tracking: Monitor your expenses across various accounts to get a complete picture of your financial habits.

- 50/30/20 Budgeting Method: Utilize our built-in budgeting framework to allocate your income effectively—50% for needs, 30% for wants, and 20% for savings.

- Detailed Spending Insights: Gain valuable insights into your spending patterns, helping you identify areas where you can cut back.

- Bill and Expense Management: Keep track of your bills and other expenses to avoid late payments and unnecessary fees.

- Month-to-Month Comparisons: Analyze your spending trends over time to see how your financial habits evolve.

- Top Spending Categories: Identify your primary spending categories to streamline your budgeting process.

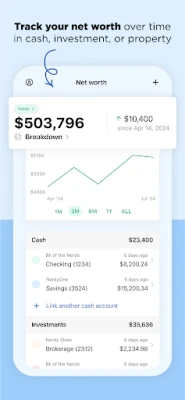

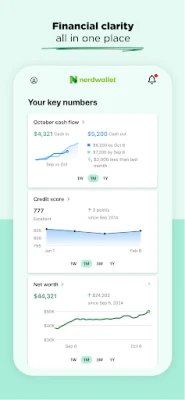

Monitor and Build Your Net Worth

Understanding your net worth is crucial for long-term financial health. Our app allows you to:

- Track Income and Debts: See how your income, debts, investments, and home value contribute to your overall net worth.

- Historical Tracking: Follow the history of your net worth over time to understand your financial growth.

- Detailed Account Insights: Zoom into individual accounts to track their performance and make necessary adjustments.

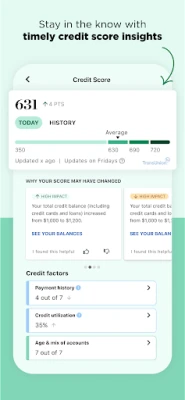

Enhance Your Credit Monitoring

Your credit score plays a significant role in your financial life. With our app, you can:

- Access Your Credit Score: Check your credit score and report anytime to stay informed about your credit health.

- Score Change Notifications: Receive alerts when your credit score changes, helping you stay on top of your financial status.

- Understand Credit Factors: Learn about the various factors that influence your credit score, empowering you to make better financial decisions.

- Build Your Credit: Discover strategies to improve your credit score, such as increasing your credit utilization or paying bills early.

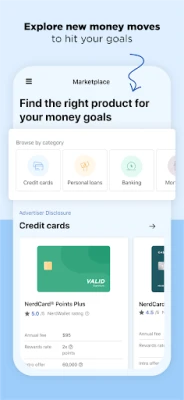

Make Smart Financial Moves

Our app not only helps you track your finances but also empowers you to make smarter financial choices:

- Compare Financial Products: Quickly find and compare credit cards, loan rates, and high-yield bank accounts that suit your needs.

- NerdWallet+ Membership: Join NerdWallet+ to earn rewards worth up to $350 for making wise financial decisions, like timely credit card payments.

- Drive Like a Nerd: Track your driving habits in real-time, score your performance, and qualify for better auto insurance rates.

Understanding Personal Loans: Interest Rates and Fees

If you’re considering personal loans, our app provides access to a marketplace where you can view various loan offers. Here’s what you need to know:

- Competitive Rates: Personal loan rates range from 4.60% to 35.99% APR, with terms from 1 to 7 years.

- Third-Party Advertisers: Offers are from third-party advertisers, and rates are subject to change without notice.

- Additional Fees: Be aware that other fees, such as origination or late payment fees, may apply depending on the lender.

- Application and Approval: All loan offers require application and approval by the lender, and not all applicants will qualify for the lowest rates.

Representative Repayment Example

To illustrate how personal loans work, consider this example:

A borrower takes out a personal loan of $10,000 with a term of 36 months at an APR of 17.59%. This includes a 13.94% yearly interest rate and a 5% one-time origination fee. The borrower would receive $9,500 in their account and would have a required monthly payment of $341.48. Over the life of the loan, total payments would amount to $12,293.46.

Conclusion

Our free personal finance tracking app is your ultimate tool for achieving financial clarity and success. By understanding your cash flow, monitoring your net worth, and enhancing your credit, you can make informed decisions that lead to a more secure financial future. Start your journey today and unlock the potential of your finances!

Rate the App

User Reviews

Popular Apps

Editor's Choice