Latest Version

October 30, 2025

NB BanCorp, Inc.

Finance

Android

0

Free

com.needhambank3699.production

Report a Problem

More About Needham Bank Business Banking

Ultimate Guide to Efficient Account Management and Security

In today's fast-paced digital world, managing your finances effectively is crucial. With the right tools and knowledge, you can streamline your account management, enhance security, and make transactions effortlessly. This guide will explore essential features that can help you take control of your finances while ensuring your account remains secure.

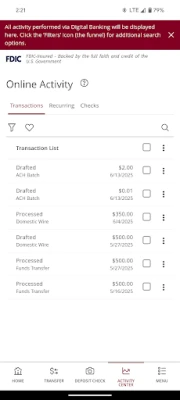

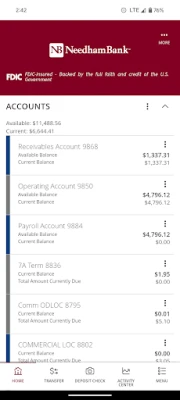

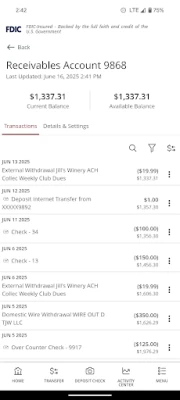

Effective Account Management

Managing your finances starts with keeping a close eye on your account. Here are some key features that can help you monitor your financial health:

- Monitor Balances and Recent Activity: Regularly checking your account balances and recent transactions allows you to stay informed about your financial status. This practice helps you identify any discrepancies or unauthorized transactions quickly.

- Track Expenses: Keeping track of your spending habits is vital for budgeting. Utilize tools that categorize your expenses, making it easier to see where your money goes each month.

- Set Up Account Alerts: Customize alerts to notify you of important account activities, such as low balances or large transactions. Adjust your preferences to receive notifications via email or SMS, ensuring you never miss critical updates.

Enhancing Account Security

Security is paramount when it comes to managing your finances. Here are some effective ways to protect your account:

- Enable Touch ID® or Face ID®: For a fast and secure way to access your account, enable biometric authentication. This feature not only speeds up the login process but also adds an extra layer of security, making it harder for unauthorized users to gain access.

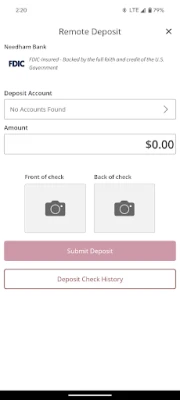

Convenient Mobile Deposit

Gone are the days of visiting the bank to deposit checks. With mobile deposit, you can manage your finances on the go:

- Deposit Checks with Ease: Simply snap a photo of your check using your mobile device. This feature allows you to deposit funds without the hassle of visiting a physical location.

- Instant Deposit Visibility: Once you submit your deposit, you can instantly view it in your account while it’s being processed. This transparency helps you keep track of your funds in real-time.

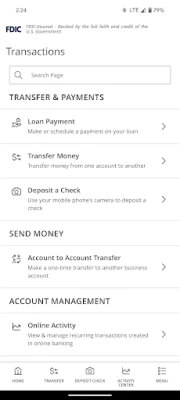

Streamlined Transfers and Payments

Managing your money effectively also involves making transfers and payments seamlessly. Here’s how you can simplify these processes:

- Transfer Funds Between Accounts: Easily move money between your accounts with just a few taps. This feature is particularly useful for managing savings and checking accounts.

- Manage Bills and Recurring Payments: Keep all your bills in one place. View and manage your recurring payments to ensure you never miss a due date, helping you avoid late fees.

- Review and Make Loan Payments: Stay on top of your loans by reviewing your payment history and making payments directly through your account. This feature helps you manage your debt effectively.

Important Disclosure

Before utilizing these features, it’s essential to understand the following:

- Free Mobile App: Our mobile app is available at no cost; however, standard mobile carrier message and data rates may apply.

- Eligibility for Features: Some features may only be available to eligible account holders or specific account types. Always check your account status to ensure you have access to all available tools.

- Bank Products and Services: All banking products and services are offered by Needham Bank, a member of the FDIC, ensuring your deposits are protected.

Conclusion

By leveraging the features outlined in this guide, you can enhance your account management and security, making your financial life more manageable. From monitoring your balances to utilizing mobile deposits and managing payments, these tools empower you to take control of your finances with confidence. Stay informed, stay secure, and enjoy the convenience of modern banking.

Rate the App

User Reviews

Popular Apps

Editor's Choice