Latest Version

October 01, 2024

National Westminster Bank PLC

Finance

Android

0

Free

com.rbs.mobile.android.natwest

Report a Problem

More About NatWest Mobile Banking

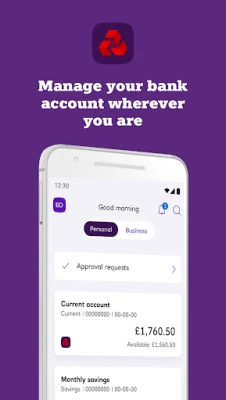

Unlocking the Benefits of the NatWest App: Your Ultimate Banking Companion

In today's fast-paced world, managing your finances efficiently is more important than ever. The NatWest app offers a comprehensive suite of features designed to simplify your banking experience. From instant account setup to advanced security measures, this app is tailored to meet the needs of modern users. Let’s explore the myriad benefits that make the NatWest app a must-have for anyone looking to streamline their financial management.

Instant Account Setup

With the NatWest app, you can set up current, savings, and student accounts in a matter of minutes. This seamless process eliminates the need for lengthy paperwork and in-branch visits, allowing you to start managing your finances right away.

Enhanced Security Features

Security is a top priority for NatWest. The app enables multi-factor authentication (MFA), ensuring that your financial information remains protected. You can also send high-value payments directly through the app, amend payment limits, and more, all while enjoying peace of mind.

Flexible Payment Options

Take control of your spending with features like Buy Now, Pay Later (BNPL) options and the ability to split bills effortlessly. Share a payment request link with multiple people, making group outings and shared expenses a breeze.

Access Cash in Emergencies

Need cash but don’t have your card? The NatWest app allows you to withdraw cash using a unique code, providing a convenient solution in emergencies. Withdraw up to £130 every 24 hours at branded ATMs, ensuring you’re never left without access to funds.

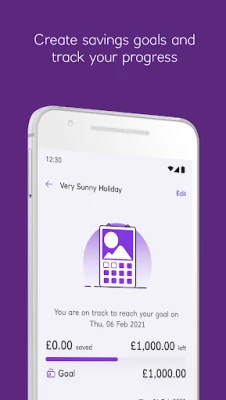

Smart Savings Features

Save your spare change effortlessly with the app’s Single or Double round-ups. This feature automatically rounds up your transactions to the nearest pound, helping you build your savings without even thinking about it.

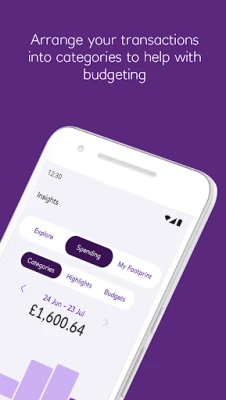

Comprehensive Financial Management

The NatWest app is not just about banking; it’s a complete financial management tool. Discover additional services such as mortgages, home and life insurance, and loans all in one place. You can also manage your monthly spending by setting categories, making budgeting easier than ever.

Track Your Carbon Footprint

In an age where sustainability matters, the NatWest app allows you to calculate your carbon footprint and track your progress. This feature empowers you to make informed decisions about your spending habits and their environmental impact.

Credit Score Insights

Understanding your credit score is crucial for financial health. The app provides insights into how your financial decisions affect your credit score, allowing you to make informed choices. Opt-in to access your credit score, available to customers over 18 with a UK address, provided by TransUnion.

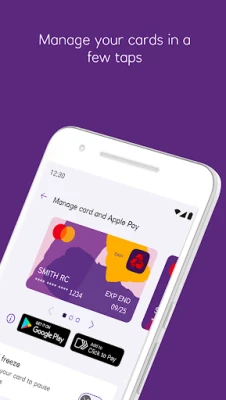

Convenient Account Management

Manage all your bank accounts in one secure place. The NatWest app allows you to add accounts from other banks, giving you a comprehensive view of your finances. You can also freeze and unfreeze your credit or debit cards at any time, providing an extra layer of security.

Premier Accounts for Enhanced Benefits

NatWest offers various Premier accounts tailored to different needs:

- Premier Select Account: A premium account with no monthly fee.

- Premier Reward Account: For just £2 a month, earn £9 back in rewards and at least 1% at partner retailers.

- Premier Reward Black Account: For £31 a month, enjoy airport lounge access, travel and phone insurance, and a 24/7 concierge service.

Student Accounts with Exclusive Offers

Students can benefit from opening a student account today, receiving £80 cash and a free Tastecard. Additionally, you can apply for an interest-free overdraft of up to £2000, providing financial flexibility during your studies.

Important Considerations

Before diving into the app, here are some important things to know:

- There is a maximum of 5 payments totaling £1000 per day, and you must be 16 or older.

- To withdraw cash, you need at least £10 available in your account and an active debit card.

- Touch ID and Face ID features are available on selected devices.

- Managing receipts is exclusive to Business Banking and Premier customers.

Permissions and Accessibility

To ensure optimal functionality, the app requires certain permissions:

- Allow the app to communicate through your network.

- Enable location services to find the nearest cash machine or branch.

- Grant access to your contacts list for the 'Pay your contacts' feature.

For users with photosensitivity, the app contains images that may cause reactions. You can disable these features in your device's settings menu.

Download the NatWest App Today

To experience all these features, download the latest version of the NatWest app, compatible with Android devices running OS 7.0 and above. By downloading the app, you accept the Terms and Conditions and should keep a copy of the Privacy Policy for your records.

In conclusion, the NatWest app is more than just a banking tool; it’s a comprehensive financial management solution that empowers users to take control of their finances with ease and security. Whether you’re a student, a professional, or someone looking to manage their money better, the NatWest app has something for everyone.

Rate the App

User Reviews

Popular Apps

Editor's Choice