Latest Version

4019.1.0

February 20, 2026

Oregon Community Credit Union

Finance

Android

0

Free

com.myoccu.mobile

Report a Problem

More About MyOCCU Mobile Banking

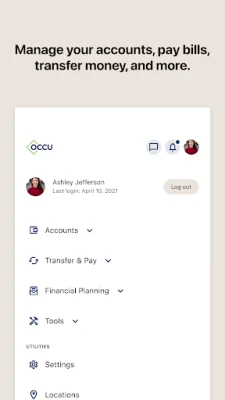

Unlocking the Power of Mobile Banking: Essential Features You Need

In today's fast-paced world, mobile banking has revolutionized the way we manage our finances. With a plethora of features designed to enhance convenience and efficiency, mobile banking apps have become indispensable tools for individuals and businesses alike. This article delves into the key features of mobile banking that empower users to take control of their financial activities seamlessly.

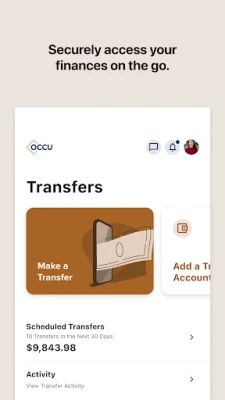

Effortless Fund Transfers

One of the standout features of mobile banking is the ability to easily transfer funds between accounts or to other individuals. Whether you need to send money to a friend, pay for services, or manage your savings, mobile banking apps simplify the process. With just a few taps on your smartphone, you can initiate transfers instantly, eliminating the need for physical visits to the bank.

Pay Bills Anytime, Anywhere

Gone are the days of writing checks or rushing to the bank before closing time. Mobile banking allows you to pay bills on the go, ensuring that you never miss a payment. With features that enable you to schedule recurring payments or make one-time transactions, managing your bills has never been easier. This flexibility not only saves time but also helps you avoid late fees and maintain a positive credit score.

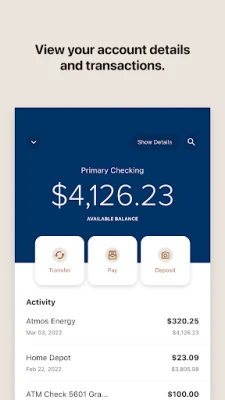

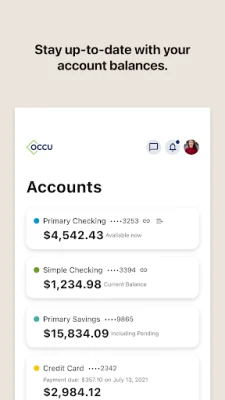

Quick Balance Checks with Snapshot

Keeping track of your finances is crucial, and mobile banking apps offer a feature called Snapshot that allows you to view your account balances quickly. This feature provides a real-time overview of your financial status, enabling you to make informed decisions on the fly. Whether you’re out shopping or planning a budget, having instant access to your balances helps you stay on top of your financial game.

Stay Informed with Account Activity Notifications

Understanding your spending habits is vital for effective financial management. Mobile banking apps come equipped with notifications that keep you updated on your account activity. From transaction alerts to balance updates, these notifications ensure that you are always aware of your financial movements. This feature not only enhances security by alerting you to unauthorized transactions but also helps you track your spending in real-time.

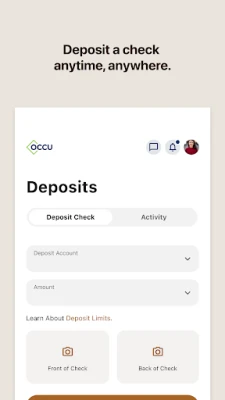

Convenient Check Deposits

Depositing checks has never been more convenient. With mobile banking, you can deposit checks directly from your smartphone. Simply take a picture of the front and back of the check, and submit it through the app. This feature eliminates the need to visit a bank branch, saving you time and effort. Plus, it allows you to access your funds faster, making it easier to manage your cash flow.

Locate Branches and ATMs with Ease

Even in a digital age, there are times when you may need to visit a physical bank branch or ATM. Mobile banking apps provide a feature to find a branch or ATM nearby, ensuring that you can access cash or in-person services whenever necessary. This feature is particularly useful when traveling or in unfamiliar areas, giving you peace of mind knowing that banking services are always within reach.

Conclusion: Embrace the Future of Banking

Mobile banking has transformed the way we handle our finances, offering a suite of features that prioritize convenience, security, and efficiency. From effortless fund transfers to quick balance checks and convenient check deposits, these tools empower users to manage their money effectively. As technology continues to evolve, embracing mobile banking is not just a trend; it’s a necessary step towards a more streamlined financial future. Take advantage of these features today and experience the freedom of banking at your fingertips.

Rate the App

User Reviews

Popular Apps

Editor's Choice