Latest Version

5.2.1

November 24, 2024

Universal bank | Monobank

Finance

Android

0

Free

com.ftband.mono

Report a Problem

More About monobank: перший цифровий банк

How to Quickly Register for Monobank: A Step-by-Step Guide

Are you looking to register for Monobank swiftly and effortlessly? This guide will walk you through the process, ensuring you can start enjoying the benefits of this innovative banking solution in no time. Follow these simple steps to get started.

Step 1: Download the Mobile Application

The first step in your registration journey is to download the Monobank mobile application. Available on both iOS and Android platforms, the app is user-friendly and designed to facilitate a seamless banking experience.

Step 2: Confirm Your Mobile Number

Once you have the app installed, the next step is to confirm your mobile number. This verification process is crucial for securing your account and ensuring that you receive important notifications and updates.

Step 3: Choose Your Registration Document

For registration, you will need to select a valid document. Monobank accepts various forms of identification, including:

- Diia (a digital ID application)

- ID card

- Passport booklet

- International passport

- Permanent residence permit

Choose the document that best suits your situation to proceed with the registration.

Step 4: Select Your Card Type

After selecting your identification document, you can choose how you would like to receive your card. You have the option to obtain a virtual card immediately or request a physical card to be picked up at a designated location or delivered to your address.

Fastest Registration Option: Use Diia

If you want the quickest registration experience, opt for the Diia application. With this method, you can complete your registration in an impressive 99 seconds, making it the fastest way to get started with Monobank.

Why Open a Monobank Account? Here Are 44 Compelling Reasons

Still on the fence about opening a Monobank account? Here are 44 unique reasons that highlight the advantages of choosing Monobank:

- Meet Monokit, a fun feature that adds a unique touch to your online banking experience.

- Enjoy enhanced security with customizable card settings.

- Make payments effortlessly without needing to extract card numbers or IBANs from messages.

- Open currency cards in USD or EUR without visiting a branch.

- Take advantage of installment purchases with top partners.

- Cancel payments within 10 seconds if you make a mistake.

- Split bills easily with friends at cafes or during taxi rides.

- Set up banks for fundraising, donations, and capital building.

- Scan your card with your camera for quick payments.

- Access elite cards at the price of a few cups of coffee.

- Block recurring payments from specific services.

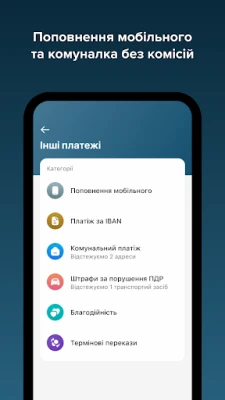

- Enjoy commission-free payments for utilities, fines, and mobile top-ups.

- Sign documents electronically with your digital signature via Diia.

- Experience a pleasant notification sound when receiving money.

- Purchase eSIMs with just one tap.

- Pay for purchases using Google Pay for added convenience.

- Set up regular payments for mobile top-ups, card transfers, and charity donations.

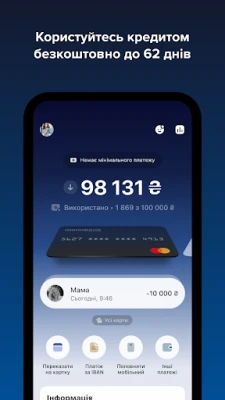

- Shop on credit at any physical or online store worldwide.

- Utilize a user-friendly dashboard to monitor current NBU limits.

- Convert old expenses into installments and receive money back on your card.

- Earn cashback on movies, TV shows, games, sports, train tickets, flights, fuel, medications, clothing, and footwear.

- Access affordable insurance policies, including OSCPV and green cards.

- Enjoy a stylish card and a convenient app interface.

- Shake your smartphone to transfer money to nearby contacts without asking for card numbers.

- No fees for withdrawing salaries or social payments.

- Buy military bonds with just two taps.

- Open currency cards and accounts for entrepreneurs with one touch.

- Manage your business finances with a personal web cabinet for accountants.

- Tag your expenses for better analytics and tracking.

- Benefit from bank cashback and donate it to charity.

- Send money quickly to contacts from your phone book without needing card numbers.

- Receive notifications about traffic fines.

- Access credit limits for your card and installment purchases.

- Open an eSupport card to receive government assistance with one tap.

- Earn rewards for using your card and repaying loans.

- Manage a child’s card with easy expense tracking.

- Use incognito mode to hide card balances from prying eyes.

- Experience top-notch customer support available 24/7 through convenient messaging apps.

- Receive bank statements and account summaries electronically via email.

- Open an account online without visiting a branch, even during air raid alerts.

- Enjoy a revamped Monobank interface with just an app update.

- Track exchange rates and perform currency exchanges effortlessly.

- Utilize a software terminal for payments and convenient transactions.

- Top up your balance and pay off loans with just a few taps.

With all these features and benefits, Monobank stands out as a leading choice for modern banking in Ukraine. Don't miss out on the opportunity to simplify your financial life!

Universal Bank JSC, NBU License No. 92 dated 20.01.1994, registered in the bank registry No. 226, Ukraine, Kyiv.

Rate the App

User Reviews

Popular Apps

Editor's Choice