Latest Version

2.5.9

October 22, 2024

Moniepoint

Finance

Android

0

Free

com.moniepoint.business

Report a Problem

More About Moniepoint Business Banking

Unlock Your Business Potential with Moniepoint: The Ultimate Banking Solution

In today's fast-paced business environment, having a reliable banking partner is crucial for success. Over 2 million business customers have placed their trust in Moniepoint to help them achieve their financial goals. With a suite of innovative banking solutions tailored for businesses and agents, Moniepoint is redefining the way you manage your finances.

Comprehensive Business Banking Solutions

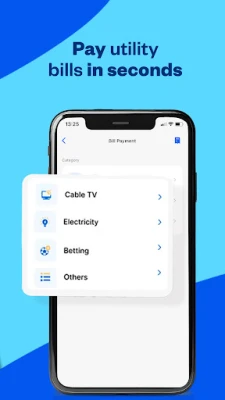

Moniepoint Business Bank offers a range of simple yet effective solutions designed to streamline your financial operations. Whether you need to manage bills, request loans, or conduct money transfers, Moniepoint has you covered. Here’s a closer look at the key features:

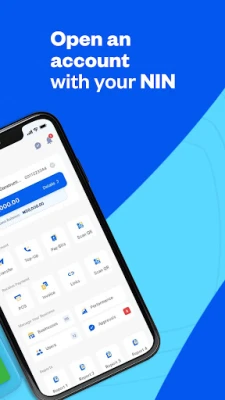

1. Effortless Business Bank Accounts

Setting up a business bank account has never been easier. With Moniepoint, you can create a business bank account in your company’s name directly from your smartphone. This user-friendly banking solution allows you to manage your finances on the go, ensuring you stay in control of your business operations.

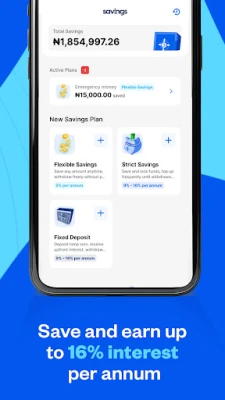

2. Tailored Business Savings Plans

Saving for the future is essential for any business. Moniepoint offers customized savings plans that cater to your specific business needs. These plans help you save money smartly, ensuring you have the funds available for growth and unexpected expenses.

3. Seamless Money Transfers

Sending and receiving money has never been more straightforward. With Moniepoint, you can transfer funds to other businesses or individuals without hidden charges. Enjoy complete control over your transactions, ensuring your money reaches its intended destination quickly and securely.

4. Convenient POS Terminals

Enhance your payment acceptance capabilities with Moniepoint’s POS terminals. You can easily request a POS terminal through the app, and it will be delivered to your doorstep within 48 hours. Accept card and bank transfer payments effortlessly, making transactions smoother for your customers.

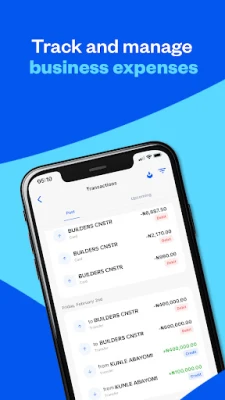

5. Efficient Business Expense Cards

Managing business expenses is crucial for maintaining financial health. Moniepoint’s expense cards allow you to track your spending in real-time and set spending limits directly from your business bank account. For just N1,000, you can obtain an expense card, with delivery available for the same price.

6. Accessible Working Capital Loans

Need funds to grow your business? Moniepoint offers working capital loans with competitive interest rates ranging from 2% to 3% per month. These loans are easy to qualify for and can be used for various purposes, including inventory purchases, business expansion, or payroll. Apply in just 5 minutes and receive a loan decision within 48 hours, with 24/7 online application availability.

7. Cashback on Airtime and Data Purchases

Every time you purchase airtime or data directly from the Moniepoint app, you’ll receive a 2% cashback. This feature not only saves you money but also enhances your overall banking experience.

The Best Business Banking Experience

Moniepoint is committed to providing a superior banking experience that empowers you to focus on what truly matters: growing your business. The Moniepoint Business Banking app offers a seamless interface that integrates operational tools such as expense cards, accounting features, and bill payment solutions, all designed to help your business run smoothly.

From Agent Banking to Comprehensive Financial Services

Originally starting as an agent banking network, Moniepoint has evolved into a full-fledged business and personal banking provider. Our mission is to empower businesses like yours with the financial resources needed to thrive. Moniepoint Microfinance Bank is the go-to bank for small and medium-sized enterprises in Nigeria, regulated by the Central Bank of Nigeria (CBN).

Contact Us for Support

Our dedicated support team is always ready to assist you. Reach out to us through the following channels:

- Helpline: 01 888 9990

- Website: www.moniepoint.com

- WhatsApp: +234 908 843 0803

- Facebook: @moniepointng

- Twitter: @moniepointng

- Instagram: @moniepointng

- YouTube: @moniepointng

- LinkedIn: Moniepoint Nigeria

Address: Oyo-Ibadan Road, Idi-Agba, Ilora, Oyo

Join the Moniepoint Community Today!

With the Moniepoint Business Banking app, you can create your business bank account in minutes, send or receive money instantly, purchase airtime, pay bills, and request expense cards and POS terminals—all within 48 hours. Experience the convenience of working capital loans tailored for your needs. Join us and embark on a journey of financial growth. Unlock your full potential and become part of our community of over 2 million satisfied businesses. Become a Moniepoint business owner or agent today!

Rate the App

User Reviews

Popular Apps

Editor's Choice