Latest Version

7.107.0

August 17, 2024

MoneyLion Inc.

Finance

Android

0

Free

com.moneylion

Report a Problem

More About MoneyLion: Bank & Earn Rewards

Unlock Financial Freedom with RoarMoney Banking: Get Paid Early and Enjoy Exclusive Benefits

In today's fast-paced world, managing your finances efficiently is crucial. With RoarMoney Banking, you can take control of your financial future by accessing your funds earlier, earning rewards, and securing cash advances when you need them most. This article explores the various features of RoarMoney Banking, including early payday access, cashback rewards, and personal loan options, all designed to enhance your financial well-being.

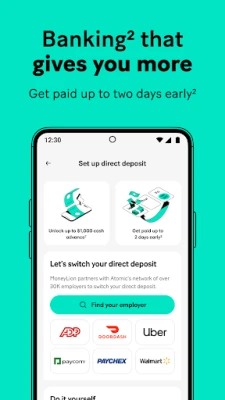

Get Paid Early: Access Your Funds Up to 2 Days Sooner

Imagine having the ability to fast forward to payday. With RoarMoney℠ direct deposit, you can access your paycheck up to two days earlier than traditional banking methods. This feature is particularly beneficial for those who need quick access to funds for unexpected expenses or bills. By opening a RoarMoney banking account, you can also take advantage of the Round Ups feature, which allows you to invest your spare change and grow your savings effortlessly.

Cash Advances Made Easy: Access Up to $1,000

Need cash in a pinch? RoarMoney offers cash advances of up to $1,000 for customers with qualifying recurring direct deposits. This service provides a safety net for those unexpected financial emergencies, allowing you to access your hard-earned money without the stress of high-interest loans. With RoarMoney, you can enjoy peace of mind knowing that financial support is just a few taps away.

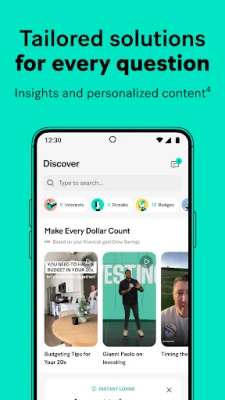

Earn Rewards and Cashback with MoneyLion Wow

RoarMoney Banking isn’t just about accessing funds; it’s also about rewarding you for your financial decisions. With MoneyLion Wow, you can earn cashback and rewards on both significant purchases and everyday spending. This program is designed to help you maximize your financial potential while providing exclusive benefits such as cell phone insurance and travel protection. Protect yourself from life's uncertainties while enjoying the perks of being a RoarMoney customer.

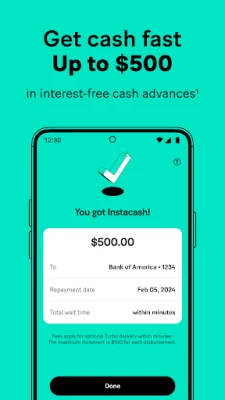

Quick Cash Advances with Instacash℠

When you need quick cash, Instacash℠ offers a seamless solution. Access up to $500 of your pay any day, with funds available in minutes. This service comes with no interest, no mandatory fees, and no credit checks, making it an ideal option for those who need immediate financial assistance. With Instacash, you can manage your cash flow effectively without the burden of traditional loan requirements.

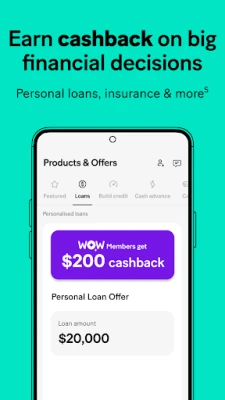

Fast Loan Offers: Compare and Choose the Best Option

If you find yourself in need of a larger sum, RoarMoney connects you with personal loan offers through the MoneyLion Marketplace. Here, you can compare various loan options, including personal loans, small loans, and online loans, ensuring you find the best fit for your financial needs. With repayment terms ranging from 12 to 84 months and APRs from 5.99% to 35.99%, you can make informed decisions that align with your budget.

Build Your Credit with a Credit Builder Loan

Establishing and improving your credit score is essential for long-term financial health. RoarMoney offers a Credit Builder loan of up to $1,000, providing you with an opportunity to build your credit while enjoying exclusive membership services. This loan is designed to help you develop a positive credit history, making it easier to secure future loans and financial products.

Why Choose RoarMoney Banking?

RoarMoney Banking stands out in a crowded market of financial apps and services. Unlike other money management apps, RoarMoney offers a comprehensive suite of features that cater to your financial needs. Whether you’re looking for early access to your paycheck, cashback rewards, or personal loan options, RoarMoney has you covered. Plus, with no affiliation to other money apps, you can trust that you’re receiving unique benefits tailored to your financial journey.

Conclusion: Take Control of Your Finances Today

With RoarMoney Banking, you can unlock a world of financial possibilities. From getting paid early to earning rewards and accessing cash advances, RoarMoney empowers you to take control of your financial future. Don’t let financial stress hold you back—open a RoarMoney banking account today and experience the benefits for yourself. Your path to financial freedom starts here!

For more information on RoarMoney Banking and its features, visit the official website and explore how you can enhance your financial journey.

Rate the App

User Reviews

Popular Apps

Editor's Choice