Latest Version

2.0.7

September 02, 2025

MONEY EMPIRE ONLINE PVT LTD

Finance

Android

0

Free

com.iw.moneyempire

Report a Problem

More About Money Empire

Maximize Your Investment Potential: A Comprehensive Guide to Financial Instruments

In today's dynamic financial landscape, understanding various investment options is crucial for building a robust portfolio. This article delves into key financial instruments such as Mutual Funds, Equity Shares, Bonds, Fixed Deposits, Portfolio Management Services (PMS), and Insurance. We will explore their features, benefits, and how they can help you achieve your financial goals.

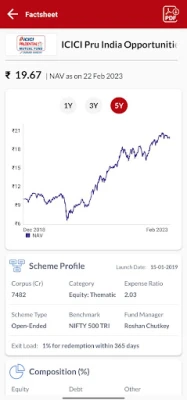

Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way for individuals to invest in a professionally managed fund without needing extensive market knowledge.

Key Features of Mutual Funds

- Access to a diversified portfolio managed by experts.

- Flexibility to invest through Systematic Investment Plans (SIPs).

- Transparency with regular updates on fund performance.

Exploring Equity Shares

Equity shares represent ownership in a company. When you buy equity shares, you become a shareholder and can benefit from the company's growth through capital appreciation and dividends.

Benefits of Investing in Equity Shares

- Potential for high returns over the long term.

- Ability to influence company decisions through voting rights.

- Liquidity, as shares can be easily bought and sold on stock exchanges.

The Stability of Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically corporate or governmental. They are considered safer than stocks and provide regular interest payments.

Advantages of Bonds

- Steady income through interest payments.

- Lower risk compared to equities.

- Portfolio diversification benefits.

Fixed Deposits: A Safe Haven

Fixed deposits (FDs) are a popular investment option in India, offering guaranteed returns over a specified period. They are ideal for conservative investors seeking stability.

Why Choose Fixed Deposits?

- Guaranteed returns with no market risk.

- Flexible tenures ranging from a few months to several years.

- Tax benefits under certain conditions.

Portfolio Management Services (PMS)

PMS offers personalized investment management services for high-net-worth individuals. It involves a tailored investment strategy based on the client's financial goals and risk appetite.

Key Features of PMS

- Customized investment strategies.

- Active management of the portfolio by professionals.

- Regular performance reviews and adjustments.

Insurance: Protecting Your Future

Insurance is a critical component of financial planning, providing financial protection against unforeseen events. It ensures that you and your loved ones are safeguarded against risks.

Types of Insurance to Consider

- Life Insurance: Provides financial security to your beneficiaries.

- Health Insurance: Covers medical expenses and hospitalizations.

- Property Insurance: Protects your assets against damage or loss.

Comprehensive Portfolio Management Tools

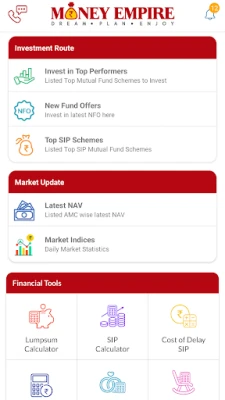

To effectively manage your investments, utilizing advanced tools and calculators can provide valuable insights. Here are some essential tools available:

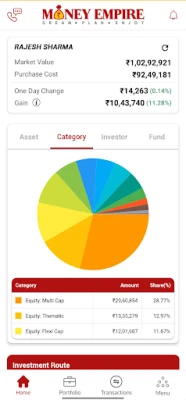

Portfolio Reporting Features

- Complete Portfolio Report: Download a detailed report of all your assets.

- Historical Performance Tracking: Easily view the performance of your portfolio over time.

- Transaction Statements: Access transaction statements for any period.

- One-Click Statement Downloads: Obtain statements from any Asset Management Company (AMC) in India with ease.

- Advanced Capital Gain Reports: Analyze your capital gains for better tax planning.

Investment Tracking and Management

- Online Investment: Invest in any mutual fund scheme or New Fund Offer (NFO) and track orders until unit allotment.

- SIP Reports: Stay informed about your running and upcoming Systematic Investment Plans (SIPs) and Systematic Transfer Plans (STPs).

- Insurance Tracking: Keep track of premiums due for your insurance policies.

- Folio Details: Access folio details registered with each AMC.

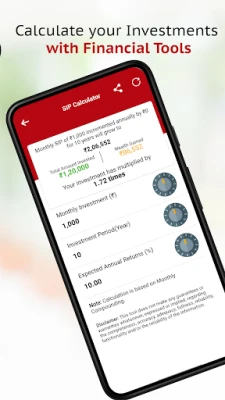

Essential Calculators for Financial Planning

Utilizing financial calculators can help you make informed decisions about your investments and future planning. Here are some calculators to consider:

- Retirement Calculator: Estimate how much you need to save for a comfortable retirement.

- SIP Calculator: Calculate the potential returns on your SIP investments.

- SIP Delay Calculator: Understand the impact of delaying your SIP contributions.

- SIP Step-Up Calculator: Plan for increasing your SIP contributions over time.

- Marriage Calculator: Estimate the funds required for your child's marriage.

- EMI Calculator: Calculate your Equated Monthly Installments for loans.

Conclusion

Investing wisely in various financial instruments can significantly enhance your wealth over time. By understanding the features and benefits of mutual funds, equity shares, bonds, fixed deposits, PMS, and insurance, you can create a diversified portfolio that aligns with your financial goals. Utilize the available tools and calculators to track your investments and make informed decisions for a secure financial future.

Rate the App

User Reviews

Popular Apps

Editor's Choice