Latest Version

2.3.0

November 16, 2024

PRG Ventures

Finance

Android

0

Free

com.prgventures.moneyapp

Report a Problem

More About Money App - Cash Advance

Unlock Instant Cash with Money App: Your Guide to Hassle-Free Cash Advances

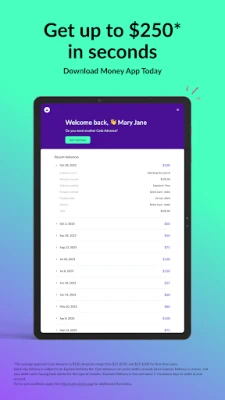

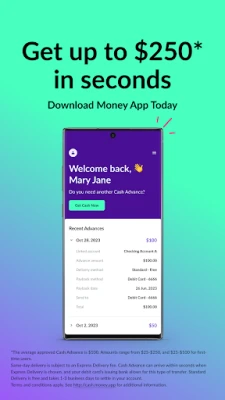

In today's fast-paced world, having quick access to cash can be a lifesaver. Money App provides a seamless solution by offering cash directly deposited into your personal bank account. With a range of benefits and no hidden costs, it’s an attractive option for those in need of immediate funds.

Why Choose Money App for Your Cash Needs?

Money App stands out in the crowded financial services market for several reasons. Here’s what makes it a preferred choice for cash advances:

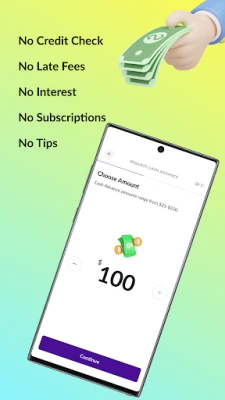

- No Interest: Enjoy the peace of mind that comes with a 0% Annual Percentage Rate (APR). You won’t have to worry about accumulating interest on your cash advance.

- No Tipping: Unlike some services that require tips, Money App keeps it straightforward—no tipping is necessary.

- No Hidden Fees: Transparency is key. With Money App, you won’t encounter unexpected charges that can catch you off guard.

- No Membership Fees: There are no ongoing membership costs, making it easy to access funds without additional financial burdens.

- No Late Fees: Forget about penalties for late payments. Money App offers flexibility without the stress of late fees.

- No Credit Check: Your credit history won’t hinder your ability to access cash. Money App provides a hassle-free experience without the need for credit checks.

Understanding Money App Cash Advances

A Money App cash advance is designed to be user-friendly and efficient. Here’s how it works:

When you request a cash advance, you can choose to pay an optional fee for expedited delivery. For instance, if you request a $40 advance and opt for the Express Delivery service at a fee of $4.99, your total repayment amount will be $44.99. This straightforward structure allows you to know exactly what you owe without any surprises.

Key Features of Money App Cash Advances

Here are some essential features that make Money App cash advances a smart choice:

- Non-Recourse Product: Unlike traditional personal loans, Money App cash advances are non-recourse. This means you are not personally liable for repayment beyond the amount you owe.

- Flexible Repayment Terms: There is no mandatory minimum or maximum timeframe for repayment. You can repay the advance at your convenience, as long as your outstanding balance is settled before requesting a new advance.

- Easy Access to Funds: With just a few taps on your smartphone, you can access cash when you need it most. The user-friendly interface makes the process quick and efficient.

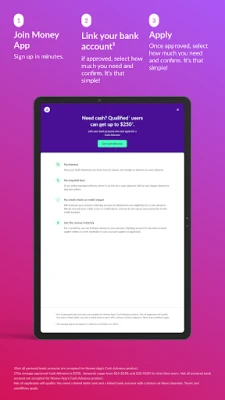

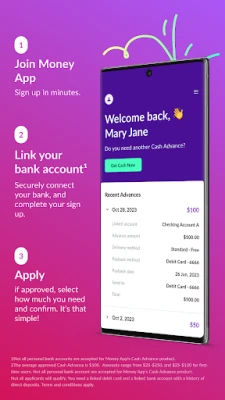

How to Get Started with Money App

Getting started with Money App is simple. Follow these steps to unlock your cash advance:

- Download the App: Begin by downloading the Money App from your device’s app store.

- Create an Account: Sign up and create your account by providing the necessary information.

- Request a Cash Advance: Once your account is set up, you can easily request a cash advance based on your needs.

- Select Delivery Option: Choose whether you want standard or expedited delivery for your funds.

- Receive Your Funds: After your request is approved, the cash will be deposited directly into your bank account.

Important Considerations

While Money App offers numerous benefits, it’s essential to understand the terms and conditions associated with cash advances. Here are a few points to keep in mind:

- Outstanding Balance: You must pay off your existing balance before requesting a new advance. This policy ensures responsible borrowing.

- Review the Cash Advance Agreement: Familiarize yourself with the Cash Advance Agreement to understand your rights and obligations.

- Visit the Official Website: For additional terms, conditions, and eligibility requirements, visit http://cash.money.app.

Conclusion

Money App provides a reliable and efficient way to access cash when you need it most. With no interest, no hidden fees, and a straightforward repayment process, it’s an excellent option for those seeking financial flexibility. Whether you need to cover unexpected expenses or simply want to manage your cash flow better, Money App is here to help. Download the app today and take control of your financial needs with ease!

Rate the App

User Reviews

Popular Apps

Editor's Choice