Latest Version

2.0.4

November 12, 2024

Payfare

Finance

Android

0

Free

com.payfare.lyft

Report a Problem

More About Lyft Direct powered by Payfare

Unlock Financial Freedom with the Lyft Direct App: A Comprehensive Guide

For drivers on the Lyft platform, managing finances can be a daunting task. Fortunately, the Lyft Direct app is designed to simplify this process, offering a suite of financial tools tailored specifically for rideshare drivers. This article delves into the key features of the Lyft Direct app, highlighting how it can enhance your financial management and overall driving experience.

Instant Payouts: Get Paid Immediately

One of the standout features of the Lyft Direct app is the Instant Payouts option. After completing each ride, drivers can access their earnings immediately, transferring funds directly into a secure bank account. This feature eliminates the waiting period typically associated with ride-sharing earnings, allowing drivers to manage their cash flow more effectively.

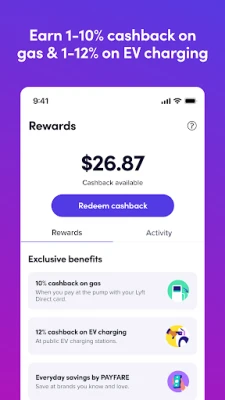

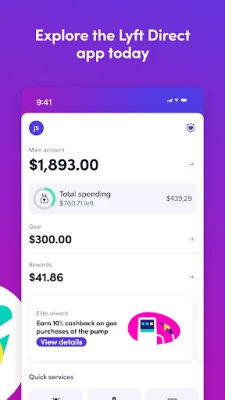

Earn Cashback on Everyday Expenses

The Lyft Direct app also offers an enticing cashback program. Drivers can earn between 1-10% cashback on gas purchases made at the pump, and 1-12% on electric vehicle (EV) charging. Additionally, users can enjoy rewards on groceries, dining, and other everyday expenses. This feature not only helps drivers save money but also incentivizes them to use their Lyft Direct Mastercard® debit card for various purchases.

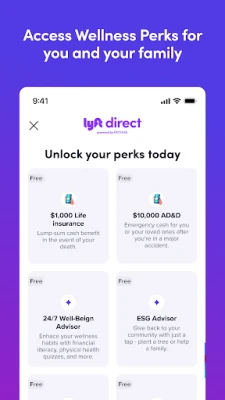

Wellness Perks by Avibra: A Safety Net for Drivers

Active drivers can unlock exclusive Wellness Perks through Avibra, which include free life and accident insurance. These benefits provide essential support for drivers' well-being, ensuring they have a safety net in case of unforeseen circumstances. To qualify for these perks, drivers must have received a payout to their Lyft Direct card within the last 60 days, making it crucial to stay active on the platform.

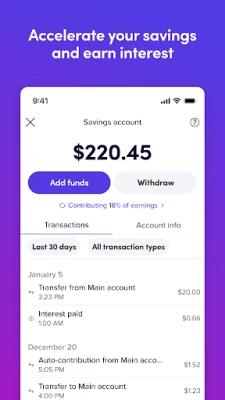

Grow Your Savings with High-Yield Accounts

The Lyft Direct app encourages financial growth by allowing users to set up automatic savings with a high-yield savings account. This account not only helps drivers save for future expenses but also earns interest on the funds deposited. With this feature, drivers can effortlessly build their savings over time, making it easier to achieve financial goals.

Balance Protection: Financial Security When You Need It

Unexpected expenses can arise at any moment, and the Lyft Direct app offers Balance Protection to help drivers navigate these challenges. Users can access between $50-$200 to cover urgent costs, providing peace of mind during financial emergencies. The amount available depends on the driver’s Lyft Rewards tier, ensuring that loyal drivers receive additional benefits.

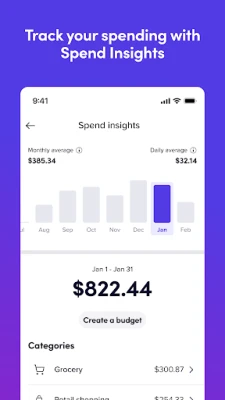

Spend Insights: Track Your Financial Habits

Understanding spending habits is crucial for effective financial management. The Lyft Direct app provides spend insights that allow drivers to monitor their average daily or monthly spending. This feature enables users to create custom budgets, helping them make informed financial decisions and avoid overspending.

Lyft Direct Mastercard®: Your Financial Companion

The Lyft Direct Mastercard® debit card is issued by Stride Bank, N.A., and is a vital tool for drivers. It facilitates instant payouts and cashback rewards, making it an essential part of the Lyft Direct experience. However, it’s important to note that ride fare earnings are sent after each ride, and there may be instances where funding is delayed. Tips from riders may take up to 24 hours to process, so drivers should plan accordingly.

Important Considerations for Cashback and Rewards

While the cashback program is a fantastic benefit, drivers should be aware that rewards categories and amounts are subject to change without notice. Cashback rewards are earned for select purchases made with the Lyft Direct debit card and become available for redemption as those purchases settle. For gas purchases, only payments made at the pump qualify for cashback, while payments made inside the gas station typically do not.

Eligibility and Terms for Wellness Perks and Balance Protection

Wellness Perks are powered by Avibra and are available to active Lyft Direct users. To maintain eligibility, drivers must have received a payout to their Lyft Direct card within the last 60 days. Additionally, Balance Protection is only available to users with enabled instant payouts to their card after every trip. The eligibility requirements for both features are subject to change, so drivers should stay informed about the latest updates.

Conclusion: Empower Your Financial Journey with Lyft Direct

The Lyft Direct app is more than just a financial tool; it’s a comprehensive solution designed to empower drivers on the Lyft platform. With features like instant payouts, cashback rewards, wellness perks, and savings options, the app provides a robust framework for managing finances effectively. By leveraging these tools, drivers can enhance their financial well-being and focus on what they do best—providing exceptional rideshare experiences.

For more information on the Lyft Direct Cardholder Agreement and Payfare Program Terms, drivers can refer to the Lyft Direct app. Embrace the financial freedom that comes with the Lyft Direct app and take control of your earnings today!

Rate the App

User Reviews

Popular Apps

Editor's Choice