Latest Version

150.05

November 02, 2024

Lloyds Banking Group PLC

Finance

Android

0

Free

com.grppl.android.shell.CMBlloydsTSB73

Report a Problem

More About Lloyds Mobile Banking

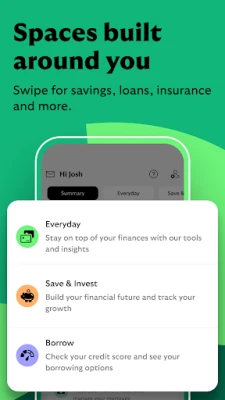

Unlocking Financial Freedom: The Ultimate Guide to Your Banking App

In today's fast-paced world, managing your finances efficiently is more important than ever. With the advent of advanced banking apps, accessing your financial information has never been easier. This article explores the features and benefits of a comprehensive banking app that empowers you to take control of your finances seamlessly.

Effortless Access to Your Accounts

Experience the convenience of quick logins with fingerprint authentication or memorable information. The app provides a summary view of all your accounts, allowing you to monitor your financial status at a glance. Discover new products and apply directly within the app, making it easier than ever to enhance your financial portfolio.

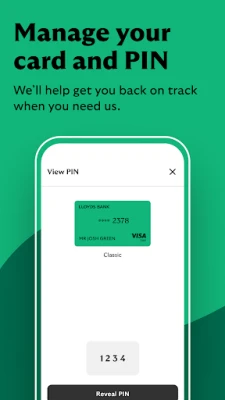

Manage your account settings effortlessly; view your PIN, freeze your card, and access a variety of features all in one place. Navigate the app smoothly using the intuitive tabs located at the top of your screen, ensuring you find what you need without hassle.

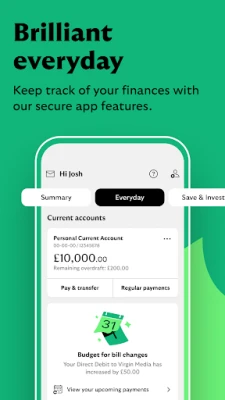

Brilliant Everyday Banking

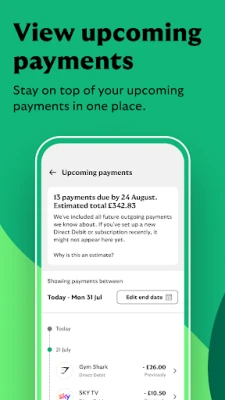

Stay on top of your finances by managing both your current and credit card accounts in one convenient location. The app allows you to block and cancel subscriptions with ease, helping you avoid unnecessary charges. Utilize powerful tools and spending insights to keep track of your expenses and make informed financial decisions.

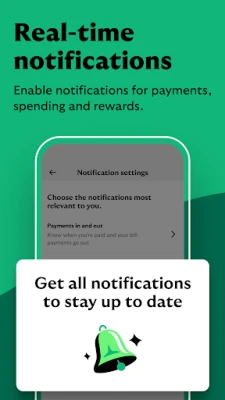

With features that alert you to upcoming payments, you can plan your budget effectively and avoid late fees. This proactive approach to managing your money ensures you are always in control of your financial future.

A Comprehensive View of Your Savings and Investments

Set savings goals and build a financial safety net with the app's innovative features. Use a handy calculator to plan for future expenses and investments, ensuring you are prepared for whatever life throws your way. The app also offers useful articles and resources to help you save for the future, making financial literacy accessible to everyone.

Stay Informed About Your Borrowing

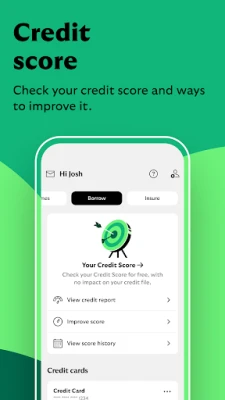

Keep track of your financial health with free credit score checks that provide insights into your borrowing status. Know exactly what you need to pay and when, allowing you to manage your credit card effectively. The app also enables you to check and adjust your credit limit, ensuring you have the flexibility you need.

Monitor your personal loans effortlessly, giving you a complete picture of your financial obligations and helping you stay on top of your borrowing.

All Your Home Needs in One Place

Manage your home finances with ease by viewing your mortgage balance and home value directly in the app. Discover potential savings on your bills and compare deals to ensure you are getting the best rates available. Additionally, browse rewards for sustainable home improvements, making it easier to invest in your property while being environmentally conscious.

Protect What Matters Most

Your peace of mind is paramount. The app allows you to view your home, car, and life insurance coverage, giving you a comprehensive understanding of your protection options. Explore various cover options and request quotes directly through the app, ensuring you have the right coverage for your needs.

Getting Started with the App

To begin your journey, you’ll need:

- Your registered phone number.

- A Lloyds personal account, Lloyds Bank Islands personal account, or Sterling international account.

Ensuring Your Online Safety

Your security is our top priority. We implement the latest online security measures to protect your money, personal information, and privacy. Rest assured that using our app will not change how we contact you. Our communications will always address you by your title and surname, including the last four digits of your account number or the last three digits of your postcode. Be cautious of any messages that deviate from this format, as they may be scams.

Important Information to Consider

While we do not charge for our services, your mobile operator may impose charges for downloading or using the app. Please check with them for details. Note that service availability may be affected by phone signal and functionality.

When using the app, we collect anonymous location data to help combat fraud, fix bugs, and improve future services. The app is available to customers with a UK personal account and a valid registered phone number. Ensure your device meets the minimum operating system requirements by checking Google Play for details. Device registration is required, and terms and conditions apply.

Freeze and Unfreeze Transactions for Peace of Mind

For added security, you can freeze and unfreeze certain types of transactions 24/7, providing peace of mind if you temporarily misplace your card. The fingerprint logon feature requires a compatible mobile device running Android 7.0 or higher and may not function on some tablets.

Lloyds and Lloyds Bank are trading names of Lloyds Bank plc, registered in England and Wales (no. 2065), with a registered office at 25 Gresham Street, London EC2V 7HN. We are authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.

Embrace the future of banking with our app, designed to simplify your financial management and enhance your overall banking experience.

Rate the App

User Reviews

Popular Apps

Editor's Choice