Latest Version

2.6.4

December 23, 2024

Wealthzi: Mutual Funds, SIP

Finance

Android

0

Free

com.wealthzi

Report a Problem

More About Lime Wealth:Direct Mutual Fund

Unlock Your Financial Future with Wealthzi: The Ultimate Mutual Fund Tracking App

In today's fast-paced financial landscape, managing your investments efficiently is crucial. Wealthzi offers a comprehensive solution for seamless mutual fund portfolio tracking, insightful portfolio reviews, and strategic exit recommendations for underperforming or high-risk mutual funds. With Wealthzi, you can embark on your investment journey with confidence.

Why Choose Wealthzi for Your Mutual Fund Investments?

- Direct Mutual Funds: Invest directly in mutual funds without any intermediaries.

- Zero Commission: Enjoy a commission-free investment experience.

- Unbiased Investment Advice: Receive impartial guidance tailored to your financial goals.

- Comprehensive Portfolio Tracking: Import and monitor all your mutual fund investments effortlessly.

Effortless Portfolio Management

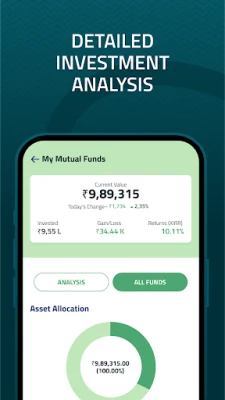

Wealthzi simplifies the process of managing your mutual fund investments. With a quick one-tap import feature, you can easily consolidate all your existing mutual funds into a detailed dashboard. This dashboard provides you with essential metrics such as XIRR, capital gains, and daily performance reports, allowing you to stay informed about your investments.

Automated Portfolio Review for Informed Decisions

Our automated portfolio review feature offers actionable insights based on your asset allocation, category selection, and fund performance. Utilizing our proprietary Zi methodology, Wealthzi evaluates your exposure to various sectors, identifies over-diversification or under-diversification, and highlights low-exposure funds and new fund offers (NFOs). This comprehensive analysis empowers you to make informed investment decisions.

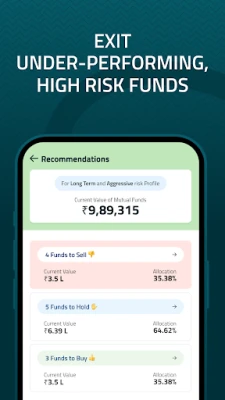

Strategic Exit Recommendations

Wealthzi provides tailored exit recommendations for underperforming and high-risk mutual funds in your portfolio. By switching to low-cost direct mutual fund plans, you can optimize your investment strategy and enhance your overall returns.

Periodic Rebalancing for Optimal Performance

To ensure your portfolio remains aligned with your risk profile and asset allocation, Wealthzi offers quarterly rebalancing advice. This proactive approach helps you stay on track to achieve your financial goals in a timely manner.

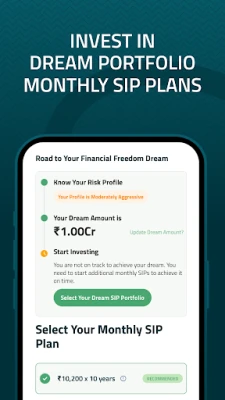

Invest in Your Dream Portfolio

With Wealthzi's Dream Planner, you can invest in zero-commission direct mutual funds and start monthly Systematic Investment Plans (SIPs) tailored to your dream portfolio. This feature allows you to build a diversified investment strategy that aligns with your financial aspirations.

Smart Redemption and Lump Sum Investment Guidance

Wealthzi offers intelligent recommendations for redeeming investments and making one-time investments. Our insights help you minimize exit loads and capital gains tax liabilities, ensuring that your investment decisions are both strategic and financially sound.

Seamless Account Opening and Digital KYC

Experience a hassle-free account opening process with our fully digital KYC, powered by Digilocker and BSE Star MF. All you need is your Aadhaar linked to your mobile number, a valid PAN card, and a copy of a canceled cheque to verify your bank account details.

Comprehensive Mutual Fund Analysis with Zi Review

Wealthzi's Zi Review provides a risk and return-based analysis of over 1,000 top mutual fund plans. This review employs metrics such as risk-adjusted returns, rolling returns, alpha over benchmarks, market risk, liquidity risk, and portfolio credit quality to categorize funds as good, average, or poor. This thorough analysis helps you make informed investment choices.

Unbiased Advisory from SEBI Registered Experts

Wealthzi is committed to providing unbiased advisory services through our SEBI-registered fee-only investment advisors. With zero-commission mutual funds, you can trust that our recommendations are in your best interest.

Data Security and Privacy Protection

Your data security is our top priority. Wealthzi employs strict data security policies to safeguard your information. Our platform is hosted on secure and encrypted Amazon AWS servers, ensuring that your personal and financial data remains protected.

Financial Calculators for Smart Planning

Wealthzi features a suite of financial calculators, including an SIP Calculator, Lump Sum Calculator, Fixed Deposit Calculator, Recurring Deposit Calculator, SIP Goal Calculator, and Loan EMI Calculator. These tools empower you to plan your financial future effectively and achieve your wealth goals.

Track Your Entire Investment Portfolio

In addition to mutual funds, Wealthzi allows you to track stocks, Portfolio Management Services (PMS), and bonds by simply uploading your NSDL/CDSL consolidated statements. This comprehensive tracking feature ensures that you have a holistic view of your investments.

Why Wealthzi Stands Out Among Mutual Fund Apps

- Invest in direct mutual funds with 0% commission, no transaction charges, and no hidden fees.

- Support for all UPI payment apps, including Google Pay, PhonePe, BHIM UPI, Paytm, Net Banking, and NPCI E-Mandate for SIP Auto Pay.

- Easily switch your mutual funds online from other platforms like Paytm Money, Groww, INDmoney, ET Money, Scripbox, myCAMS, Zerodha Coin, FundsIndia, and MFCentral.

- Diverse investment options, including equity mutual funds, tax-saving ELSS mutual funds, small-cap, large-cap, mid-cap, multi-cap, flexi-cap mutual funds, balanced funds, gold mutual funds, sector mutual funds, and international funds—all accessible from one app.

- Start SIPs in top mutual funds from leading Asset Management Companies (AMCs) such as SBI, ICICI Prudential, HDFC, Nippon India, Kotak, Aditya Birla Sun Life, UTI, Axis, Mirae Asset, Motilal Oswal, Parag Parikh, Edelweiss, DSP, Canara Robeco, Navi, LIC, Quant Mutual Fund, and more.

In conclusion, Wealthzi is your go-to app for efficient mutual fund management, offering a range of features designed to enhance your investment experience. Start your journey towards financial success today with Wealthzi!

Rate the App

User Reviews

Popular Apps

Editor's Choice