Latest Version

1.83

August 09, 2024

NortonMobile

Finance

Android

0

Free

com.symantec.lifelock.memberapp

Report a Problem

More About LifeLock Identity by Norton

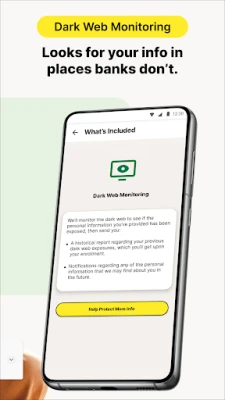

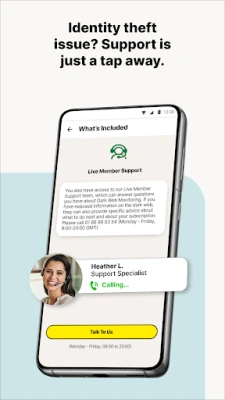

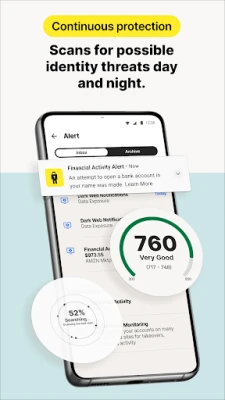

LifeLock is a comprehensive identity theft protection service that offers various plans to safeguard your personal information and finances. The plans include features such as the LifeLock Identity Alert™ System, Dark Web Monitoring, and access to US-based ID restoration specialists. In the event that you become a victim of identity theft, LifeLock also offers a Million Dollar Protection Package to cover expenses and provide legal assistance.

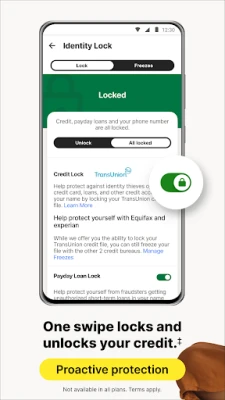

For added protection, the Advantage and Ultimate Plus plans also include easy access to credit scores and reports, as well as the ability to lock your TransUnion credit file with a single tap. Transaction monitoring is also available to keep an eye on your bank, credit card, and retirement account activity. However, it's important to note that Norton 360 plans without LifeLock only include dark web monitoring.

In addition to the standard plans, LifeLock also offers the Identity Advisor plan which includes dark web monitoring, breach notifications, and merchant resolution management. However, it does not include the Million Dollar Protection Package or additional alert features found in higher-tiered plans.

It's important to keep in mind that no one can prevent all identity theft or cybercrime. However, LifeLock's plans offer a comprehensive approach to protecting your personal information and finances. It's also important to note that in order to receive credit reports, scores, and monitoring features, your identity must be successfully verified with Equifax and they must be able to locate your credit file with sufficient credit history information.

Lastly, it's important to understand that locking or unlocking your credit file does not affect your credit score and does not prevent all companies and agencies from pulling your credit file. The credit lock on your TransUnion file will also be unlocked if your LifeLock subscription is downgraded or cancelled.

Rate the App

User Reviews

Popular Apps

Editor's Choice