Latest Version

8.5.1

November 13, 2024

Lenme Inc.

Finance

Android

0

Free

com.lenmoinc.lenmo

Report a Problem

More About Lenme: Investing and Borrowing

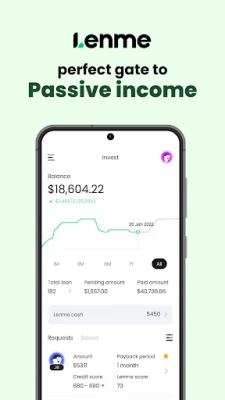

Unlock Instant Loans and Investment Opportunities with Lenme

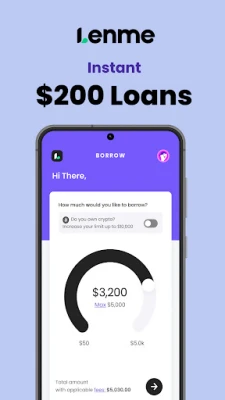

In today's fast-paced financial landscape, obtaining a loan has never been easier. With Lenme, borrowers can secure the funds they need in just minutes, all from the convenience of their mobile device. Our innovative app not only simplifies the borrowing process but also allows users to increase their loan eligibility over time, with potential limits reaching up to $5,000!

Seamless Borrowing Experience

Lenme revolutionizes the way individuals access loans. Here’s what you can expect:

- No Credit Score Required: Forget about the traditional barriers of credit scores and debt-to-income ratios. With Lenme, you can apply without the usual paperwork hassle.

- Quick Loan Requests: Create your borrower profile and request a loan in under three minutes!

- Competitive Rates: Thousands of investors compete to offer you the best rates, giving you the power to choose what works for you.

- Fast Fund Transfers: Receive funds in your bank account as quickly as the same day.

- Increasing Loan Limits: As long as you repay your loans, your borrowing limit will continue to grow, potentially reaching up to $5,000!

Investing Made Easy with Lenme

If you're interested in investing, Lenme provides an ideal platform to earn passive income. Here’s how you can benefit:

- Diversify Your Portfolio: Invest in a market characterized by low volatility.

- Tailored Investments: Choose investments that align with your risk tolerance.

- Free Withdrawals: Enjoy the freedom to withdraw your earnings without any fees.

- Investment Assistance: Utilize LenmePredict, our advanced predictive service, to make informed investment decisions.

- Crypto-Backed Loans: Invest in loans secured by cryptocurrency, providing an additional layer of security.

New Crypto-Backed Loan Options

Lenme has introduced a groundbreaking loan option that allows borrowers to access up to $10,000 using their cryptocurrency wallet as collateral. This feature is perfect for crypto owners looking to leverage their assets for larger loans. Investors can also benefit significantly, with potential earnings of up to $1,700 when funding these loans.

Anonymous and Transparent Lending

Lenme connects borrowers with financial institutions, lending businesses, and individual investors while ensuring complete anonymity throughout the process. Our app features a “feed” tab that promotes transparency by displaying funded loans and associated fees, fostering a fair and competitive lending environment. Please note that some loans may not be available to Android users.

Subscription Plans for Enhanced Features

Lenme offers flexible subscription options through Google Play, with both monthly and annual plans available. Subscriptions automatically renew unless canceled 24 hours before the end of the subscription period. You can cancel anytime via your Google Play account.

Additionally, our LenmePredict service, powered by machine learning, is available for lenders through Apple Pay. This service can be purchased on a per-use basis or via subscription, with similar renewal and cancellation policies.

Understanding Crypto-Backed Loans

Our innovative crypto-backed loans allow investors to fund cash loans secured by the borrower's cryptocurrency. In the event of a default or a sudden drop in the cryptocurrency's value, the collateral may be liquidated to cover the loan. While Lenme does not directly influence lending decisions, we provide a transparent platform where borrowers can request loans based on various factors, including credit history, income, and cash flow analysis.

Loan Cost Example

To illustrate the potential costs associated with borrowing, consider this example: If you borrow $1,000 over a one-year term with an APR of 12% and an origination fee of 1%, your monthly payment would be approximately $89.75. The total amount payable would be $1,076.96, which includes $76.96 in interest and fees.

Learn More About Lenme

For further details, please review our Privacy Policy and Terms of Use.

With Lenme, you can unlock a world of financial opportunities, whether you're looking to borrow or invest. Experience the future of lending today!

Rate the App

User Reviews

Popular Apps

Editor's Choice