Latest Version

5.7.4

August 21, 2025

Legacy Bank Mobile

Finance

Android

0

Free

com.legacybank.legacybankapp

Report a Problem

More About Legacy Bank Mobile

Unlocking the Power of Modern Banking: Essential Features You Need

In today's fast-paced world, managing your finances efficiently is more important than ever. With the rise of digital banking, consumers now have access to a plethora of features designed to enhance their banking experience. This article explores the essential features that modern banking apps offer, ensuring you stay informed and in control of your finances.

Stay Informed with Real-Time Account Balances

One of the standout features of contemporary banking applications is the ability to access up-to-date account balance information. This real-time data allows you to monitor your finances effortlessly, ensuring you always know how much money you have available. Whether you're checking your balance before making a purchase or planning your monthly budget, having instant access to your account information is invaluable.

Comprehensive Transaction History and Details

Understanding your spending habits is crucial for effective financial management. Modern banking apps provide a detailed transaction history, allowing you to review past purchases and payments. This feature not only helps you track your expenses but also aids in identifying any unauthorized transactions, giving you peace of mind.

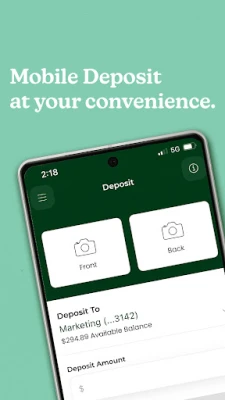

Convenient Mobile Check Deposit

Gone are the days of visiting a bank branch to deposit checks. With mobile check deposit functionality, you can easily deposit checks using your smartphone's camera. This feature saves time and simplifies the banking process, making it easier than ever to manage your funds on the go.

Seamless Fund Transfers

Transferring funds between internal and external accounts has never been easier. Modern banking apps allow you to move money quickly and securely, whether you're sending money to a friend or transferring funds to your savings account. This flexibility ensures that your money is always where you need it, when you need it.

Pay-a-Person Feature for Easy Transactions

The Pay-a-Person feature enables you to send money to anyone with just a few taps on your smartphone. This service is perfect for splitting bills, paying back friends, or making quick payments without the hassle of cash or checks. It streamlines the payment process, making it more convenient than ever.

Effortless Loan and Bill Payments

Managing loans and bills can be a daunting task, but modern banking apps simplify this process. With the ability to make loan and bill payments directly through the app, you can ensure that your payments are made on time, avoiding late fees and maintaining a good credit score.

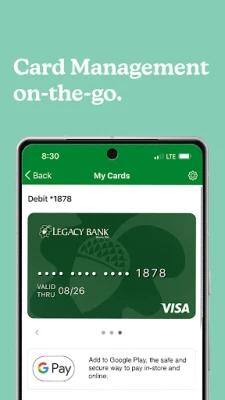

Comprehensive Card Management Services

Keeping track of your cards is essential for financial security. Banking apps offer complete card management services, allowing you to monitor your card activity, report lost or stolen cards, and even temporarily freeze your card if needed. This level of control helps protect your finances and provides peace of mind.

Track Your Spending Habits

Understanding your spending habits is key to effective budgeting. Many banking apps include features that allow you to track your spending patterns, categorize expenses, and set financial goals. This insight empowers you to make informed decisions about your finances and encourages responsible spending.

Access to Statements Anytime, Anywhere

With digital banking, accessing your statements has never been easier. You can view your account statements at any time, eliminating the need for paper statements and reducing clutter. This feature not only enhances convenience but also promotes eco-friendly banking practices.

Stop Payment Services for Added Security

If you ever need to halt a payment, modern banking apps provide stop payment services. This feature allows you to prevent a check or transaction from being processed, offering an extra layer of security in case of errors or fraud.

Direct Communication with Customer Support

Having direct access to customer support is crucial for resolving any banking issues. Many banking apps offer messaging or calling features, allowing you to connect with customer service representatives quickly. This accessibility ensures that you receive assistance whenever you need it.

Enhanced Security with Face ID and Touch ID

Security is a top priority for modern banking. Many apps now offer Face ID and Touch ID login options, providing a secure and convenient way to access your account. These biometric features enhance security while making it easier to log in without remembering complex passwords.

Customizable Notifications for Better Control

Staying informed about your account activity is essential. Banking apps allow you to customize text and push notifications for each card and account. This feature ensures that you receive timely alerts about transactions, helping you stay on top of your finances.

Easy eBank Web Connection for Additional Functionality

For those who prefer managing their finances on a larger screen, many banking apps offer an easy eBank web connection. This feature provides additional functionality and a more comprehensive view of your financial landscape, making it easier to manage your accounts from your computer.

Find a Location Near You

Even in a digital world, sometimes you need to visit a physical bank location. Modern banking apps include features that help you find the nearest branch or ATM, ensuring you can access in-person services when necessary.

Conclusion: Embrace the Future of Banking

With these essential features, modern banking apps are revolutionizing the way we manage our finances. From real-time account balances to seamless fund transfers and enhanced security measures, these tools empower consumers to take control of their financial lives. Embrace the future of banking and make the most of these innovative features to enhance your financial well-being.

Rate the App

User Reviews

Popular Apps

Editor's Choice