Latest Version

1.238.14

August 27, 2025

Dreamplug Technologies Private Limited

Finance

Android

0

Free

com.gooogle.android.kuvera.app

Report a Problem

More About Kuvera: Mutual Funds, SIP App

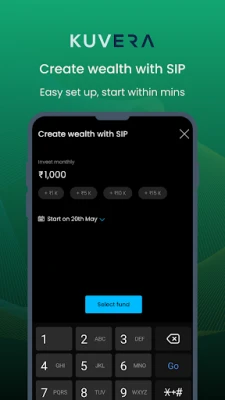

ONE APP FOR ALL YOUR INVESTING NEEDS

In today's fast-paced financial landscape, having a comprehensive investment solution at your fingertips is essential. Whether you're looking to build long-term wealth or manage your finances efficiently, our app offers a seamless experience for all your investing needs.

Start Your Journey with Mutual Funds

Embark on your investment journey by starting a Systematic Investment Plan (SIP) in mutual funds. This method allows you to create long-term wealth effortlessly. With access to over 5,000 direct mutual fund plans, you can choose from a diverse range of options tailored to your financial goals.

Diverse Investment Options

- Equity Funds: Invest in large-cap, mid-cap, and small-cap stocks.

- Debt Funds: Secure your investments with fixed income options.

- Hybrid Funds: Balance your portfolio with a mix of equity and debt.

- Index Funds & ETFs: Track market indices with ease.

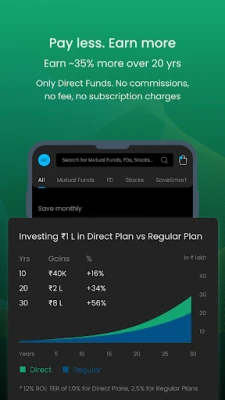

Make informed decisions by comparing fund performances against benchmarks like Nifty 50 and Nifty MidCap 100. You can also switch from regular to direct mutual fund plans at no extra cost, potentially earning up to 1.5% higher returns.

Financial Planning Made Simple

Our app simplifies financial planning, allowing you to set and achieve your financial goals. Whether it's buying a home, saving for retirement, or funding your child's education, our goal-planning feature helps you stay on track.

Family Account Management

Create a joint or individual account under a single login, making it easy to manage your family's investments. Whether you're overseeing your parents' portfolios or investing alongside your spouse, our platform offers a user-friendly experience.

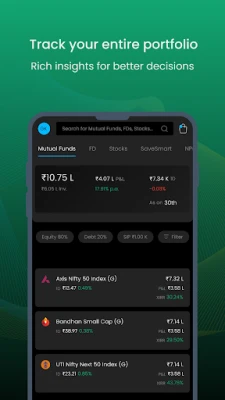

Smart Analytics for Informed Decisions

Gain valuable insights into your investments with our smart analytics feature. Analyze your asset allocation, track your portfolio's XIRR, and compare your performance with peers to make smarter investment choices.

Emergency Planning with SaveSmart

Prepare for unexpected expenses by investing in Liquid Mutual Funds. With SaveSmart, you can withdraw up to ₹2 lakhs within 30 minutes, ensuring you have access to funds when you need them most.

Maximize Your Savings and Wealth Creation

Our platform empowers you to save more and create wealth efficiently:

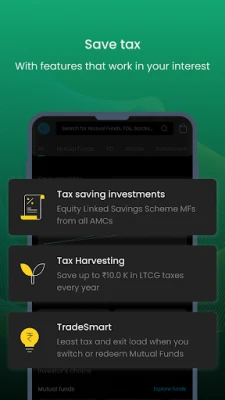

- Direct Mutual Funds: Save 35% over 20 years by investing in direct plans with zero commission.

- Tax Harvesting: Save up to ₹10,000 in Long-Term Capital Gains (LTCG) taxes every financial year.

- ELSS Mutual Funds: Reduce your tax liability with Equity Linked Savings Schemes from various Asset Management Companies (AMCs).

- TradeSmart: Enjoy minimal tax and exit load when switching or redeeming mutual funds.

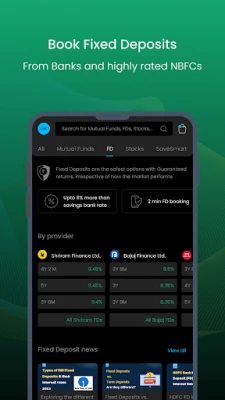

Investing in Fixed Deposits Made Easy

Your go-to app for fixed deposits allows you to book online in just a few minutes. Compare FD rates from a wide range of banks and Non-Banking Financial Companies (NBFCs) to find the best options for your investment needs.

Top Fixed Deposit Options

Choose from reputable institutions like Bajaj Finance, Shriram Finance, Mahindra Finance, and Axis Bank, with more options being added regularly.

Effortless Stock Market Investing

Navigate the stock market with ease. Buy and sell shares on the NSE Nifty 50 and BSE Sensex while tracking live price movements. Import your stock portfolio from brokers and demat accounts like Zerodha and Upstox, or upload your Consolidated Account Statement (CAS) from CDSL or NSDL.

Comprehensive Stock Insights

Stay informed with the latest share prices, top gainers and losers, and detailed financial statements. Utilize intuitive charts to compare your investments with peers and make data-driven decisions.

Your Data is Safe with Us

We prioritize your security with 128-bit bank-grade encryption and hold an ISO/IEC 27001:2013 certification. As a SEBI-registered investment advisor, you can trust that your investments are in safe hands.

Get Started Today!

Take control of your financial future with our all-in-one investment app. For any inquiries or support, feel free to reach out to us at support@kuvera.in.

AREVUK Advisory Services Pvt Ltd | SEBI Registration No. INA200005166

Disclaimer: Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully. Registration granted by SEBI, membership of BASL (in case of IAs), and certification from NISM do not guarantee the performance of the intermediary or provide any assurance of returns to investors. Investments in the securities market are subject to market risks. Review all related documents carefully before investing. The securities quoted are for illustration only and are not recommendations.

Rate the App

User Reviews

Popular Apps

Editor's Choice