Latest Version

2.17.1

October 15, 2025

BANK OF AYUDHYA PUBLIC COMPANY LIMITED

Finance

Android

0

Free

com.krungsri.kept

Report a Problem

More About Kept – saving with your style

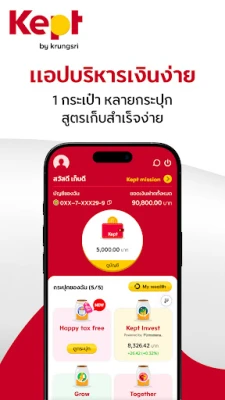

Maximize Your Savings Effortlessly with Kept: The Ultimate Financial Tool

In today's fast-paced world, managing your finances can be a daunting task. Fortunately, with the innovative features offered by the Kept app, saving money has never been easier or more efficient. This article explores the automatic features of Kept that empower you to save effortlessly while achieving your financial goals.

Set Your Budget and Watch Your Savings Grow

One of the standout features of the Kept app is its ability to help you manage your budget effectively. By setting a spending limit, any excess funds are automatically transferred to your Kapook Grow account. This feature not only ensures that you stay within your budget but also allows your savings to earn a higher interest rate. Imagine watching your money grow without lifting a finger!

Automatic Savings with Every Purchase

Every time you make a purchase, the Kept app takes the initiative to help you save. It automatically allocates a portion of your spending to your Kapook Fun account, where you can enjoy special rewards. This seamless integration of saving while spending means you can indulge in your favorite activities without feeling guilty about your finances.

Regular Savings Made Simple

Consistency is key when it comes to saving money. The Kept app offers an automatic regular save feature that allows you to set up daily, weekly, or monthly savings plans. This feature ensures that you are regularly contributing to your savings without having to think about it. Whether you prefer to save a little each day or make a larger contribution once a month, Kept has you covered.

Set Savings Goals and Collaborate with Friends

Setting financial goals is crucial for successful saving. With the Kapook Together feature, you can establish your savings objectives and invite friends to join you on your journey. This collaborative approach not only keeps you motivated but also fosters a sense of community as you work together to achieve your financial aspirations.

Explore Investment Opportunities with Kept Invest

For those looking to expand their financial horizons, the Kapook Kept Invest feature opens up a world of investment opportunities. You can choose from various investment plans tailored to your risk tolerance and financial goals. However, it's essential to study the fund features, conditions of returns, and associated risks before making any investment decisions. Kept provides the tools you need to make informed choices about your financial future.

Experience the Benefits of Kept Today!

With its array of automatic features designed to simplify saving and investing, the Kept app is your ultimate financial companion. You will be amazed at how easily you can meet your financial goals with the help of Kept. Don't wait any longer—start your journey towards financial freedom today!

For more information, visit www.keptbykrungsri.com.

Contact: Bank of Ayudhya PCL, 1222 Rama III Road, Bang Phongphang, Yan Nawa, Bangkok 10120, Thailand.

Rate the App

User Reviews

Popular Apps

Editor's Choice