Latest Version

1.9.2

April 13, 2025

Banco Itaú Uruguay S.A.

Finance

Android

0

Free

com.uy.itau.appile

Report a Problem

More About Itaú Empresas Uruguay

Comprehensive Guide to Payroll and Supplier Payments with Itaú

Managing payroll and supplier payments efficiently is crucial for any business. With Itaú's advanced banking solutions, you can streamline these processes while ensuring security and convenience. This article explores the various services offered by Itaú, including digital tools, transaction details, and customer support options.

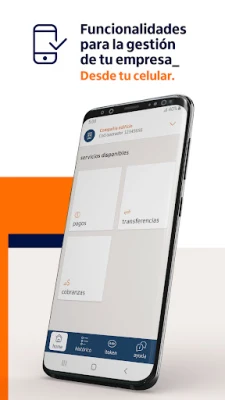

Efficient Payroll and Supplier Payments

One of the primary services provided by Itaú is the seamless processing of payroll and supplier payments. This service allows businesses to manage their financial obligations with ease, ensuring that employees and suppliers are paid on time. By utilizing Itaú's platform, companies can automate their payment processes, reducing the risk of errors and enhancing overall efficiency.

Transfer Options: Local and International

Itaú offers a variety of transfer options to meet the needs of businesses operating both locally and internationally. With the ability to make transfers to other banks within the country and abroad, Itaú ensures that your payments reach their destination quickly and securely. This flexibility is essential for businesses that engage in cross-border transactions or have suppliers in different regions.

Direct Debits for Hassle-Free Payments

Another feature that enhances payment efficiency is the option for direct debits. This service allows businesses to set up automatic payments for recurring expenses, such as utility bills or supplier invoices. By automating these transactions, companies can save time and avoid late fees, ensuring that their financial commitments are met without manual intervention.

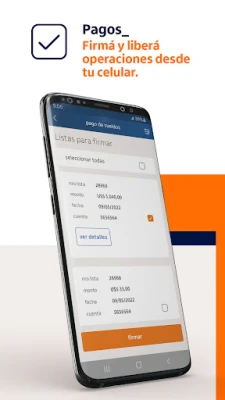

Incorporating Digital iToken for Limitless Operations

To further enhance security and convenience, Itaú has introduced the digital iToken. This innovative tool allows users to operate without limits, providing an additional layer of security for online transactions. With the iToken, businesses can confidently manage their finances, knowing that their sensitive information is protected against unauthorized access.

Online Receipts for Record Keeping

Itaú also provides online receipts that can be easily shared or used as records of completed transactions. This feature is particularly beneficial for businesses that need to maintain accurate financial records for auditing or tax purposes. By having access to digital receipts, companies can streamline their record-keeping processes and ensure compliance with financial regulations.

Transaction Queries: Accessing Operation Details

For businesses that require detailed insights into their financial activities, Itaú offers comprehensive transaction queries. Users can access information about entered operations and view historical transaction data. This transparency allows businesses to monitor their financial health and make informed decisions based on their transaction history.

Customer Support: Assistance When You Need It

Itaú understands that timely assistance is vital for businesses. Therefore, they provide a virtual assistant to help users navigate their banking needs. Additionally, a dedicated emergency contact number is available for urgent situations, ensuring that businesses can receive support whenever necessary.

Additional Services: Branch and ATM Information

Beyond payment processing and customer support, Itaú offers a range of additional services to enhance the banking experience. Users can access information about branch locations and ATMs, making it easier to manage their banking needs in person. This accessibility is crucial for businesses that prefer face-to-face interactions or require cash transactions.

Conclusion: Streamlining Your Financial Operations with Itaú

In conclusion, Itaú provides a comprehensive suite of services designed to streamline payroll and supplier payments. With features like local and international transfers, direct debits, digital iToken security, online receipts, and robust customer support, businesses can manage their financial operations with confidence. By leveraging these tools, companies can enhance their efficiency, maintain accurate records, and ensure timely payments, ultimately contributing to their overall success.

Rate the App

User Reviews

Popular Apps

Editor's Choice