Latest Version

24.37

September 13, 2024

Credit Karma, LLC

Finance

Android

0

Free

com.creditkarma.mobile

Report a Problem

More About Intuit Credit Karma

Unlock Your Financial Potential: A Comprehensive Guide to Credit Monitoring and Personal Finance Tools

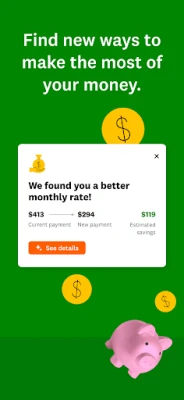

In today's fast-paced financial landscape, managing your finances effectively is crucial. With the right tools, you can monitor your transactions, track your spending, and even improve your credit score. This article explores various features that can help you take control of your financial health, from credit monitoring to personal loan marketplaces.

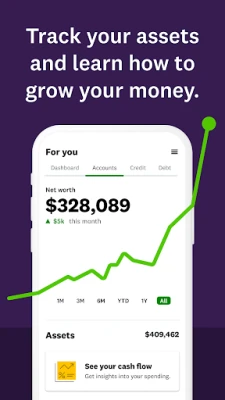

Centralized Financial Insights

Imagine having all your financial accounts in one place. By connecting your accounts, you can easily monitor your transactions, spending habits, and net worth. This centralized view not only simplifies your financial management but also helps you identify areas where you can save money. With real-time insights, you can make informed decisions that positively impact your financial future.

Free Credit Monitoring: Stay Informed

Understanding your credit score is essential for financial health. With free credit monitoring services, you receive alerts whenever your score changes. This feature allows you to learn what factors influence your credit score and provides valuable tips on how to improve it. Staying informed about your credit status empowers you to take proactive steps toward enhancing your financial profile.

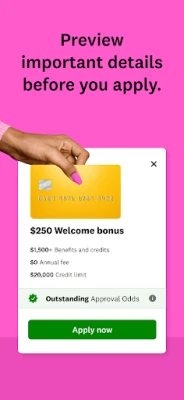

Advanced Cards and Loan Marketplace: Tailored Offers Just for You

Finding the right credit card or personal loan can be overwhelming. However, with an advanced cards and loan marketplace, you can discover the best offers tailored to your financial situation. This platform allows you to view specific credit limits, exact loan amounts, and interest rates you could qualify for. By comparing various options, you can make smarter financial choices that align with your goals.

Boost Your Credit Score with Credit Builder

If you have a low credit score, a credit builder program can be a game-changer. On average, users see an increase of 21 points in just three days after activating the plan. This quick boost can open doors to better financial opportunities, such as lower interest rates on loans and credit cards. Taking advantage of credit-building tools is a strategic move for anyone looking to improve their financial standing.

Effortless Checking with Early Pay Access

Managing your cash flow is vital, and with a checking account that offers direct deposit, you can access your paycheck up to two days earlier. This feature can be particularly beneficial for those who need quick access to funds for bills or unexpected expenses. By streamlining your banking experience, you can focus more on your financial goals and less on waiting for your paycheck.

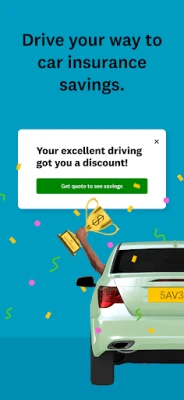

Drive Score: Save on Car Insurance

Your driving habits can significantly impact your car insurance rates. By maintaining a good drive score, you could save substantially on premiums from nationally trusted providers. This feature not only rewards safe driving but also encourages responsible behavior behind the wheel, ultimately benefiting your wallet.

Get Started Today: Download the App

With all these features at your fingertips, getting started is easy. Simply download the app and take the first step toward better financial management. Whether you're looking to monitor your credit, find the best loan offers, or improve your spending habits, this app provides the tools you need to succeed.

Important Disclosures

Banking services are provided by MVB Bank, Inc., Member FDIC. Please note that maximum balance and transfer limits apply per account. The Credit Builder program is not provided by MVB Bank. To activate the Credit Builder plan, a connected paycheck or a one-time direct deposit of $750 is required. The plan is serviced by Credit Karma Credit Builder and requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in four days of activating the plan.

Banking services are provided by MVB Bank, Inc., Member FDIC, with maximum balance and transfer limits applying. Early access to your paycheck is dependent on your employer submitting payroll information to the bank before the release date.

Loan services are offered through Credit Karma Offers, Inc., NMLS ID# 1628077. Personal loan offers displayed on the Credit Karma marketplace come from third-party advertisers, and Credit Karma receives compensation for these offers. Rates for personal loans range from 3.86% APR to 35.99%, with terms from 1 to 10 years. Other fees may apply, and all loan offers require your application and approval by the lender.

For example, if you take out a $15,000 personal loan with a four-year term, your monthly payments could range from $338 to $594, depending on the APR. The total amount paid over the term would range from $16,212 to $28,492, assuming all payments are made on time.

In conclusion, leveraging these financial tools can significantly enhance your financial well-being. Start today and unlock your financial potential!

Rate the App

User Reviews

Popular Apps

Editor's Choice