Latest Version

19.10.1

January 04, 2025

Banco Internacional del Peru

Finance

Android

0

Free

pe.com.interbank.mobilebanking

Report a Problem

More About Interbank APP

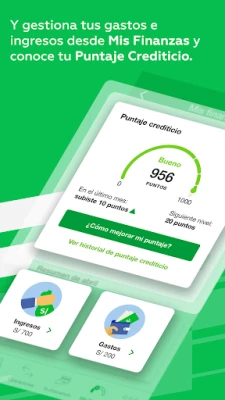

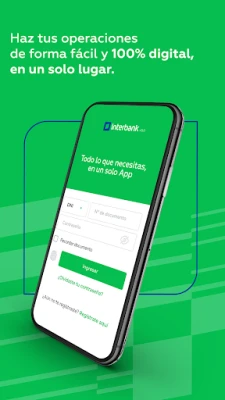

Unlock the Full Potential of Your Finances with the Interbank App

In today's fast-paced world, managing your finances efficiently is crucial. The Interbank App offers a comprehensive suite of features designed to streamline your banking experience. Whether you want to check your account balances or make secure online purchases, this app has you covered. Here’s a detailed look at what you can do with the Interbank App.

Check Balances and Transactions with Ease

With the Interbank App, you can effortlessly consult your account balances and transaction history for both your accounts and cards. For enhanced privacy, the app now allows you to hide your balances, ensuring that your financial information remains secure.

Quick Payment Access on Your Home Screen

The app features a user-friendly interface that lets you view your quick payments directly on the main screen. This functionality saves you time and makes it easier to manage your financial obligations at a glance.

Customize Your Frequent Transactions

Personalization is key to a seamless banking experience. The Interbank App allows you to customize your frequent operations from the Operations menu. This means you can set up shortcuts for the transactions you perform most often, making your banking experience more efficient.

Effortless QR Code Payments

Paying with QR codes has never been easier. The Interbank App enables you to make QR payments in just one step, providing a quick and secure way to complete transactions without the hassle of cash or cards.

Secure Online Shopping with Your Digital Card

For those who frequently shop online, the app offers a Digital Card feature. This allows you to visualize your digital card for faster and safer online purchases, ensuring that your financial data is protected while you shop.

Stay Informed with Alerts and Notifications

Security is paramount when it comes to managing your finances. The Interbank App allows you to activate consumption alerts and notifications. This feature keeps you informed about your spending and helps you monitor any unusual activity on your accounts.

Free Transfers Between Accounts

Transferring money has never been more convenient. You can make transfers to Interbank accounts and other banks completely free of charge. This feature is perfect for those who need to send money quickly and without incurring additional fees.

Configure Your Cards for Online and International Purchases

The app also allows you to set up your cards for online shopping and international transactions. This flexibility ensures that you can make purchases wherever you are, without any hassle.

Manage Your Credit Card Payments

Keeping track of your credit card payments is essential. With the Interbank App, you can pay your Interbank credit cards and those from other banks or financial institutions with ease, helping you stay on top of your financial commitments.

Convert Purchases into Installments

If you’ve made a purchase with your Interbank credit card, you can convert it into installments. This feature provides you with the flexibility to manage your payments over time, making larger purchases more manageable.

Special Exchange Rates for Currency Conversion

Traveling or making international purchases? The app allows you to exchange soles and dollars at a special exchange rate, giving you more value for your money when dealing with foreign currencies.

Pay Bills and Recharge Your Mobile

Managing your bills is a breeze with the Interbank App. You can pay services and recharge your mobile phone directly through the app, ensuring that you never miss a payment.

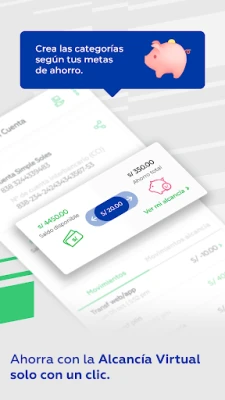

Access Financial Products Tailored for You

The app features a dedicated section called “Para ti”, where you can acquire financial products that suit your needs. This personalized approach helps you find the right financial solutions quickly and easily.

Secure Your Card Instantly

In case of loss or theft, the Interbank App allows you to block your card instantly. This feature provides peace of mind, knowing that you can protect your finances at a moment's notice.

Conclusion: Experience Banking Like Never Before

The Interbank App is more than just a banking tool; it’s a comprehensive financial management solution. With its wide array of features, you can take control of your finances, make secure transactions, and enjoy a personalized banking experience. For more information, visit Interbank's official website or stop by at Av. Carlos Villarán N° 140, Urb. Santa Catalina, La Victoria, Lima, Perú.

Rate the App

User Reviews

Popular Apps

Editor's Choice