Latest Version

3.52.0

December 15, 2024

HSBC

Finance

Android

0

Free

in.hsbc.hsbcindia

Report a Problem

More About HSBC India

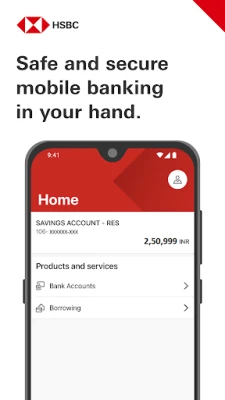

Experience Seamless Mobile Banking with HSBC India

In today's fast-paced world, mobile banking has become an essential tool for managing finances efficiently and securely. HSBC India offers a comprehensive mobile banking experience that combines convenience with robust security features. Here’s how you can make the most of your banking experience with HSBC India.

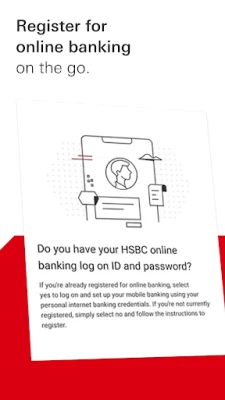

Easy Online Banking Registration

Setting up your online banking account has never been easier. With HSBC India, you can register directly from your mobile device. All you need is your phone banking number or your Permanent Account Number (PAN) for verification. This streamlined process ensures that you can access your banking services quickly and securely.

Enhanced Security with Fingerprint ID

For those who value speed and security, HSBC India supports Fingerprint ID for certain certified Android devices. This feature allows you to log in faster, confirm transactions, and manage your user profile with just a touch. For more details on compatible devices, visit our website.

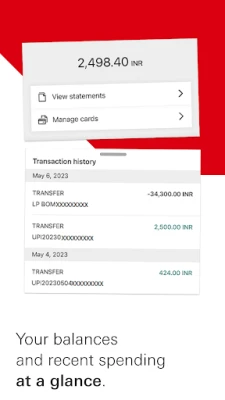

Comprehensive Accounts Summary

Stay informed about your finances with the updated accounts summary feature. The HSBC mobile app provides a clear overview of your accounts, allowing you to monitor your financial status at a glance. This seamless mobile experience ensures you are always in control of your finances.

Digital Secure Key for Online Banking

Generate a security code for online banking quickly and securely with the Digital Secure Key feature. This eliminates the need for a physical security device, making your banking experience more convenient while maintaining high security standards.

Effortless Money Management

Managing your finances is simple with HSBC India. You can add new beneficiaries for domestic payments quickly and securely, as well as make local currency transfers with ease. This feature ensures that your money management is both efficient and secure.

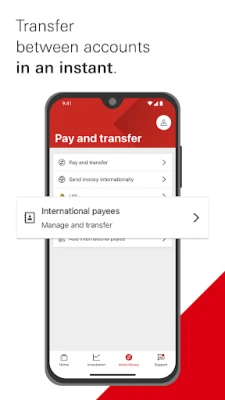

Global Money Transfers Made Easy

Send money like a local with HSBC's global money transfer service. You can manage your international payees and send money in over 20 currencies to more than 200 countries and territories. Enjoy a fee-free, secure, and quick transfer process that makes international banking hassle-free.

Seamless University Payments

HSBC India offers a cost-effective and secure way to handle all your university payments. Experience a smooth transaction process that simplifies your financial obligations while studying.

Quick UPI Payment Services

With UPI payment services, sending and receiving money locally is quick and easy. This feature allows you to make transactions effortlessly, enhancing your overall banking experience.

Digital Wealth Management Account Opening

HSBC India enables both resident and non-resident customers to apply for a Wealth Management Account digitally. This feature allows you to invest and manage your investments from anywhere, at any time, ensuring a secure and efficient process.

Mobile Wealth Dashboard for Easy Management

Review your investment performance and manage transactions effortlessly with the Mobile Wealth Dashboard. This feature consolidates all your investment information in one place, making it easier to track your financial growth.

Seamless Trading with Simply Invest

Link your HSBC account to retail broking services through our referral partner, ICICI Securities. Enjoy the benefits of seamless trading executed at the speed of your decisions, enhancing your investment experience.

Secure Messaging and Chat Support

Need assistance? Send a secure message or chat with us directly through the app. Our support team is ready to help you with any inquiries, making it as easy as texting a friend.

Access Your eStatements Anytime

View and download your bank account and credit card statements with ease. The eStatements feature allows you to keep track of your financial activities without the hassle of paper statements.

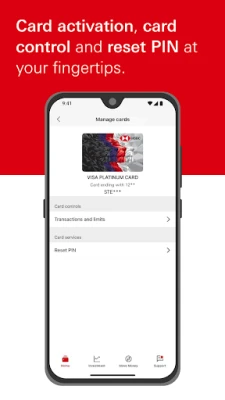

Manage Your Credit and Debit Cards

Activating your credit or debit card and resetting your PIN is now simpler than ever. With just a few steps, you can manage your cards efficiently, ensuring you have full control over your finances.

Overlimit Consent Management

Manage your financial needs by providing consent for credit card overlimit usage. This feature allows you to stay in control of your spending while ensuring you have access to additional funds when necessary.

Cash on EMI for Convenient Borrowing

The Cash-on-EMI feature on your HSBC credit card provides a convenient way to borrow cash and repay it in installments at lower interest rates. This option offers flexibility for managing unexpected expenses.

Loan on Phone for Simplified Payments

Pay off multiple credit card transactions with a single installment plan through the Loan on Phone feature. This service simplifies your payment process, making it easier to manage your finances.

Real-Time Transaction Updates

Stay informed with real-time updates of your credit card transactions. This feature ensures you are always aware of your spending, helping you manage your finances more effectively.

Update Your Profile and KYC Records

Keep your individual profile and KYC records up to date with ease. This feature allows you to manage your personal information securely and efficiently.

Reactivation of Inoperative Accounts

If you have an inoperative account, reactivating it is a straightforward process. This feature ensures that you can regain access to your funds without unnecessary complications.

Generate Interest Certificates Easily

Generate interest certificates for your savings and fixed deposit accounts effortlessly. This feature simplifies your financial documentation, making it easier to keep track of your earnings.

Personalized In-App Messaging

Eligible customers will receive personalized messages related to the latest offers, helpful reminders, and important notices. This feature keeps you informed and engaged with your banking services.

Download the HSBC India app now to enjoy a comprehensive digital banking experience on the go!

Important Note: HSBC India is authorized and regulated by the Reserve Bank of India. This app is provided by HSBC India for the use of its existing customers. If you are outside of India, we may not be authorized to offer or provide you with the products and services available through this app in your country or region.

Rate the App

User Reviews

Popular Apps

Editor's Choice