Latest Version

3.26.0

September 05, 2025

HomeTown Mobile

Finance

Android

0

Free

coop.hometowncu.grip

Report a Problem

More About HomeTown Mobile

Unlock the Power of Mobile Banking: Your Ultimate Guide

In today's fast-paced world, managing your finances on the go has never been easier. Mobile banking offers a suite of features designed to give you complete control over your accounts right from your smartphone. Here’s a comprehensive look at what you can do with mobile banking and how it can simplify your financial life.

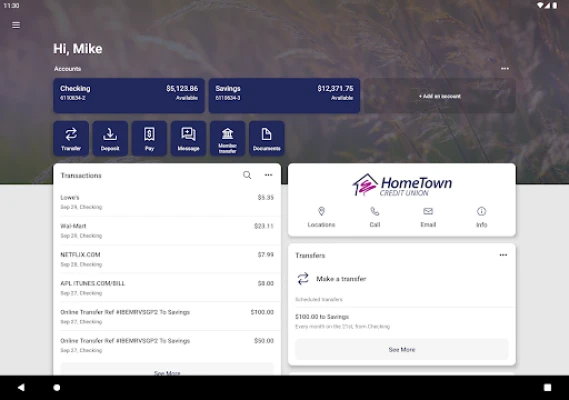

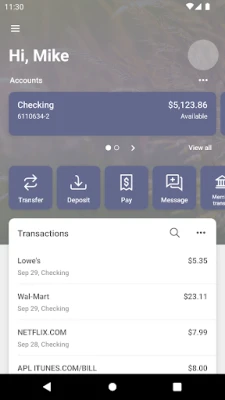

Check Your Account Balances Anytime, Anywhere

One of the most convenient features of mobile banking is the ability to check your account balances at any time. Whether you're at home, at work, or on the move, you can quickly access your financial information. This real-time access helps you stay informed about your spending and savings, allowing you to make better financial decisions.

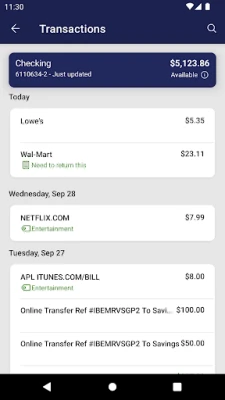

Review Recent Transactions with Ease

Keeping track of your spending is crucial for effective budgeting. With mobile banking, you can easily review your recent transactions. This feature allows you to monitor your purchases, identify any unauthorized charges, and ensure that your financial records are accurate. By regularly checking your transaction history, you can maintain a clear picture of your financial health.

Seamlessly Transfer Funds Between Your Accounts

Need to move money from your savings to your checking account? Mobile banking makes it simple. With just a few taps, you can transfer funds between your accounts without the hassle of visiting a bank branch. This feature is particularly useful for managing your finances, ensuring that you have the necessary funds available when you need them.

Deposit Checks Instantly

Gone are the days of waiting in line to deposit a check. Mobile banking allows you to deposit checks instantly using your smartphone's camera. Simply take a picture of the front and back of the check, and submit it through your banking app. This feature not only saves you time but also provides a secure way to manage your deposits from the comfort of your home.

View and Pay Bills Effortlessly

Managing bills can be a daunting task, but mobile banking simplifies the process. You can view your upcoming bills and make payments directly through your banking app. Set up reminders or automate your payments to ensure you never miss a due date. This feature helps you stay organized and avoid late fees, giving you peace of mind.

Access Mobile Banking for Free

One of the best aspects of mobile banking is that it is free to access. While you may incur messaging and data rates depending on your mobile plan, the banking services themselves come at no additional cost. This accessibility allows you to manage your finances without worrying about extra fees, making it an economical choice for everyone.

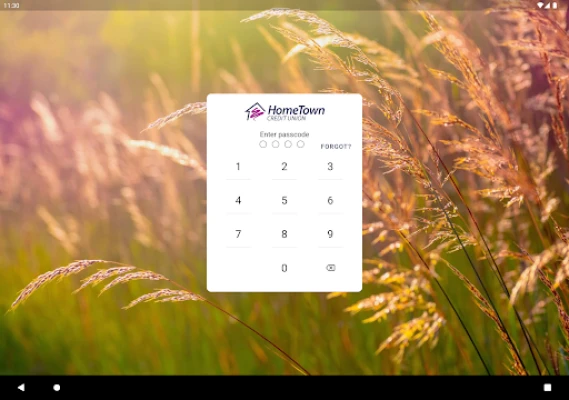

Security You Can Trust

Your financial security is paramount, and mobile banking platforms prioritize protecting your information. Most mobile banking apps use advanced encryption and security measures to safeguard your data. Additionally, your accounts are federally insured by the NCUA, providing an extra layer of protection for your funds. You can bank with confidence, knowing that your information is secure.

Conclusion: Embrace the Future of Banking

Mobile banking is revolutionizing the way we manage our finances. With features like checking account balances, reviewing transactions, transferring funds, depositing checks, and paying bills, it offers unparalleled convenience. Take advantage of these tools to streamline your financial management and enjoy the freedom of banking on the go. Embrace the future of banking today and experience the benefits of mobile banking for yourself!

Rate the App

User Reviews

Popular Apps

Editor's Choice