Latest Version

3.9.2

August 08, 2025

Hang Seng Bank Ltd

Finance

Android

0

Free

com.hangseng.cmbmobileapp

Report a Problem

More About Hang Seng Business Mobile App

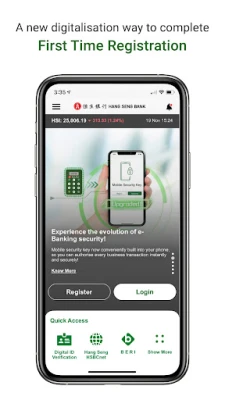

Maximize Your Business Efficiency with Hang Seng Business e-Banking

In today's fast-paced business environment, managing finances efficiently is crucial for success. Hang Seng Business e-Banking offers a comprehensive suite of features designed to streamline your banking experience. From managing debit cards to real-time transaction tracking, this platform empowers businesses to operate smoothly and effectively. Below, we explore the key functionalities that make Hang Seng Business e-Banking an essential tool for modern enterprises.

Control Your Commercial Debit Cards

With Hang Seng Business e-Banking, you can easily manage your Commercial Debit Cards. Set spending and withdrawal limits to maintain control over your finances. If you ever need to secure your funds, the option to temporarily block your cards is just a click away. Additionally, you can manage card-not-present transactions, ensuring that your credit cards are protected against unauthorized use.

Track and Redeem Rewards Effortlessly

Stay updated on the rewards you earn through Ever Earn missions. The platform allows you to check your rewards balance and redeem points either online or at physical redemption locations. This feature not only enhances your banking experience but also adds value to your business transactions.

Streamlined Identity Verification

Completing identity verification has never been easier. Utilize the iAM Smart feature to save time during the verification process. For various service applications, you can also verify your identity remotely using Digital ID Verification, ensuring a seamless experience without the need for in-person visits.

Instant Payments with QR Codes

Collecting payments for your business is simplified with the ability to generate QR codes instantly. This feature allows for quick and efficient transactions, enhancing customer satisfaction and improving cash flow.

Access to Account Balances and Transfers

Once your application is approved, you can check your Hang Seng (China) account balances effortlessly. The platform also facilitates easy local and overseas transfers between your accounts and to existing or new beneficiaries. You can update beneficiary details and authorize new additions, making fund management straightforward.

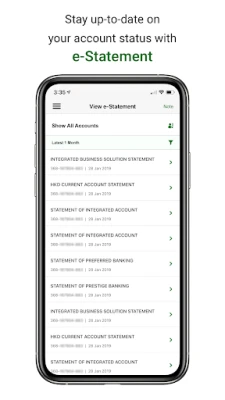

View Historical Account Data

Need to review past transactions? Hang Seng Business e-Banking allows you to view and save designated advices for up to 180 days. Additionally, you can access account statements for up to 7 years, with options to filter records and customize sorting according to your preferences.

24/7 Instant Support and Notifications

Receive instant support through Live Chat with customer service representatives, available around the clock. Stay informed about your account activities with Push Notifications, which also include updates on marketing promotions, ensuring you never miss an opportunity.

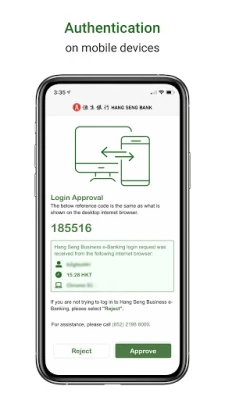

Enhanced Security Features

For transactions that previously required verification from a security device, you can now utilize the Mobile Security Key and Push Authentication. This enhancement not only streamlines the transaction process but also strengthens security. Furthermore, binding your profile to WeChat allows you to receive mobile reminders, reducing reliance on traditional mobile numbers or SIM cards.

AI-Powered Virtual Assistant

Meet B E R I, your AI-powered virtual assistant. Capable of addressing general commercial banking inquiries 24/7, B E R I enhances your banking experience by providing instant access to account summaries and facilitating a one-stop foreign exchange buy/sell experience.

Comprehensive Business Banking Services

Applying for Business Banking Accounts and submitting supplementary documents can be done online, making the process efficient and hassle-free. The platform also offers a one-stop service for Business Loans, allowing you to preview repayment schedules and submit applications seamlessly.

Biometric Authentication for Enhanced Security

Access your company account securely with biometric authentication using fingerprint verification. This feature adds an extra layer of security while ensuring quick access to your financial information.

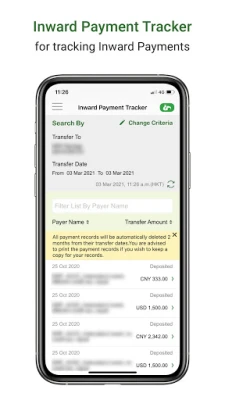

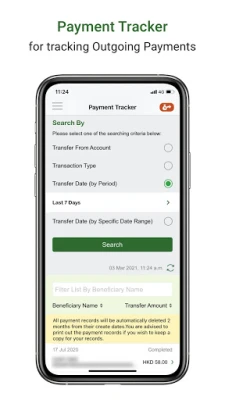

Real-Time Payment Tracking

Track the progress of your inward and outgoing payments in real-time. The platform allows you to access specific transactions with a custom search, ensuring you stay informed about your financial activities.

Stay Updated with Latest Promotions and Market Information

Keep abreast of the latest promotions and market information through Hang Seng Business e-Banking. Access foreign exchange information, property valuation services, and MPF information, all in one place.

Mobile Banking for Key Financial Functions

For Hang Seng Business e-Banking customers, the Hang Seng Business Mobile Banking app provides key financial functions, including:

- Account overview

- Fund transfers between your Hang Seng accounts

- Transfers to registered accounts (local and overseas banks)

- Foreign exchange services

- FX Order Watch

- Setting up new time deposits

- Transaction authorization, amendment, and deletion

- Push notifications for account status updates

In conclusion, Hang Seng Business e-Banking is designed to meet the diverse needs of modern businesses. With its robust features and user-friendly interface, it empowers you to manage your finances efficiently, ensuring that you can focus on what truly matters—growing your business.

Rate the App

User Reviews

Popular Apps

Editor's Choice