Latest Version

6.8.2

November 03, 2024

NetSpend

Finance

Android

0

Free

com.netspend.mobileapp.heb

Report a Problem

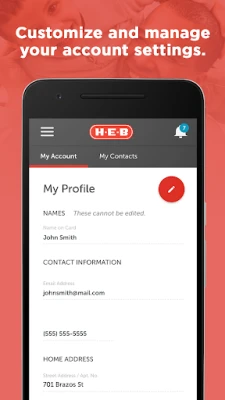

More About H-E-B Prepaid

Maximize Your Card Account: Balance Checks, Money Transfers, and More

Managing your finances has never been easier with the advanced features available for your Card Account. From checking your balance to sending money to loved ones, this guide will walk you through the essential functionalities that can enhance your financial experience.

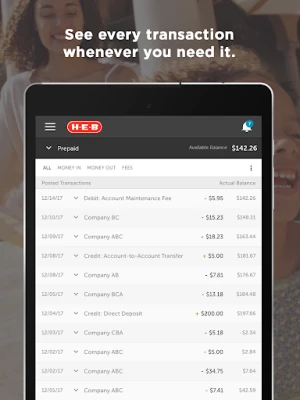

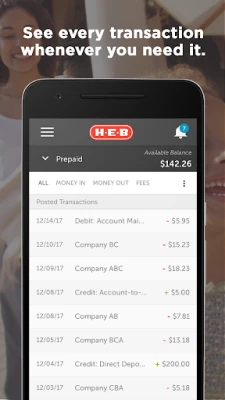

Check Your Card Account Balance and Transaction History

Staying informed about your finances is crucial. With your Card Account, you can easily check your balance and review your transaction history at any time. This feature allows you to monitor your spending habits, ensuring you stay within your budget. Accessing your account is straightforward; simply log in to your online banking portal or mobile app to view real-time updates on your balance and transactions.

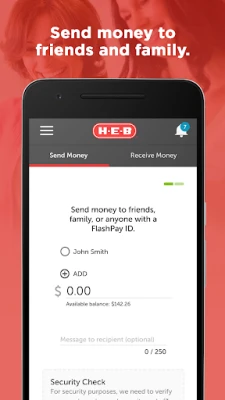

Send Money to Friends and Family Effortlessly

Need to send money quickly? Your Card Account makes it simple to send money to friends and family with just a few taps. Whether you’re splitting a bill or sending a gift, this feature allows for instant transfers, making it easier than ever to manage shared expenses. Just enter the recipient's details, specify the amount, and confirm the transaction. It’s fast, secure, and convenient.

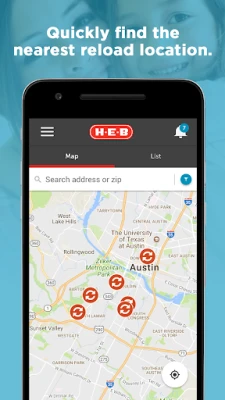

Find No-Cost Reload Locations

Reloading your Card Account doesn’t have to come with fees. You can easily find no-cost reload locations near you. Many retailers and partner locations offer free reload services, allowing you to add funds to your account without incurring additional charges. Check the app or website for a list of participating locations, and keep your account funded without the worry of extra costs.

Load Checks to Your Card Account with Ease

One of the standout features of your Card Account is the ability to load checks directly to your account. With the Mobile Check Load service, you can deposit checks simply by taking a picture. This innovative feature streamlines the process, allowing you to manage your funds without needing to visit a bank. Just follow these steps:

- Open the mobile app and select the Mobile Check Load option.

- Take clear pictures of the front and back of your check.

- Submit the images for processing.

Approval typically takes between 3 to 5 minutes, although it can take up to one hour. All checks are subject to approval, and it’s important to note that unapproved checks will not be funded to your card. This service is provided by First Century Bank, N.A. and Ingo Money, Inc., ensuring a secure and efficient transaction process.

Understanding Fees and Terms

While many features of your Card Account are free, it’s essential to be aware of potential fees associated with certain transactions. For instance, while loading checks may be convenient, fees may apply for approved Money in Minutes transactions funded to your card. Always refer to your Cardholder Agreement for detailed information on fees, terms, and conditions related to your account.

Additionally, your wireless carrier may charge fees for message and data usage when using mobile services. It’s advisable to review all associated costs to avoid any surprises.

Stay Informed and Secure

As you utilize the features of your Card Account, remember to stay informed about your financial activities. Regularly checking your balance and transaction history can help you detect any unauthorized transactions early. Moreover, always ensure that you are using secure networks when accessing your account online or through mobile apps.

In conclusion, your Card Account offers a range of features designed to simplify your financial management. From checking your balance to sending money and loading checks, these tools empower you to take control of your finances efficiently. Make the most of your Card Account today!

Rate the App

User Reviews

Popular Apps

Editor's Choice