Latest Version

5.0.7

November 14, 2024

Grid Paycheck Boost

Finance

Android

0

Free

com.hatfield.grid

Report a Problem

More About Grid Money

Unlock Financial Flexibility with Cash Advances and PayBoost

In today's fast-paced world, unexpected expenses can arise at any moment, leaving you in need of quick financial solutions. Cash advances and innovative services like PayBoost offer a lifeline, allowing you to manage your finances effectively between paychecks. This article explores how these services work, their benefits, and how you can take advantage of them to enhance your financial well-being.

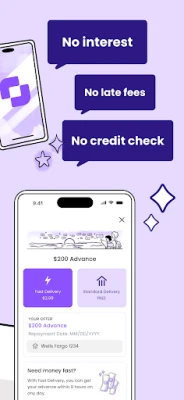

Understanding Cash Advances

Cash advances provide a convenient way to access funds when you need them most. With our Levels program, you can secure up to $200* per advance without the hassle of credit checks. This means you can get the cash you need quickly and transparently, ensuring you stay on top of your financial obligations.

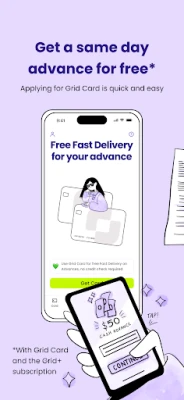

How Cash Advances Work

Getting a cash advance is straightforward. Simply sign up through our user-friendly app, and you can request an advance in just a few taps. The process is designed to be fast and efficient, allowing you to focus on what matters most—your financial stability.

Eligibility Requirements

While cash advances are accessible, certain eligibility criteria must be met. Your initial advance limit may be less than $200, but it can increase over time based on various factors, including:

- Your account activity and balance

- Direct deposit history

- Timely repayment of previous advances

- Income and tax refund projections

- Other risk-based factors

It's important to note that you can only take one advance at a time, ensuring responsible borrowing practices.

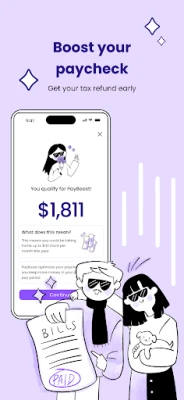

Boost Your Paycheck with PayBoost

Imagine receiving a portion of your tax refund with every paycheck. With PayBoost, this dream becomes a reality. This innovative service allows you to take home more of your earnings while providing early access to your tax refund, up to $250 per month.

How PayBoost Works

Signing up for PayBoost is simple and can significantly enhance your financial situation. By enrolling, you can receive a portion of your yearly tax refund distributed across your paychecks, giving you more control over your finances throughout the year.

The Benefits of PayBoost

Utilizing PayBoost offers several advantages:

- Increased Cash Flow: Enjoy more disposable income each month, allowing you to manage expenses more effectively.

- Financial Planning: With predictable cash flow, you can plan your budget better and avoid financial stress.

- Early Access to Funds: Get a head start on your tax refund, providing you with the flexibility to address urgent financial needs.

No Credit Checks for Easy Sign-Up

One of the standout features of both cash advances and PayBoost is the absence of credit checks during the sign-up process. This means you can quickly access the funds you need without the worry of impacting your credit score. The application process is designed to be user-friendly, ensuring that you can get started in no time.

Need Assistance? We're Here to Help!

If you have any questions or need support, our dedicated team is always available to assist you. Reach out to us at support@getgrid.app, and we’ll be happy to help you navigate your financial options.

Important Information

While cash advances and PayBoost provide valuable financial solutions, it’s essential to understand the terms and conditions associated with these services. Cash advances are subject to eligibility requirements, and your advance limit may change based on your financial activity. Additionally, interest checking accounts are established by Evolve Bank & Trust, Member FDIC, ensuring that your funds are secure and insured.

Loans are provided by licensed U.S. lenders, including Synapse Credit LLC and Pier Lending, LLC. For complete details, please refer to your loan documents and the Interest Checking Account Agreement.

Conclusion

Cash advances and PayBoost are powerful tools that can help you manage your finances more effectively. By providing quick access to funds and enhancing your paycheck, these services empower you to take control of your financial future. Don’t let unexpected expenses derail your plans—explore the benefits of cash advances and PayBoost today!

Remember, financial flexibility is just a few clicks away!

Rate the App

User Reviews

Popular Apps

Editor's Choice