Latest Version

4.66.0

September 22, 2024

Green Dot

Finance

Android

0

Free

com.cardinalcommerce.greendot

Report a Problem

More About Green Dot - Mobile Banking

Unlock the Benefits of Green Dot Cards: Your Ultimate Guide

Green Dot cards offer a versatile range of features designed to enhance your financial management. Whether you're looking for early access to your paycheck or convenient ways to send money, Green Dot has you covered. In this article, we will explore the key features of Green Dot cards, how to maximize their benefits, and why they stand out in the market.

Early Direct Deposit: Get Paid Sooner

One of the standout features of Green Dot cards is the early direct deposit option. With this feature, you can receive your paycheck up to 2 days early and government benefits up to 4 days early. This can significantly improve your cash flow, allowing you to manage your expenses more effectively. However, it's important to note that the availability of early direct deposit may vary based on the payor type and timing.

Convenient Money Management

Green Dot cards provide a seamless way to send money and pay bills. With just a few taps on your smartphone, you can transfer funds to friends and family or settle your monthly bills. This feature is especially useful for those who prefer digital transactions over traditional banking methods.

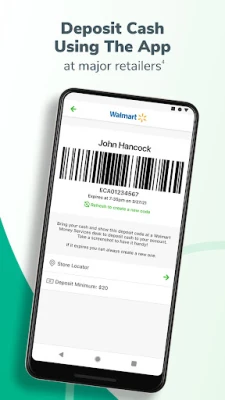

Deposit Cash with Ease

Using the Green Dot app, you can easily deposit cash at participating retailers. This feature eliminates the need to visit a bank branch, making it more convenient for users who prefer to manage their finances on the go. Keep in mind that limits and fees may apply, so it's advisable to check the app for details.

No Minimum Balance Requirement

Another attractive aspect of Green Dot cards is the no minimum balance requirement. This means you can maintain your account without the pressure of keeping a certain amount of money in it. This flexibility is ideal for individuals who may not have a consistent income or those who want to avoid unnecessary fees.

Additional Features for Enhanced Financial Control

Green Dot cards come with a variety of additional features that can further enhance your financial experience:

- Free ATM Network: Access a network of free ATMs, although limits apply. This can save you money on withdrawal fees.

- Overdraft Protection: With an opt-in and eligible direct deposits, you can enjoy overdraft protection up to $200. This feature provides peace of mind in case of unexpected expenses.

- Cash Back Rewards: Earn 2% cash back on qualifying online and mobile purchases with the Green Dot Cash Back Visa® Debit Card. This can add up to significant savings over time.

- High-Yield Savings Account: Save money in the Green Dot High-Yield Savings Account and earn 2.00% Annual Percentage Yield (APY) on balances up to $10,000. This is an excellent way to grow your savings while enjoying the benefits of a debit card.

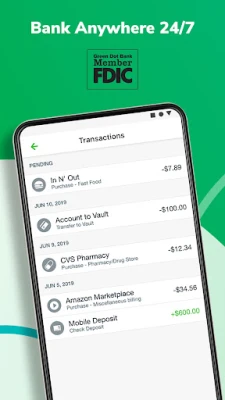

Manage Your Account with the Green Dot App

The Green Dot app is your go-to tool for managing your account efficiently. With the app, you can:

- Register and Activate: Easily register and activate your new card.

- View Balance and Transactions: Keep track of your spending and account balance in real-time.

- Lock/Unlock Your Account: Enhance security by locking your card if it’s lost or stolen.

- Deposit Checks: Use your mobile phone to deposit checks directly into your account.

- Mobile Payment Options: The card works seamlessly with mobile payment options like Apple Pay.

- Set Up Alerts: Stay informed with account alerts for transactions and balances.

- Customer Support: Access chat support for any inquiries or issues you may encounter.

Important Considerations

While Green Dot cards offer numerous benefits, there are some important considerations to keep in mind:

- Age Requirement: You must be 18 or older to purchase a Green Dot card.

- Activation Requirements: Activation requires online access, a mobile number, and identity verification, including your Social Security Number (SSN).

- Fees and Limits: Be aware of potential fees and limits associated with certain features, such as overdrafts and ATM withdrawals.

Conclusion: Why Choose Green Dot Cards?

Green Dot cards provide a comprehensive suite of features that cater to modern financial needs. From early direct deposits to cash back rewards and a user-friendly app, they offer a convenient and flexible banking solution. Whether you're looking to manage your money more effectively or save for the future, Green Dot cards can help you achieve your financial goals.

For more information and to explore the full range of features, visit GreenDot.com.

©2023 Green Dot Corporation. All rights reserved. Green Dot cards are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A., Inc. and Mastercard International Inc.

Rate the App

User Reviews

Popular Apps

Editor's Choice