Latest Version

1.2.4

December 10, 2024

JM Bullion, Inc.

Finance

Android

0

Free

com.jmbullion.app

Report a Problem

More About Gold & Silver Spot Price

Unlocking Precious Metals: Your Ultimate Guide to Real-Time Spot Prices and Alerts

In the ever-evolving world of precious metals, staying informed about spot prices is crucial for investors and enthusiasts alike. This article delves into the essential features that can enhance your experience in tracking the prices of silver, gold, platinum, and palladium. From interactive charts to real-time updates, discover how to make the most of your investment strategy.

Interactive Charts: Visualize Precious Metal Trends

One of the standout features for anyone interested in precious metals is the availability of interactive charts. These charts provide a comprehensive view of spot prices for silver, gold, platinum, and palladium over various timeframes. Whether you want to analyze trends over the past five years or focus on the last 24 hours, these visual tools make it easy to understand market movements.

- 5 Years: Long-term trends and historical data.

- 1 Year: Yearly performance insights.

- 6 Months: Short-term fluctuations.

- 3 Months: Recent market behavior.

- 1 Month: Monthly price changes.

- 7 Days: Weekly trends.

- 24 Hours: Immediate price shifts.

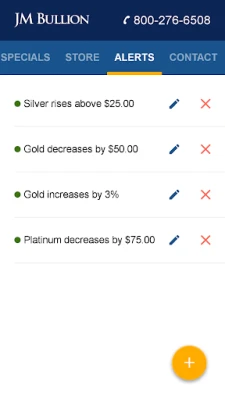

Stay Alert: Set Up Price Notifications

In the fast-paced world of precious metals, timing is everything. The ability to set up email and text price alerts for silver and gold prices ensures you never miss a critical market movement. You can easily configure alerts through popular platforms such as Facebook, Google+, Yahoo!, or Outlook. This feature allows you to receive real-time notifications directly to your preferred device, keeping you informed and ready to act.

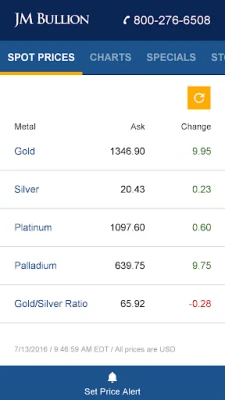

Real-Time Spot Price Updates: Instant Access to Market Data

Access to real-time spot price updates for silver, gold, platinum, and palladium is essential for making informed investment decisions. With live data at your fingertips, you can track price changes as they happen, allowing you to capitalize on favorable market conditions. This feature is particularly beneficial for traders who need to react quickly to price fluctuations.

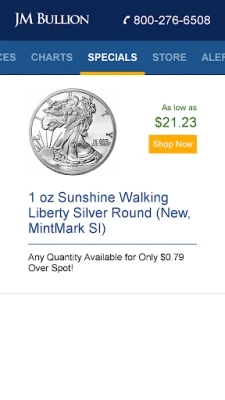

Exclusive Offers: Weekly On-Sale Items

Investing in precious metals can be more rewarding with access to weekly on-sale items and special price-over-spot offers. These promotions provide opportunities to purchase metals at competitive rates, enhancing your investment portfolio. By keeping an eye on these exclusive deals, you can maximize your returns and make the most of your investments.

Gold/Silver Ratio: Understanding Market Dynamics

The real-time gold/silver ratio updates are another invaluable feature for investors. This ratio indicates the relative value of gold to silver and can provide insights into market trends. By monitoring this ratio, you can make more informed decisions about when to buy or sell your precious metals, ultimately optimizing your investment strategy.

Conclusion: Empower Your Precious Metals Investment Journey

In conclusion, the features outlined above are designed to empower investors in the precious metals market. With interactive charts, real-time updates, and customizable alerts, you can stay ahead of the curve and make informed decisions. Whether you are a seasoned investor or just starting, leveraging these tools will enhance your understanding of market dynamics and help you achieve your investment goals.

Stay informed, stay alert, and make the most of your precious metals investments today!

Rate the App

User Reviews

Popular Apps

Editor's Choice