Latest Version

7.9

December 13, 2024

Goalsetter

Finance

Android

0

Free

com.goalsetter

Report a Problem

More About Goalsetter: Invest & Bank

Empower Your Family's Financial Future with Goalsetter: The Ultimate Debit Card and Investment Platform

In today's fast-paced financial landscape, understanding money management is crucial for families. Goalsetter stands out as a pioneering financial technology company, offering innovative solutions that empower families to take control of their finances. Unlike traditional banks, Goalsetter partners with Webster Bank, N.A., Member FDIC, to provide banking services, while the Cashola Prepaid Debit Mastercard® is issued by Pathward, N.A. (formerly MetaBank, N.A.), also a Member FDIC.

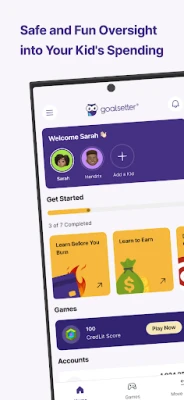

Goalsetter: A Comprehensive Debit Card Solution for All Ages

Goalsetter is designed to help families learn essential money management skills. With a debit card tailored for every family member, users can earn, spend wisely, and save effectively. Parents have the ability to send money directly to their children's debit cards, manage card activity, and monitor transaction history. This transparency fosters a collaborative environment where families can cultivate healthy spending and saving habits together. The standard Goalsetter plan encompasses all features, excluding the premium Goalsetter Gold investment accounts.

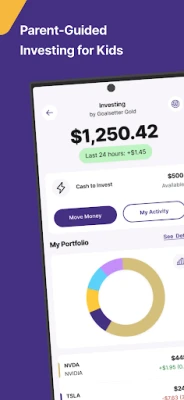

Introducing Goalsetter Gold: Investing Made Accessible

The Goalsetter Gold plan revolutionizes family investing by allowing members to buy and sell stocks and Exchange-Traded Funds (ETFs). This unique brokerage plan not only enables families to own shares in various companies but also provides access to educational tools that demystify the stock market and investing.

With our Learning Mode, users can explore essential stock trading terminology through engaging videos that address common questions. This feature is designed to empower users to become investment experts at their own pace. Each video is accompanied by a matching quiz, ensuring that users can reinforce their knowledge and track their progress.

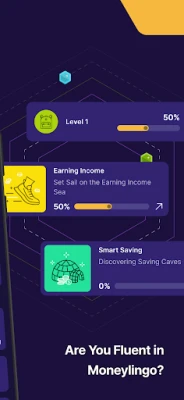

Financial Literacy Through Fun: Memes and Games

Goalsetter believes that learning about finances should be enjoyable for everyone. Our financial literacy quizzes cater to all family members, from adults to kids, ensuring that everyone can develop healthy money habits. These quizzes align with national financial literacy standards, teaching essential financial language and math skills through relatable pop culture memes and GIFs.

Chores and Allowance: Customizable Family Solutions

Understanding that every family has its own approach to allowances, Goalsetter offers customizable Allowance Rules. Parents can set specific amounts for each child and link their bank accounts for seamless weekly allowance transfers. This eliminates the need for IOUs and simplifies the process of managing family finances.

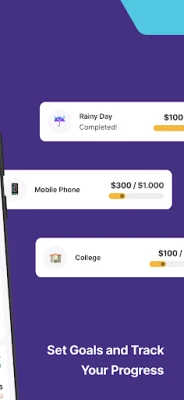

Goal Tracking: Saving for the Future

Goalsetter's app allows families to set and track savings goals, whether for a rainy day or a dream vacation. Both kids and parents can contribute to these goals, serving as a constant reminder of the importance of saving for the future. Once a goal is achieved, funds can be easily accessed and utilized. Flexibility is key; families can cash out from a goal at any time, accommodating life's unexpected changes.

Safety and Security: Your Financial Data is Protected

At Goalsetter, the safety of your financial information is paramount. We utilize 128-bit encryption to safeguard your data, ensuring that personal information is never stored or moved without your explicit authorization. For those wishing to delete app data, please reach out to us at Hello@goalsetter.co. Note that financial transaction data is retained in accordance with federal and state regulations.

Award-Winning Innovation in Financial Technology

Goalsetter's commitment to excellence has been recognized through numerous awards, including:

- Winner of an FDIC Award 2021

- Winner of JP Morgan Chase Financial Solutions Lab 2018

- Winner of Morgan Stanley Innovations Lab 2018

- Winner of FinTech Innovation Lab 2019

Important Disclosures for Investors

Investment advice is provided by Goalsetter Advisors, LLC, operating as Goalsetter Gold. Please be aware that Goalsetter Gold investment accounts are not FDIC-insured, nor are they bank guaranteed, and they may lose value. It is essential for families to understand the risks associated with investing and to make informed decisions.

Conclusion: Start Your Financial Journey with Goalsetter Today

Goalsetter is more than just a financial tool; it is a comprehensive platform designed to educate and empower families in their financial journeys. With features that promote saving, investing, and financial literacy, Goalsetter is the ideal partner for families looking to build a secure financial future. Join the Goalsetter community today and take the first step towards mastering your family's finances!

Rate the App

User Reviews

Popular Apps

Editor's Choice