Latest Version

1.1.9

August 11, 2025

Pieter Hurter

Finance

Android

0

Free

com.hurtertrading.fx_journal

Report a Problem

More About FX Journal

Mastering Trade Journals: The Key to Successful Trading

In the fast-paced world of trading, maintaining a meticulous record of your activities is crucial for long-term success. A well-structured trade journal not only helps you track your performance but also enhances your decision-making process. This article delves into the essential components of an effective trade journal and how it can elevate your trading game.

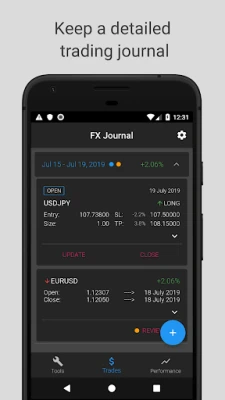

1. Maintain a Comprehensive Trade Log

Keeping a detailed log of your trades is fundamental. Document every trade you execute, including entry and exit points, trade size, and the rationale behind each decision. This practice allows you to analyze your performance over time and understand the percentage-based growth of your account. By focusing on the percentage of gains or losses, you can better assess your trading strategies without getting distracted by the absolute monetary values.

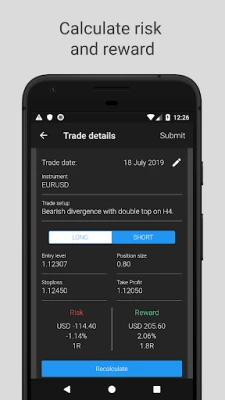

2. Validate Trade Setups and Assess Risk/Reward Ratios

Before executing any trade, it’s essential to validate your trade setups. This involves analyzing market conditions, technical indicators, and other relevant factors that support your trading decision. Additionally, calculating the risk/reward ratio is vital. A favorable risk/reward ratio ensures that the potential reward justifies the risk taken, helping you make informed decisions that align with your trading goals.

3. Document Your Thought Process

Recording your thought process from the initial trade idea to a post-trade review is invaluable. This narrative not only captures your reasoning but also serves as a learning tool for future trades. Reflecting on your decisions helps identify patterns in your trading behavior, allowing you to refine your strategies and improve your overall performance.

4. Utilize Visual Aids and Data Exporting

Incorporating visual aids, such as screenshots of your trades, can enhance your trade journal significantly. Visual representations of your trades provide context and clarity, making it easier to analyze your decisions later. Furthermore, exporting your data to CSV format allows for easier manipulation and analysis, enabling you to create comprehensive reports on your trading performance.

5. Shift Your Focus to Percentages

Learning to think in percentages rather than focusing solely on monetary values is a game-changer for traders. By concentrating on the percentage of your account that you are risking or gaining, you can make more rational decisions. This mindset shift helps you maintain a balanced perspective, reducing emotional reactions to market fluctuations and enhancing your overall trading discipline.

6. Identify Strengths and Weaknesses

One of the most significant benefits of maintaining a trade journal is the ability to identify your strengths and weaknesses as a trader. By analyzing your past trades, you can pinpoint recurring mistakes and successful strategies. This self-awareness is crucial for developing your unique edge in the market, allowing you to capitalize on your strengths while addressing your weaknesses.

Conclusion: The Path to Trading Mastery

In conclusion, a well-maintained trade journal is an indispensable tool for any trader aiming for success. By keeping a detailed log, validating trade setups, documenting your thought process, utilizing visual aids, focusing on percentages, and identifying your strengths and weaknesses, you can significantly enhance your trading performance. Embrace the discipline of journaling, and watch as it transforms your trading journey.

For further insights or suggestions, feel free to leave comments or reach out via email.

Rate the App

User Reviews

Popular Apps

Editor's Choice