Latest Version

1.89.0

May 08, 2025

Fundrise

Finance

Android

0

Free

com.fundrise.android

Report a Problem

More About Fundrise: Invest in Alts

Unlocking Wealth: The Power of Private Real Estate and Alternative Investments

In today's dynamic financial landscape, private real estate investing stands out as a compelling avenue for generating consistent cash flow and long-term wealth through appreciation. With platforms like Fundrise, investors can access a diverse portfolio of real estate assets, including single-family rentals, industrial properties, and multifamily apartments, collectively valued at over $7 billion. This article explores the benefits of private real estate, venture capital, private credit, and advanced diversification strategies that can enhance your investment journey.

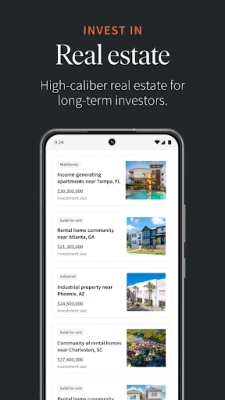

The Benefits of Private Real Estate Investing

Private real estate investing offers unique advantages that traditional investments often lack. Here are some key benefits:

- Consistent Cash Flow: Real estate investments can provide regular income through rental payments, making them an attractive option for those seeking steady cash flow.

- Long-Term Appreciation: Over time, real estate properties tend to appreciate in value, contributing to overall wealth growth.

- Diverse Investment Options: Platforms like Fundrise allow investors to diversify their portfolios across various property types, reducing risk and enhancing potential returns.

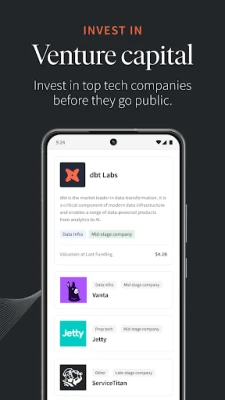

Venture Capital: Investing in Tomorrow's Technology

Investing in high-growth private technology companies has emerged as one of the most lucrative strategies over the past five decades. Fundrise's venture capital fund focuses on mid-to-late stage startups in cutting-edge sectors such as:

- Artificial Intelligence: Companies leading the AI revolution are reshaping industries and creating unprecedented opportunities.

- Modern Data Infrastructure: As data becomes the new oil, investing in companies that manage and analyze data is crucial.

- Machine Learning: This technology is transforming how businesses operate, making it a prime area for investment.

By investing in these sectors, you can gain early access to some of the world's most promising tech companies before they go public.

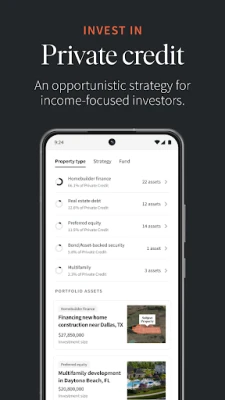

Private Credit: Capitalizing on Market Opportunities

The current economic environment presents unique opportunities for private credit investments. With a growing number of borrowers seeking capital and fewer lenders available, the cost of borrowing has surged. This scenario creates a rare window for private lending, offering:

- Attractive Risk-Adjusted Returns: Private credit investments can yield higher returns compared to traditional fixed-income securities.

- Income-Generating Opportunities: Investors can benefit from consistent income streams through interest payments from loans.

Advanced Diversification: A Smart Investment Strategy

Diversification is essential for long-term wealth creation and risk management. Fundrise simplifies the process of diversifying beyond traditional stocks and bonds, allowing you to:

- Minimize Asset Correlation: By investing in a variety of private market assets, you can reduce the overall risk of your portfolio.

- Gain Immediate Exposure: Diversifying with Fundrise provides instant access to a wide range of high-quality investments.

Transparent Reporting: Stay Informed About Your Investments

With Fundrise, you can monitor your investments in real-time. Within minutes of investing, you can:

- Track Diversification: See how your funds are allocated across various assets.

- Receive Updates: Stay informed about new acquisitions, construction progress, market trends, and exit strategies.

Bank-Level Security: Protecting Your Investments

Your security is paramount when investing. Fundrise employs bank-level security measures to safeguard your information, including:

- AES Encryption: All investor data is encrypted to ensure confidentiality.

- Two-Factor Authentication: This added layer of security helps protect your account from unauthorized access.

- Biometric Access: App users can utilize biometric features for enhanced security.

Expert Support: Assistance When You Need It

Fundrise provides dedicated support through its Investor Relations team, available via email or phone. Whether you have questions about your account or need assistance with your investments, expert help is just a call or click away.

Getting Started: A Simple Investment Process

Embarking on your investment journey with Fundrise is straightforward:

- Download the App: Access the free mobile app or visit fundrise.com to get started.

- Choose Your Investment Amount: With flexible minimums starting at just $10, you can invest according to your budget.

- Grow Your Portfolio: Continue investing over time to build your net worth and achieve your financial goals.

Conclusion: Embrace the Future of Investing

Private real estate, venture capital, and private credit represent powerful investment opportunities that can enhance your financial portfolio. By leveraging platforms like Fundrise, you can access diverse assets, benefit from expert support, and enjoy the peace of mind that comes with bank-level security. Start your investment journey today and unlock the potential for long-term wealth creation.

Disclosures: The total real estate value of projects invested in since the inception of Rise Companies Corp sponsored real estate investment programs is as of 12/31/2022. Fundrise Advisors, LLC is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Fundrise’s charges and expenses. Nothing in this material should be construed as investment or tax advice, or a solicitation or offer, or recommendation, to buy or sell any security. All images and return and projection figures shown are for illustrative purposes only, may assume additional investments over time, and are not actual Fundrise customer or model returns or projections. Visit fundrise.com/oc for offering documents and other information.

Rate the App

User Reviews

Popular Apps

Editor's Choice