Latest Version

7.5.1

September 14, 2024

FloatMe

Finance

Android

0

Free

io.floatme.floatmeapp

Report a Problem

More About FloatMe: Budget & Cash Advance

Unlock Your Financial Freedom with FloatMe: Cash Advances Made Easy

In today's fast-paced world, managing finances can be challenging. Whether you need to pay bills, fill up your gas tank, or buy groceries, unexpected expenses can arise at any moment. Fortunately, FloatMe offers a seamless solution to help you access your earned wages quickly and efficiently. This article will explore how FloatMe's cash advances, financial forecasting, and other features can empower you to take control of your finances.

What Are Cash Advances?

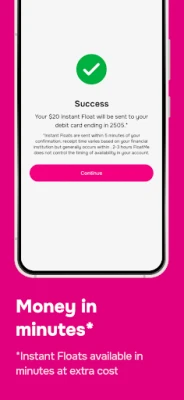

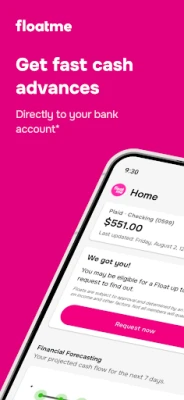

FloatMe provides a unique service known as cash advances, allowing you to access your earned but unpaid wages. With FloatMe, you can request Floats at no cost, and the funds will be deposited into your bank account in three days or less. If you need immediate access to cash, FloatMe offers an expedited service called Instant Float, which delivers funds within minutes for a small fee.

How to Get Started with FloatMe

Getting started with FloatMe is simple. Just download the app and connect your bank account. Once you're a member, you can easily request Floats whenever you need them. Membership costs just $3.99 per month, providing you access to a suite of financial products and services designed to help you manage your money effectively.

Financial Forecast: Plan Ahead with Confidence

FloatMe introduces the Financial Forecast feature, which offers a smart look ahead at your finances. This tool calculates your likely available balance based on your recurring expenses and projected paydays. By understanding your financial landscape, you can make informed decisions and avoid unnecessary stress.

Stay Informed with Low Balance Alerts

One of the most frustrating aspects of managing finances is dealing with overdraft fees. FloatMe helps you avoid these pesky charges with low balance alerts. You'll receive notifications when your bank balance is getting low, allowing you to take action before it's too late.

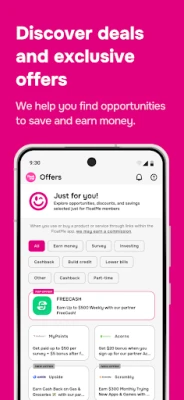

Exclusive Offers to Save and Earn

FloatMe also provides members with exclusive offers from a growing list of partners. These recommendations can help you save money or even earn additional income. By taking advantage of these offers, you can enhance your financial well-being and make the most of your resources.

Gain Insights into Your Spending

Understanding your spending habits is crucial for effective financial management. FloatMe's spending insights feature provides you with a detailed view of your transactions, categorized for your convenience. This handy chart allows you to identify areas where you can cut back and save more.

Security You Can Trust

Your financial security is paramount. FloatMe uses Plaid Portal to securely connect your bank accounts, employing 256-bit bank-level security to protect your information and funds. With Plaid's integration, FloatMe works seamlessly with over 10,000 banking institutions across the United States, ensuring a safe and reliable experience.

About FloatMe: Our Mission

Founded in early 2020, FloatMe aims to guide millions of Americans toward financial prosperity. By bridging small cash gaps with Floats and offering a suite of tools designed to help members earn, manage, and save money, FloatMe is committed to empowering individuals to achieve their financial goals.

Membership Details and Benefits

Membership with FloatMe costs $3.99 per month, granting you access to a variety of financial products and services. The subscription fee is auto-renewed every month unless canceled. You can cancel your membership at any time through the app or by contacting FloatMe's support team at support@floatme.com.

Important Information About Cash Advances

To request cash advances, membership is required, and approval is not guaranteed. It's essential to note that FloatMe's advances are not loans and do not have a mandatory minimum or maximum repayment period. The service is not a payday loan, cash loan, or personal loan app. Money advanced through FloatMe has a 0% maximum interest rate and 0% APR. Instant Float fees are optional and vary from $3 to $7, depending on the delivery method.

For example, if you accept a $50 cash advance via ACH transfer, there is no transfer fee, and your total repayment amount will be $50. However, if you choose the optional instant delivery for a $5 fee, your total repayment will be $55.

Availability and Restrictions

As of October 1, 2023, cash advances or "Floats" are not available to residents of Connecticut. Additionally, starting August 1, 2024, this service will not be available to residents of Maryland. It's important to check the availability of FloatMe's services in your state.

Contact Us for Support

If you have any questions or need assistance, FloatMe's support portal is available at www.floatme.com/support. You can also review FloatMe's Privacy Policy and Terms and Conditions for more information.

Conclusion: Take Control of Your Finances with FloatMe

FloatMe is more than just a cash advance service; it's a comprehensive financial tool designed to help you manage your money effectively. With features like financial forecasting, low balance alerts, and spending insights, FloatMe empowers you to make informed financial decisions. Join FloatMe today and unlock the potential for financial freedom!

Rate the App

User Reviews

Popular Apps

Editor's Choice