Latest Version

6.8.1

September 23, 2024

NetSpend

Finance

Android

0

Free

com.netspend.mobileapp.ace.flare

Report a Problem

More About Flare Account

Ultimate Guide to Managing Your Finances with NetSpend

In today's fast-paced world, managing your finances on-the-go has never been more convenient. With NetSpend, you can easily check your account balance, send money to friends and family, and access a variety of services that make handling your money simpler than ever. This article will explore the key features of NetSpend and how they can enhance your financial management experience.

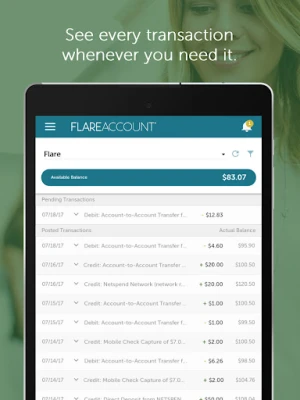

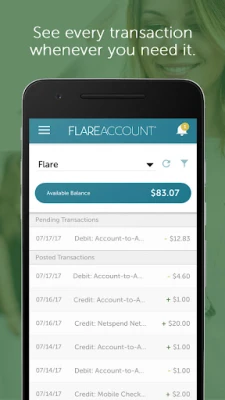

Check Your Account Balance and Transaction History

One of the most essential features of any financial service is the ability to monitor your account balance and transaction history. With NetSpend, you can quickly access this information through their user-friendly mobile app or website. This feature allows you to:

- Stay informed about your spending habits

- Track your expenses in real-time

- Identify any unauthorized transactions immediately

By regularly checking your account, you can maintain better control over your finances and make informed decisions about your spending.

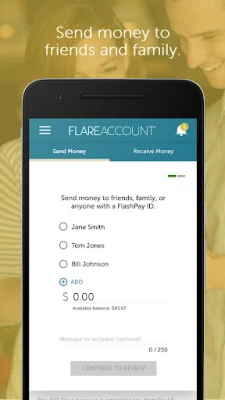

Send Money to Friends and Family

Transferring money to friends and family has never been easier. NetSpend allows you to send money quickly and securely, making it a great option for splitting bills, sending gifts, or helping out loved ones in need. Here’s what you need to know:

- Bank transfer fees may apply, depending on the transferor’s bank.

- Online or mobile Account-to-Account transfers between NetSpend accounts are free.

- A $4.95 fee applies for transfers conducted through a Customer Service agent.

With these options, you can choose the method that best suits your needs while keeping costs in check.

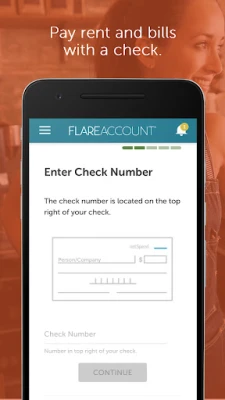

Access Optional NetSpend® Pre-Funded Check Service

NetSpend offers an optional Pre-Funded Check Service that provides added flexibility for managing your finances. This service allows you to issue checks directly from your NetSpend account, making it easier to pay bills or send money without needing a traditional bank account. Here are some key points to consider:

- Terms and conditions apply; be sure to review the NetSpend Pre-Funded Checks Terms and Conditions for details.

- This service is not a product of Pathward, N.A., and they do not endorse or provide bank-related services in connection with it.

By opting into this service, you can enjoy the convenience of check writing without the hassle of maintaining a separate checking account.

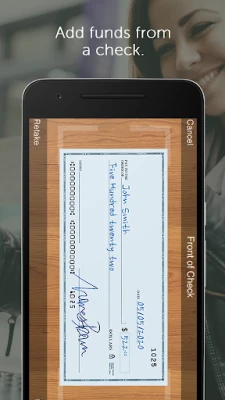

Add Money to Your Account with Mobile Check Capture

Another fantastic feature of NetSpend is the Mobile Check Capture service, which allows you to add funds to your account quickly and easily. Here’s how it works:

- Simply take a photo of your check using the NetSpend mobile app.

- Submit the check for approval, which usually takes 3 to 5 minutes but can take up to one hour.

- All checks are subject to approval for funding at Ingo Money’s discretion.

Keep in mind that fees may apply for approved Money in Minutes transactions funded to your account. Additionally, unapproved checks will not be funded, so it’s essential to ensure that your checks meet the necessary criteria.

Stay Informed About Fees and Charges

While NetSpend offers a range of convenient services, it’s crucial to stay informed about any associated fees. Here are some important points to remember:

- Your wireless carrier may charge fees for message and data usage when using the mobile app.

- Additional transaction fees, costs, terms, and conditions may apply to the funding and use of your account.

- Refer to your Deposit Account Agreement for comprehensive details on fees and services.

By understanding the potential costs, you can make more informed decisions about how to use your NetSpend account effectively.

Conclusion

Managing your finances has never been easier with NetSpend. From checking your account balance and transaction history to sending money and accessing optional services, NetSpend provides a comprehensive suite of tools designed to help you stay on top of your financial game. By leveraging these features, you can enjoy greater control over your money and make informed decisions that align with your financial goals.

Whether you’re looking to simplify your money management or need a reliable way to send funds to loved ones, NetSpend has you covered. Explore the various services available and take charge of your financial future today!

Rate the App

User Reviews

Popular Apps

Editor's Choice