Latest Version

5.9.09

October 31, 2024

First Citizens Bank & Trust

Finance

Android

1

Free

com.mcom.firstcitizens

Report a Problem

More About First Citizens Mobile Banking

Unlocking the Power of First Citizens Digital Banking: A Comprehensive Guide

In today's fast-paced financial landscape, having a reliable digital banking solution is essential for both consumers and businesses. First Citizens Digital Banking offers a suite of features designed to streamline your banking experience, making it easier to manage your finances anytime, anywhere. This article delves into the key functionalities of First Citizens Digital Banking, highlighting how it can benefit you.

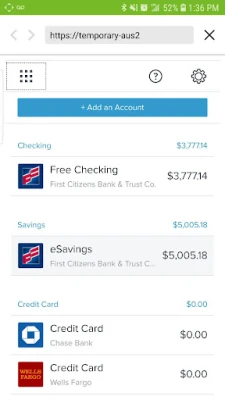

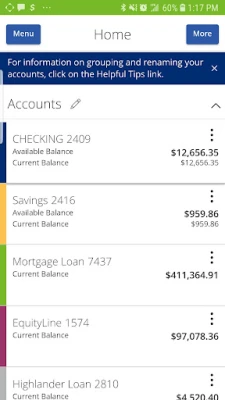

Comprehensive Account Management

First Citizens Digital Banking allows users to effortlessly view their accounts and transaction history. Whether you are checking your checking account balance or reviewing your credit card transactions, everything is accessible at your fingertips. This feature ensures that you stay informed about your financial activities, helping you make better financial decisions.

Convenient Mobile Check Deposits

Gone are the days of visiting a bank branch to deposit checks. With First Citizens Digital Banking, you can deposit checks directly from your mobile device. This feature not only saves time but also provides a secure way to manage your deposits without the hassle of physical paperwork.

Effortless Bill Payments and Transfers

Managing your bills has never been easier. First Citizens Digital Banking enables you to pay bills and transfer funds between your First Citizens accounts seamlessly. This functionality ensures that you never miss a payment and can easily manage your cash flow.

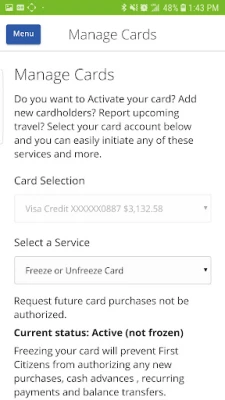

Streamlined Credit Card Management

Managing your credit cards is quick and efficient with First Citizens Digital Banking. Users can lock and unlock cards, activate new cards, report travel plans, and even report lost or stolen cards—all from the app. This level of control enhances security and provides peace of mind for cardholders.

Real-Time Alerts for Enhanced Security

Stay informed about your account activity with real-time alerts. First Citizens Digital Banking allows you to receive account and security alerts via text or email. This feature helps you monitor your accounts closely, ensuring that you are immediately aware of any suspicious activity.

Access to Financial Statements Anytime

With First Citizens Digital Banking, you can securely access your checking, savings, and credit card statements at any time. This feature provides you with a comprehensive view of your financial health, allowing you to track your spending and savings effectively.

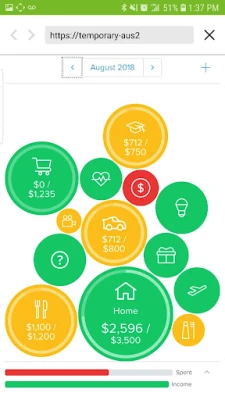

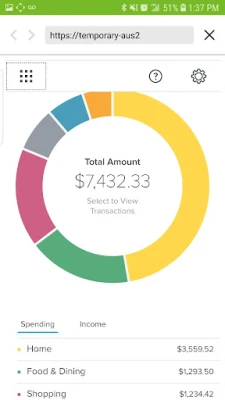

Link All Your Accounts for a Holistic View

Consumer customers can link all their financial accounts, even those held at other institutions, to get a complete financial picture. This feature allows you to track spending patterns, create budgets, and understand your net worth—all in one convenient location.

Send Money Easily with Zelle®

First Citizens Digital Banking integrates with Zelle®, allowing you to send money to friends, family, and trusted individuals quickly and securely. This feature simplifies peer-to-peer transactions, making it easier to manage shared expenses or send gifts.

Transfer Funds Between Institutions

Transferring funds to and from accounts at other financial institutions is a breeze with First Citizens Digital Banking. This functionality provides flexibility and convenience, ensuring that your money is where you need it when you need it.

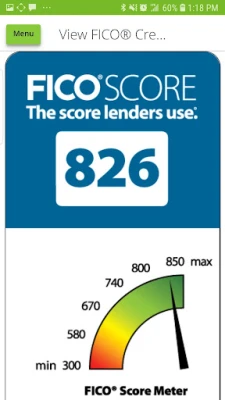

Monitor Your Credit Score

For those with consumer loans, credit cards, or mortgages, First Citizens Digital Banking offers the ability to view your FICO® Scores. Keeping an eye on your credit score is crucial for maintaining financial health and making informed borrowing decisions.

Customizable Alerts for Card Activity

Set up text and email alerts to monitor your credit and debit card activity. This feature helps you stay on top of your spending and quickly identify any unauthorized transactions.

Business Banking Features

First Citizens Digital Banking is not just for consumers; it also offers robust features for business customers. Businesses can set up multi-user access, allowing employees to manage finances while maintaining control over who has access to sensitive information.

Efficient Payment Solutions for Businesses

Business customers can send domestic wire transfers and make payments via ACH, streamlining their payment processes. Additionally, features like ACH Monitor and Positive Pay help detect fraud, providing an extra layer of security for business transactions.

Stay Informed with Alerts

Just like consumer accounts, business customers can set up text and email alerts to monitor credit card activity. This feature ensures that businesses can react quickly to any unusual transactions, safeguarding their financial assets.

About First Citizens Bank

Founded in 1898 and headquartered in Raleigh, North Carolina, First Citizens Bank has a rich history of serving customers across the United States. With over 600 branches in 22 states, the bank is committed to providing exceptional service and innovative banking solutions. For more information, visit firstcitizens.com.

Accessing First Citizens Digital Banking

First Citizens does not charge fees for downloading or accessing First Citizens Digital Banking, including the mobile banking app or Text Banking. However, mobile carrier fees may apply for data and text message usage, so it's advisable to check with your carrier for details. Note that fees may apply for certain services within First Citizens Digital Banking.

Conclusion

First Citizens Digital Banking offers a comprehensive suite of features designed to enhance your banking experience. Whether you are a consumer looking to manage your personal finances or a business seeking efficient banking solutions, First Citizens has you covered. Embrace the convenience and security of digital banking today!

Rate the App

User Reviews

Popular Apps

Editor's Choice