Latest Version

4.1.7

October 07, 2024

Experian

Finance

Android

0

Free

com.experian.android

Report a Problem

More About Experian

Unlock Your Financial Potential: Get Started with Experian for Free

In today's fast-paced financial landscape, understanding your credit score and managing your finances effectively is crucial. Experian offers a suite of tools designed to empower you to take control of your financial health. From checking your credit report to boosting your score, here’s how you can get started for free and make the most of these services.

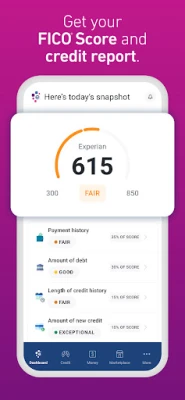

Access Your Experian Credit Report and FICO® Score

With Experian, you can check your FICO® Score and credit report anytime, anywhere, without any impact on your credit. This service allows you to monitor your credit status every 30 days, providing insights into the factors that influence your score. Understanding what helps or hurts your FICO® Score is essential for making informed financial decisions. Take proactive steps to improve your credit by following the recommended actions based on your report.

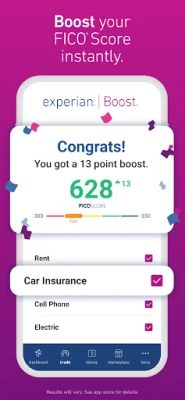

Boost Your Credit Score with Experian Boost®

Experian Boost® is a revolutionary feature that allows you to enhance your FICO® Score by incorporating bills you already pay. Whether it’s your cell phone, utilities, video streaming services, or eligible rent payments, you can leverage these regular expenses to potentially increase your credit score. This innovative approach means that even if you have limited credit history, you can still work towards a better score.

Build Credit Without Debt Using Experian Smart Money™

The Experian Smart Money™ Digital Checking Account is designed to help you build credit without incurring debt. By automatically connecting to Experian Boost®, this account allows you to manage your finances while simultaneously working on improving your credit score. It’s a smart way to ensure that your everyday spending contributes positively to your financial future.

Stay Informed with Credit Monitoring

Credit monitoring is a vital tool for anyone looking to maintain a healthy credit profile. With Experian, you receive push notifications whenever there are changes to your FICO® Score, new accounts opened in your name, or inquiries made on your credit report. This real-time information helps you stay vigilant and take immediate action if any suspicious activity occurs.

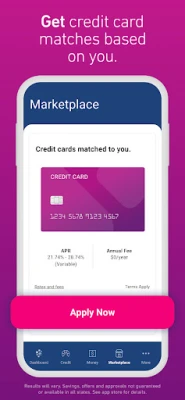

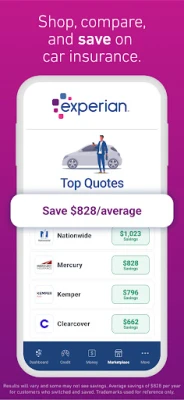

Explore the Marketplace for Tailored Financial Products

Experian’s Marketplace allows you to compare various financial products, including credit cards, loans, and auto insurance options, tailored to your unique credit profile. This feature ensures that you find the best deals available, helping you save money and make informed choices about your financial products.

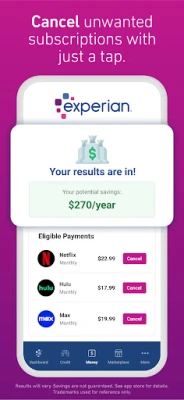

Premium Benefits: Bill Negotiation and Subscription Cancellation

One of the standout features of Experian is the ability to save time and money through bill negotiation and subscription cancellation. Their team of experts works on your behalf to negotiate better prices on your bills, ensuring you get the best possible rates. Additionally, if you have subscriptions you no longer use, Experian can help you cancel them, freeing up your finances for more important expenses.

Understanding the Terms and Conditions

Before diving into these services, it’s essential to familiarize yourself with the Terms of Use Agreement, Privacy Policy, and other relevant disclosures available at experian.com/legal. This ensures that you are fully aware of your rights and responsibilities when using Experian’s services.

Conclusion: Take Charge of Your Financial Future

Experian provides a comprehensive suite of tools to help you manage your credit and finances effectively. By taking advantage of their free services, you can monitor your credit score, boost it using your existing bills, and explore tailored financial products. With features like credit monitoring and bill negotiation, Experian empowers you to take control of your financial future. Start today and unlock the potential of your financial health!

©2024 Experian. All rights reserved. Experian and its trademarks are the property of Experian and its affiliates. Other product and company names mentioned are the property of their respective owners.

Rate the App

User Reviews

Popular Apps

Editor's Choice