Latest Version

Version

3.10.2

3.10.2

Update

October 06, 2024

October 06, 2024

Developer

Bishinews

Bishinews

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

$5.99

$5.99

Package Name

com.expensemanager.pro

com.expensemanager.pro

Report

Report a Problem

Report a Problem

More About Expense Manager Pro

This is Ad-free edition of Expense Manager by Bishinews. You can review the free version before buying it. One click to transfer data from free version to pro version (Settings/Backup/Import Data from Free Edition).

Mastering Expense Tracking: The Ultimate Guide to Financial Management

Managing your finances effectively is crucial for achieving your financial goals. With the right tools and strategies, you can track your expenses, organize your budget, and gain insights into your spending habits. This comprehensive guide will explore the essential features of an expense tracking app that can help you take control of your finances.Comprehensive Expense and Income Tracking

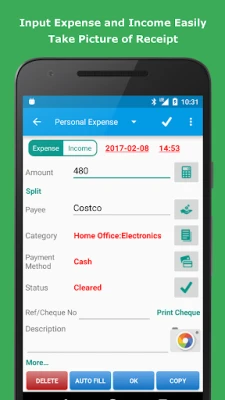

Tracking your expenses and income is the foundation of effective financial management. A robust expense tracking app allows you to:- Record All Transactions: Easily log your expenses and income, ensuring you have a complete overview of your financial situation.

- Split Transactions: Record multiple items within a single transaction, categorizing each item with different amounts for accurate tracking.

- Manage Recurring Transactions: Set up recurring expenses and income to automate your financial tracking.

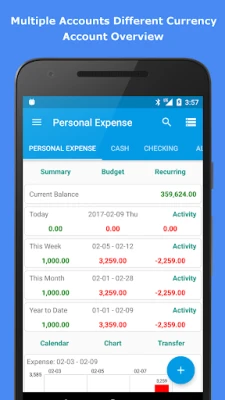

- Handle Multiple Accounts: Keep track of various accounts, including bank accounts and credit cards, all in one place.

- Capture Receipts: Take pictures of your receipts for easy record-keeping and expense verification.

- Track Taxes and Mileage: Monitor your tax obligations and mileage for business-related expenses.

- Manage Debts: Keep an eye on your debts to ensure timely payments and avoid late fees.

Efficient Budgeting and Bill Organization

Organizing your bills and budgeting effectively can help you avoid overspending and ensure timely payments. Key features include:- Organize Bills: Sort your bills by week, month, year, and categories for better visibility.

- Schedule Payments: Set up payment schedules for recurring bills to automate your financial obligations.

- Receive Payment Alerts: Get notifications for upcoming payments to avoid late fees.

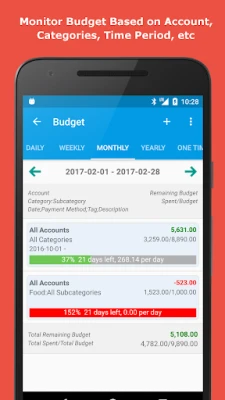

- Visual Budgeting: Utilize daily, weekly, monthly, and yearly budgets with progress bars to track your spending.

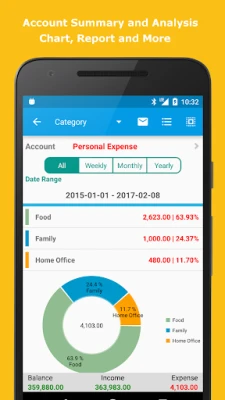

- Summary Reports: Access daily, weekly, monthly, and yearly summaries to evaluate your financial health.

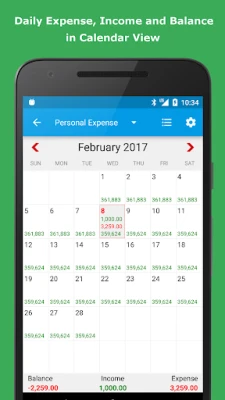

- Calendar View: Visualize your expenses and income on a calendar for better planning.

- Set Savings Goals: Define and track your savings objectives to stay motivated.

- Organize Loans: Keep track of your loans and their repayment schedules.

Advanced Search and Reporting Features

Finding specific transactions and generating reports is essential for effective financial analysis. Look for these features:- Search Functionality: Search transactions by category, payee, payment method, and more for quick access to information.

- Generate Reports: Create reports in various formats, including HTML, CSV, Excel, and PDF for easy sharing and analysis.

- Import and Export Data: Seamlessly import and export account activities for comprehensive financial management.

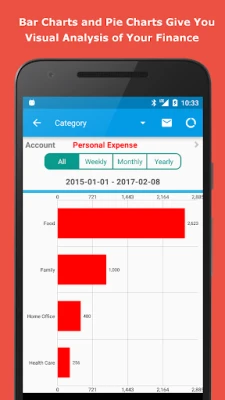

- Visual Charts: Utilize charts to analyze spending patterns by category, date, and other criteria.

- Email Reports: Easily send reports for printing or sharing with others.

Backup and Synchronization for Peace of Mind

Data security is paramount when managing your finances. Ensure your app offers:- Automatic Backups: Back up your data on cloud services like Dropbox and Google Drive for added security.

- Device Synchronization: Sync your data across multiple devices to access your financial information anytime, anywhere.

Convenient Financial Tools

Enhance your financial management experience with built-in tools:- Currency Converter: Easily convert currencies for international transactions.

- Calculators: Use various calculators, including loan, tip, and interest calculators, to assist with financial decisions.

- Notes and Shopping Lists: Keep track of important notes and create shopping lists for better organization.

Customization for a Personalized Experience

A great expense tracking app should allow for customization to suit your preferences:- Personalize Appearance: Change background colors, action bar colors, and button colors to create a user-friendly interface.

- Custom Date Formats: Adjust date formats to match your preferences.

- Flexible Categories: Customize categories and subcategories for better organization.

- Multiple Currencies: Support for various currencies to accommodate international users.

Connect to Your PC for Enhanced Functionality

Connecting your expense tracking app to a PC can enhance your experience:- WiFi Connection: Export and import data between your phone and PC for easier management.

- Multi-Record Entry: Add multiple records on one screen for efficiency.

- Account Summaries: View summaries from multiple accounts on a larger screen.

- Visual Charts: Analyze your financial data on a bigger screen for better insights.

Multilingual Support for Global Users

To cater to a diverse user base, ensure the app supports multiple languages, including:- English

- German

- French

- Spanish

- Portuguese

- Russian

- Italian

- Turkish

- Indonesian

- Chinese (Simplified and Traditional)

Additional Features for Enhanced User Experience

Look for extra features that can improve usability:- Widgets: Access quick views of your finances through customizable widgets.

- PIN Protection: Secure your app with a PIN for added security.

- Active Developer Support: Benefit from ongoing support and updates from the development team.

- No Registration Required: Enjoy the app without the need for registration or internet access.

Understanding Permissions for Security

Be aware of the permissions required by the app:Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Nova BrowserJef Studios

Throne WishlistThrone.com

Roman empire games - AoD RomeRoboBot Studio

Dark Web Browser : OrNETStronger Apps

XENO; Plan, AutoSave & InvestXENO Investment

CHANCE THE GAMETake Your Chance !

Dot PaintingChill Calm Cute

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD