Latest Version

2024.10.01

January 11, 2025

EASTMAN CREDIT UNION

Finance

Android

0

Free

com.ifs.mobilebanking.fiid3164

Report a Problem

More About ECU Mobile

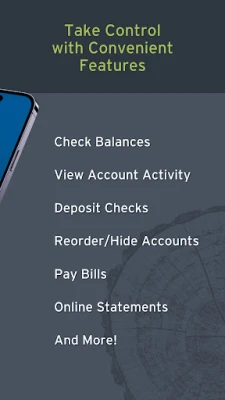

Unlock the Power of ECU Mobile: Your Ultimate Banking Companion

In today's fast-paced world, managing your finances on the go is essential. With ECU Mobile, you can take control of your banking needs right from your smartphone. This comprehensive app offers a suite of features designed to simplify your financial management, whether you're at home or on the move. Let’s explore the remarkable capabilities of ECU Mobile and how it can enhance your banking experience.

Effortless Money Management

One of the standout features of ECU Mobile is its Money Management tool. This feature allows you to create a personalized budget and track your spending in real-time. By monitoring your financial habits, you can make informed decisions and stay on top of your finances.

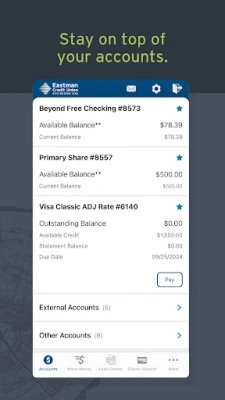

Real-Time Account Access

With ECU Mobile, checking your account balances and viewing transactions has never been easier. The app provides real-time updates, ensuring you always know where your money stands. This transparency helps you manage your finances more effectively.

Seamless Money Transfers with Zelle®

Need to send or request money quickly? ECU Mobile integrates with Zelle®, allowing you to transfer funds to friends and family instantly. This feature is perfect for splitting bills or sending gifts without the hassle of cash or checks.

Open New Accounts Online

Looking to expand your savings? With ECU Mobile, you can open new deposit accounts online, including savings, checking, and certificates. This convenience means you can manage your finances without visiting a branch.

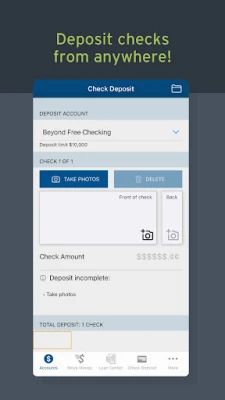

Deposit Checks Anytime, Anywhere

Gone are the days of rushing to the bank to deposit checks. ECU Mobile allows you to deposit checks from anywhere, making it easier than ever to manage your funds. Simply take a picture of your check, and the app does the rest.

Efficient Fund Transfers

Transferring money between your accounts is a breeze with ECU Mobile. Whether you need to move funds for savings or pay off a credit card, the app streamlines the process, saving you time and effort.

Maximize Your Rewards

Are you taking full advantage of your credit card rewards? ECU Mobile lets you view and redeem your credit card rewards easily. Keep track of your points and make the most of your spending.

Card Control at Your Fingertips

With the ECU Cards app, you can manage your card settings directly from your mobile device. This feature allows you to set spending limits, freeze your card, and receive alerts for transactions, giving you peace of mind.

Streamlined Bill Payments

Paying bills has never been simpler. ECU Mobile’s Bill Pay feature allows you to set up payees and schedule payments, ensuring you never miss a due date. This functionality helps you maintain a good credit score and avoid late fees.

Access Your Statements Anytime

Stay organized by accessing your online statements through ECU Mobile. This feature allows you to review your financial history and keep track of your spending patterns, all from the convenience of your device.

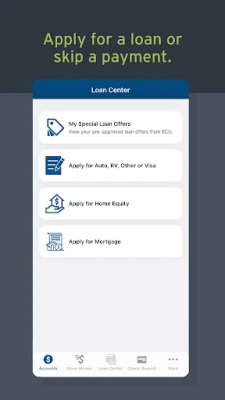

Loan Management Made Easy

Need a loan? ECU Mobile makes it easy to apply for loans and manage your payments. You can even request a Skip-a-Payment if you need a little extra flexibility in your budget.

Stay Informed with Alerts

Set up alerts for balances, payments, and transactions to stay informed about your financial activity. This proactive approach helps you manage your finances effectively and avoid any surprises.

Find ATMs with Ease

When you need cash, ECU Mobile helps you locate an ECU or surcharge-free Allpoint ATM nearby. This feature ensures you can access your funds without incurring additional fees.

Stop Payments and Update Information

Need to stop a payment on a check? ECU Mobile allows you to place a stop payment quickly and easily. Additionally, you can update your contact information to ensure you receive important notifications.

Advanced Security Features

Your security is a top priority with ECU Mobile. The app offers biometric login options, including Face ID and fingerprint recognition, ensuring that your account remains secure. The Quick Balance widget provides instant access to your account information at a glance, making it even more convenient.

Business Banking on the Go

For ECU Business Banking members, the ECU Mobile app offers tailored features to manage business accounts efficiently. Enjoy user-level access controls, tokenized security, and enhanced ACH and wire capabilities, all designed to keep your business running smoothly while you’re on the go.

Get Started with ECU Mobile

To take advantage of all these features, you must be enrolled in ECU Online Banking. For business banking features, enrollment in the ECU Business Banking platform is required. For assistance, call 800-999-2328 or visit your nearest ECU branch. For more information, visit www.ecu.org.

ECU Mobile is federally insured by NCUA, ensuring your funds are protected. To learn more about how we safeguard your privacy, please visit our privacy policy.

Experience the convenience and security of ECU Mobile today and take control of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice