Latest Version

15.34

September 13, 2024

Activehours Inc.

Finance

Android

0

Free

com.activehours

Report a Problem

More About EarnIn: Make Every Day Payday

Unlock Your Earnings: How EarnIn's Cash Out Feature Can Transform Your Financial Life

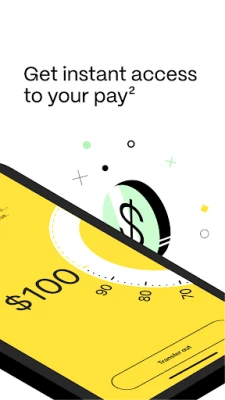

In today's fast-paced world, managing finances can be a daunting task. Unexpected expenses can arise at any moment, leaving many individuals scrambling for cash. Fortunately, with EarnIn's Cash Out feature, you can access your hard-earned money quickly and easily. This innovative service allows you to withdraw up to $100 per day and $750 per paycheck, providing a safety net for day-to-day costs and unforeseen financial challenges.

Understanding Cash Out on EarnIn

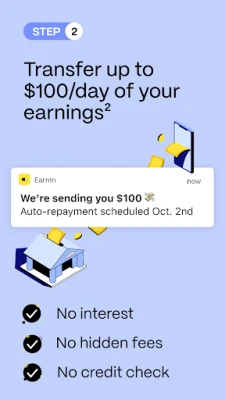

EarnIn revolutionizes the way you access your earnings. Unlike traditional cash advances or payday loans, which often come with high fees and interest rates, EarnIn offers a straightforward solution. By tapping into the money you've already earned, you can avoid the pitfalls of costly borrowing. With no interest, no credit checks, and no hidden fees, EarnIn simplifies the process of getting paid in advance.

How Cash Out Works

Using the Cash Out feature is incredibly simple. Follow these steps to get started:

- Download the EarnIn app: Begin by downloading the EarnIn app and entering your personal information.

- Connect your bank account: Link your bank account to gain instant access to your earnings.

- Access your funds: Withdraw up to $100 per day and $750 per pay period as needed.

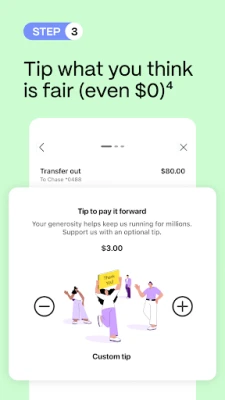

- Tip if you wish: You have the option to tip what feels right, although this is entirely optional.

- Automatic repayment: Any money accessed, along with optional fees and tips, is automatically deducted from your next paycheck.

With EarnIn, you can enjoy instant access to your money whenever you need it, making it a smarter alternative to traditional cash advances.

Benefits of Using EarnIn

1. Access Your Earnings Instantly

With EarnIn, you can connect your bank account to access your pay in advance. The app works seamlessly with major banks, including Bank of America, Wells Fargo, Chase, and Capital One. Enjoy Lightning Speed transfers that allow you to receive your funds in minutes, ensuring you never miss a beat when it comes to your finances.

2. Financial Flexibility

EarnIn empowers you to manage your finances effectively. With the ability to withdraw up to $750 every pay period, you can handle financial emergencies, cover loan payments, or simply keep up with daily expenses. This flexibility makes EarnIn a far better option than traditional cash advances or payday loans, as you are accessing your own earnings rather than borrowing money.

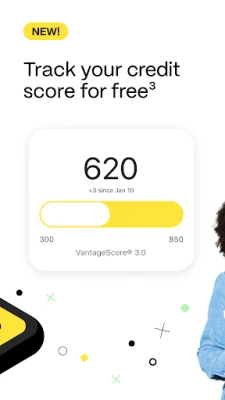

3. Free Credit Score Monitoring

In addition to cash advances, EarnIn offers free credit score tracking. This feature allows you to monitor your credit score and receive alerts when there are changes to your credit file. By keeping an eye on your credit health, you can take proactive steps to improve your financial standing and avoid potential pitfalls.

4. 24/7 Customer Support

EarnIn understands that questions and issues can arise at any time. That's why they provide 24/7 customer support through their Live Chat team. Whether you have a question about your account or need assistance with a transaction, help is always just a message away.

Why Choose EarnIn Over Traditional Loans?

Many people find themselves trapped in a cycle of debt due to high-interest loans and cash advances. EarnIn offers a refreshing alternative that prioritizes your financial well-being. Here are a few reasons to choose EarnIn:

- No Interest or APR: Unlike payday loans, EarnIn does not charge interest or APR on cash outs, making it a cost-effective solution.

- No Credit Checks: You can access your earnings without the stress of credit checks, ensuring that your financial history does not hinder your access to funds.

- Privacy Protection: EarnIn values your privacy and does not sell your personal data to third parties, allowing you to use the app with confidence.

Conclusion: Take Control of Your Finances with EarnIn

In a world where financial uncertainty is common, EarnIn provides a reliable solution to help you manage your money effectively. With the Cash Out feature, you can access your earnings instantly, avoid costly loans, and monitor your credit health—all from the convenience of your smartphone. Download the EarnIn app today and take the first step towards financial empowerment.

Remember, EarnIn is not affiliated with other financial apps and services, ensuring that you receive a unique and dedicated experience tailored to your needs. Start your journey towards financial freedom with EarnIn now!

Rate the App

User Reviews

Popular Apps

Editor's Choice