Latest Version

7.9.1

August 16, 2024

Current

Finance

Android

0

Free

com.current.app

Report a Problem

More About Current: The Future of Banking

Unlock Financial Freedom with Current: Your Ultimate Guide to Modern Banking

In today's fast-paced world, managing your finances efficiently is more crucial than ever. Current, a leading financial technology company, offers innovative solutions that empower users to take control of their financial lives. While Current is not an FDIC-insured bank, it partners with FDIC-insured institutions to provide essential banking services. This article explores the features and benefits of Current, helping you understand how it can enhance your financial journey.

Understanding Current's Role in Your Finances

Current operates as a financial technology platform, providing a range of services that cater to modern banking needs. It's important to note that while Current itself is not an FDIC-insured bank, it collaborates with Choice Financial Group and Cross River Bank, both of which are FDIC members. This partnership ensures that your funds are protected under FDIC insurance, up to $250,000, provided certain conditions are met.

Key Features of Current

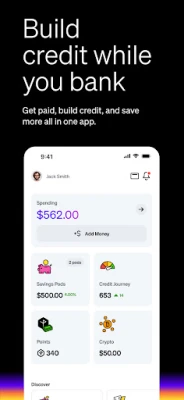

1. Build Your Credit with Ease

One of the standout features of Current is the ability to build credit effortlessly. With the Current Build Card, users can enhance their credit scores with every swipe, all without the need for credit checks. This feature is particularly beneficial for those looking to establish or improve their credit history.

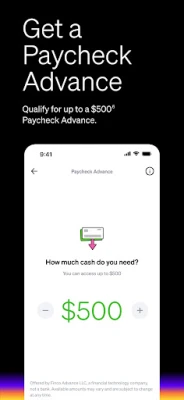

2. Access Cash When You Need It

Current offers a Paycheck Advance feature, allowing eligible users to qualify for up to $500 in advance of their paycheck. This service provides a financial cushion for unexpected expenses, ensuring you have access to cash when you need it most.

3. Enjoy Fee-Free Banking

Say goodbye to unnecessary banking fees! Current provides fee-free overdraft protection and allows users to withdraw cash without incurring fees at over 40,000 Allpoint ATMs across the United States. This feature is a game-changer for those who want to keep their banking costs low.

4. Get Paid Faster

With Current, payday comes up to two days earlier with direct deposit. This means you can access your hard-earned money sooner, giving you more flexibility in managing your expenses and savings.

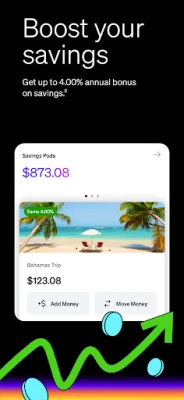

5. Save Smartly

Current encourages users to save by offering an impressive annual bonus of up to 4.00% on savings. This feature allows you to grow your savings effortlessly, making it easier to reach your financial goals.

6. Earn Rewards on Your Spending

Current rewards its users with up to 7x the points and cash back on eligible purchases. This means that every swipe of your Current card can lead to exciting rewards, making your everyday spending more rewarding.

7. 24/7 Customer Support

Current understands that financial questions can arise at any time. That's why they offer 24/7 support through their app, ensuring you have access to assistance whenever you need it.

Understanding Fees and Conditions

While Current offers many fee-free services, it's essential to be aware of potential fees that may apply. For instance, out-of-network ATM withdrawals may incur a fee of $2.50 per transaction, and late payment fees can reach up to 3% of the outstanding balance. Additionally, foreign transaction fees and card replacement fees may apply. Always review the terms and conditions to stay informed about any applicable fees.

How to Get Started with Current

Getting started with Current is simple. To apply for the Current Visa® Debit Card or the Current Visa® secured charge card, you need to create an Individual Account. Approval is independent and may vary based on eligibility. Once your account is set up, you can begin enjoying the numerous benefits that Current has to offer.

Conclusion: Embrace the Future of Banking with Current

Current is revolutionizing the way we think about banking. With its innovative features, user-friendly interface, and commitment to customer satisfaction, Current provides a modern solution for managing your finances. Whether you're looking to build credit, access cash quickly, or save smarter, Current has the tools you need to succeed. Embrace the future of banking today and unlock your financial potential with Current.

Rate the App

User Reviews

Popular Apps

Editor's Choice