Latest Version

2.0.1

November 09, 2025

CITY UNION BANK LTD

Finance

Android

0

Free

com.cub.plus.gui

Report a Problem

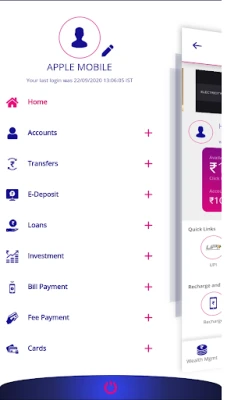

More About CUB All in one Mobile App

Unlock Seamless Banking: Your Guide to City Union Bank's Mobile and Internet Banking

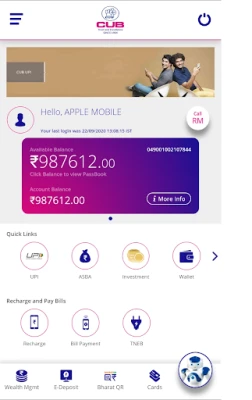

In today's fast-paced world, managing your finances should be as effortless as a few taps on your smartphone. City Union Bank (CUB) offers a robust mobile and internet banking platform that allows you to handle your banking needs with ease. Whether you want to make quick payments, invest in mutual funds, or manage your bills, CUB has you covered. Below, we explore the key features of CUB's banking services and how you can make the most of them.

Quick Pay: Instant Transfers Made Easy

With the Quick Pay feature, customers can execute instant transfers and even download or share payment advice. This functionality is perfect for those who need to send money quickly without the hassle of traditional banking methods.

Device Registration: Get Started with Ease

To begin using the CUB mobile banking app, users must register their devices. Here’s how:

- Click on 'Let's get started' to initiate the registration process.

- If you have a dual SIM phone, the app will prompt you to select the SIM linked to your bank account.

- Standard SMS charges apply during registration, so ensure you have sufficient balance to send the SMS.

- Keep your mobile data or internet connection active throughout the process.

- Make sure your SIM is enabled in the settings to avoid registration failures.

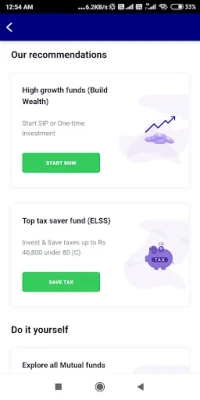

Mutual Fund Investments: Wealth Management at Your Fingertips

CUB allows customers to invest in various Asset Management Companies (AMCs) available in the market. You can choose between a Systematic Investment Plan (SIP) or make a one-time payment, making it easier than ever to grow your wealth.

Wallet: Secure Transactions for Everyday Payments

The CUB Wallet feature enables customers to securely transact while paying utility bills, recharging mobile phones, and more. This feature simplifies everyday transactions, ensuring you can manage your finances on the go.

BHIM CUB UPI: Effortless Digital Payments

BHIM CUB UPI is an initiative designed to facilitate safe, easy, and instant digital payments through your mobile phone. Here’s what you need to know:

- Ensure your mobile number is linked to your bank account.

- Your phone must have an active SIM linked to your bank account.

- If you have a dual SIM, select the SIM associated with your bank account.

- A valid debit card is required to generate your UPI PIN.

How Does the BHIM CUB UPI App Work?

To get started with the BHIM CUB UPI app:

- Download the app and register.

- Select 'Manage Accounts' and choose your preferred bank account.

- Create a unique UPI ID (e.g., yourname@cub).

- Verify your account and set your UPI PIN.

Understanding Your UPI PIN

Your UPI PIN is similar to your debit card PIN and consists of 4 to 6 digits. This PIN is essential for all UPI debit transactions, so keep it confidential.

Checking Your Account Balance

To check your account balance, simply click on ‘Check Balance’ next to the desired account number and enter your UPI PIN to confirm.

Sending Money Made Simple

To send money, select the pay option, enter the receiver’s unique UPI ID, specify the amount, and confirm the payment by entering your UPI PIN.

Transaction Limits for UPI

The transaction limit for UPI transactions is set at Rs. 1,00,000 per transaction and per day, ensuring secure and manageable transactions.

Scan and Pay: Instant Payments with QR Codes

With the Scan and Pay feature, you can quickly scan QR codes to make payments instantly, adding another layer of convenience to your banking experience.

Conversational BOT: Your Banking Assistant

The CUB app features a Conversational BOT that allows customers to engage in banking inquiries and transactions. This multilingual bot enhances user experience by providing assistance in various languages.

Bill Payments: Simplifying Your Financial Obligations

Manage your bills effortlessly with features like:

- Register/Instant Pay

- Mobile and DTH Recharge

- View/Pay Bills

- Mobile/DTH Recharge Status

- Bill Payment History

- View/Delete Biller

Card Management: Control at Your Fingertips

Manage your cards with ease through features such as:

- Card Block

- ATM PIN Reset

- Manage Cards

- Card PIN Authentication

TNEB Bill Payment: Pay Your Electricity Bills Seamlessly

Easily pay your TNEB bills through the CUB app, ensuring you never miss a payment.

Online E-Deposit: Flexible Deposit Management

Open deposit accounts, make partial withdrawals, and manage loans against deposits—all from the comfort of your home.

Enquiry and Transaction Features: Stay Informed

Stay updated with features like:

- Balance Enquiry

- Mini Statement

- Transactions between your own accounts, other CUB accounts, and other bank accounts using NEFT/IMPS

Experience the comprehensive features of the CUB all-in-one mobile application. Your feedback is invaluable, so don’t forget to rate our application and share your reviews!

Rate the App

User Reviews

Popular Apps

Editor's Choice