Latest Version

24.07.1

August 24, 2024

Credit One Bank, N.A.

Finance

Android

0

Free

com.creditonebank.mobile

Report a Problem

More About Credit One Bank Mobile

Ultimate Guide to Secure and Convenient Banking: Features You Can't Miss

In today's fast-paced world, having a secure and efficient banking experience is essential. With advanced technology at your fingertips, managing your finances has never been easier. This article explores the key features that ensure your banking is both secure and rewarding, allowing you to take control of your financial journey.

Unmatched Security Features

When it comes to banking, security is paramount. Here are some innovative features designed to keep your information safe:

- Quick and Secure Sign-In: Enjoy the convenience of signing in using your fingerprint. This biometric authentication method not only speeds up the login process but also adds an extra layer of security, ensuring that only you can access your account.

- Customized Fraud Alerts: Stay one step ahead of potential threats by setting up personalized fraud alerts. Receive notifications for transactions, balance changes, and other important activities, giving you peace of mind and control over your finances.

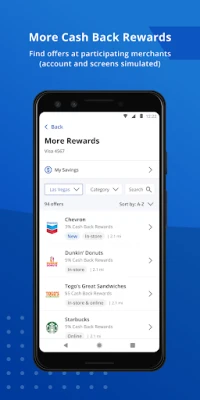

Maximize Your Rewards

Banking should not only be secure but also rewarding. Here’s how you can make the most of your financial products:

- Instant Notifications for New Offers: Be the first to know when you qualify for a new account or a credit line increase. Accept these offers directly through the app, making it easier than ever to enhance your financial portfolio.

- Track Your Rewards: Keep an eye on the cash back rewards or points you’ve accumulated with your card. Knowing your rewards status helps you make informed decisions about your spending and redeeming options.

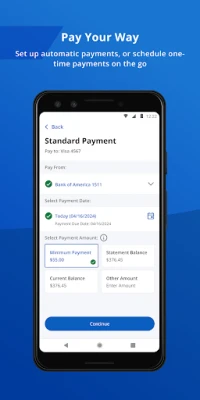

Flexible Payment Options

Managing payments should be hassle-free. Here are some features that simplify the payment process:

- Schedule Payments Anytime: With the ability to quickly schedule payments, you can manage your bills and obligations on your own terms. No more missed deadlines or late fees!

- AutoPay for Convenience: Turn on AutoPay to automate your monthly payments. This feature allows you to focus on other important tasks while ensuring your bills are paid on time.

- Seamless Integration with Google Pay: Add your card to Google Pay for a smooth payment experience, whether you’re shopping online or in-store. Enjoy the convenience of contactless payments at your fingertips.

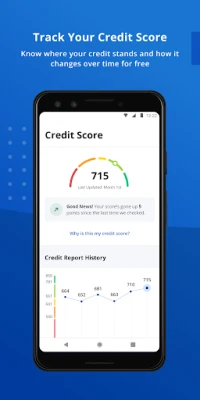

Stay Informed About Your Credit

Understanding your credit status is crucial for financial health. Here’s how you can keep track:

- Free Monthly Credit Score Tracking: Monitor your credit score at no cost. Regularly checking your score helps you stay informed about your financial standing and make necessary adjustments.

- Insightful Credit Reports: Gain insights into what factors are influencing your credit score with your free monthly credit report. This knowledge empowers you to improve your creditworthiness over time.

Access Support Anytime, Anywhere

Your banking experience should be seamless, no matter where you are. Here’s how you can access support easily:

- Quick View Feature: Use the Quick View option to check your balance or make a payment without the need to sign in. This feature saves you time and provides instant access to your account information.

- Easy Access to Help: Get the support you need whenever you require assistance. Whether you have questions about your account or need help with transactions, support is just a click away.

Conclusion

In conclusion, modern banking offers a plethora of features designed to enhance security, maximize rewards, and simplify payment processes. By leveraging these tools, you can take control of your financial life with confidence. Embrace the convenience and security of today’s banking solutions, and enjoy a more rewarding financial journey.

Rate the App

User Reviews

Popular Apps

Editor's Choice