Latest Version

4.1.7

August 19, 2025

Crayola LLC Employees Credit Union

Finance

Android

0

Free

com.cssinc.crayolaefcuhb

Report a Problem

More About Crayola EFCU

Unlocking the Power of Mobile Banking: Your Ultimate Guide

In today's fast-paced world, mobile banking has revolutionized the way we manage our finances. With just a few taps on your smartphone or tablet, you can access your accounts anytime, anywhere. This convenience not only saves time but also enhances your financial management experience. Let’s explore the myriad benefits of mobile banking and how it can simplify your life.

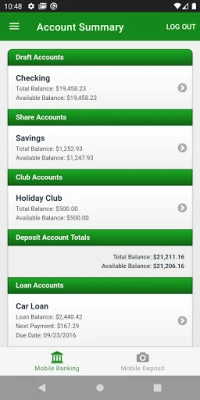

Access Your Accounts Anytime, Anywhere

Mobile banking allows you to check your account balances and access real-time information from virtually any location. Whether you’re at home, at work, or on the go, your financial data is just a click away. This flexibility empowers you to stay on top of your finances without being tied to a desktop computer.

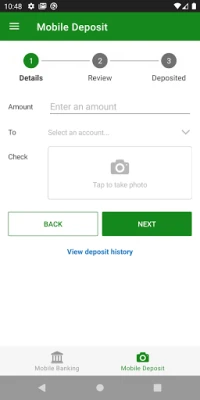

Instant Fund Transfers

One of the standout features of mobile banking is the ability to transfer funds instantly. Need to send money to a friend or pay off a loan? With mobile banking, you can transfer funds between accounts or to other credit union accounts in real-time. This feature eliminates the hassle of writing checks or visiting a bank branch, making transactions seamless and efficient.

Comprehensive Transaction History

Keeping track of your spending is crucial for effective financial management. Mobile banking provides you with easy access to your transaction history, allowing you to monitor your expenses and identify spending patterns. This transparency helps you make informed financial decisions and stay within your budget.

Convenient Online Bill Pay

Paying bills has never been easier. With mobile banking, you can set up Online Bill Pay to manage your payments effortlessly. Whether it’s utilities, credit cards, or subscriptions, you can schedule payments at your convenience. This feature not only saves time but also helps you avoid late fees and maintain a good credit score.

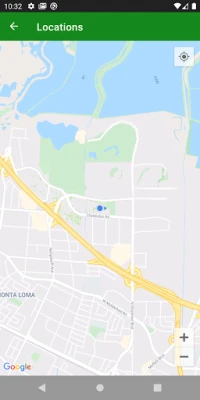

Find ATMs and Branches Near You

Need cash or want to visit a branch? Mobile banking apps often include a feature that helps you locate nearby ATMs and branches. This functionality ensures that you can access your funds or get assistance whenever you need it, enhancing your overall banking experience.

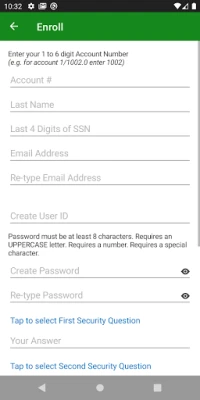

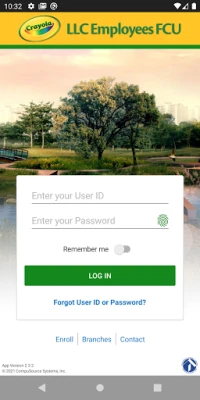

Safety and Security in Mobile Banking

Concerns about security are common when it comes to online transactions. However, mobile banking is designed with robust security measures to protect your information. Most banking apps use encryption, multi-factor authentication, and biometric security features like fingerprint recognition to ensure that your data remains safe. This peace of mind allows you to manage your finances confidently.

Cost-Effective Banking Solution

Another significant advantage of mobile banking is that it is often free of charge. Many financial institutions offer mobile banking services without any monthly fees, making it a cost-effective solution for managing your finances. This accessibility allows you to take control of your financial health without incurring additional costs.

Conclusion: Embrace the Future of Banking

Mobile banking is not just a trend; it’s a fundamental shift in how we interact with our finances. By leveraging the convenience, security, and efficiency of mobile banking, you can take charge of your financial future. Whether you’re transferring funds, paying bills, or checking your balance, mobile banking offers a comprehensive solution that fits your lifestyle. Embrace this technology and unlock the full potential of your financial management today!

Rate the App

User Reviews

Popular Apps

Editor's Choice