Latest Version

6.7.1

August 21, 2024

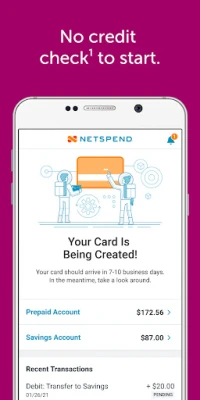

NetSpend

Finance

Android

0

Free

com.netspend.product.android

Report a Problem

More About Classic Netspend

Unlocking the Benefits of Netspend All-Access: A Comprehensive Guide

In today's fast-paced financial landscape, having quick access to your funds is essential. The Netspend All-Access account offers a unique solution for customers seeking faster funding and seamless transactions. This article delves into the features, benefits, and important details of the Netspend All-Access account, ensuring you have all the information you need to make informed financial decisions.

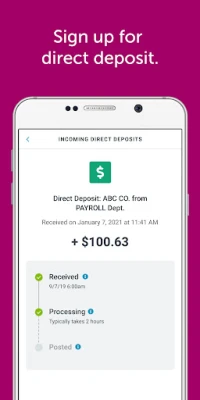

Faster Funding with Netspend All-Access

The Netspend All-Access account provides a significant advantage over traditional banking methods. Unlike typical banks that post funds at settlement, Netspend allows for funds to be available upon receipt of payment instructions. This means that customers can access their money more quickly, enhancing their financial flexibility.

However, it’s important to note that fraud prevention measures may occasionally delay fund availability, with or without prior notice. To enjoy early access to funds, customers must have the support of direct deposit from their payor, which is subject to the timing of the payor's payment instructions.

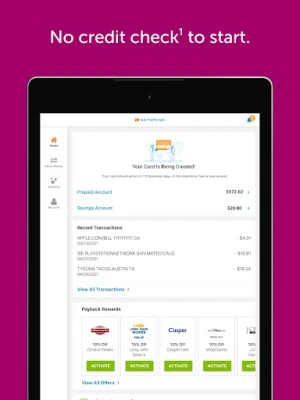

No Hidden Fees for Account Transfers

One of the standout features of the Netspend All-Access account is the cost-effective nature of its services. There are no fees for online or mobile account-to-account transfers between Netspend cardholders. However, if you choose to conduct a transfer through a Netspend Customer Service agent, a fee of $4.95 will apply. This transparency in fees makes it easier for customers to manage their finances without unexpected charges.

Understanding the Netspend Network

The Netspend Network is a robust platform provided by Netspend Corporation and its authorized agents. As a licensed provider of money transfer services (NMLS ID: 932678), Netspend ensures that customers can access reliable and secure financial services. For more information on licenses and related details, customers can visit www.netspend.com/licenses.

It’s essential to be aware that fees, limits, and other restrictions may be imposed by Netspend and third parties when using the Netspend Network. This ensures that customers are well-informed about the terms of service and can plan their financial activities accordingly.

Netspend Visa Prepaid Card & Netspend Prepaid Mastercard

The Netspend Visa Prepaid Card and the Netspend Prepaid Mastercard are issued by reputable financial institutions, including The Bancorp Bank, Pathward™, National Association, and Republic Bank & Trust Company. These cards are accepted wherever Visa and Mastercard debit cards are recognized, providing customers with widespread usability.

It’s crucial to understand that the use of these cards is subject to activation, ID verification, and availability of funds. Transaction fees and specific terms and conditions apply, so customers should refer to the Cardholder Agreement for comprehensive details. Additionally, both Mastercard and Visa are registered trademarks, ensuring that customers are using trusted financial products.

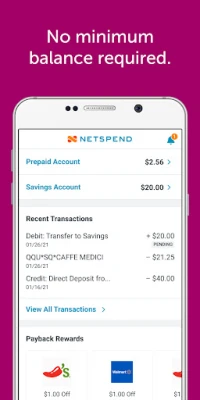

The Netspend All-Access Account Explained

The Netspend All-Access Account is a deposit account established by Pathward, N.A., a member of the FDIC. Netspend acts as a service provider to Pathward, ensuring that customers receive top-notch service and support. This account is also offered by Republic Bank & Trust Company, another member of the FDIC, further enhancing the credibility and reliability of the services provided.

As with any financial product, fees, terms, and conditions apply to the Netspend All-Access account. Customers should familiarize themselves with these details to maximize their benefits and avoid any surprises.

Conclusion: Why Choose Netspend All-Access?

The Netspend All-Access account stands out as a valuable financial tool for those seeking quick access to their funds and a user-friendly experience. With features like faster funding, no-cost transfers between cardholders, and a reliable network, it caters to the needs of modern consumers. By understanding the terms and conditions, customers can leverage the full potential of their Netspend All-Access account, making it a smart choice for managing finances effectively.

For more information on how to get started with Netspend All-Access, visit their official website and explore the various options available to you. Take control of your financial future today!

Rate the App

User Reviews

Popular Apps

Editor's Choice