Latest Version

21.4

September 05, 2024

Citibank Singapore Ltd.

Finance

Android

1

Free

com.citibank.mobile.sg

Report a Problem

More About Citibank SG

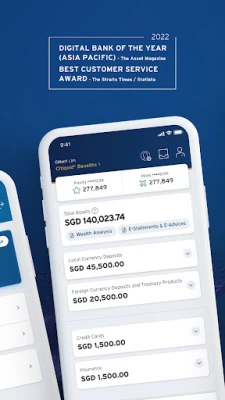

Enhance Your Banking Experience with Citibank's Mobile App

In today's fast-paced world, managing your finances should be seamless and intuitive. Citibank is dedicated to continuously enhancing its mobile banking experience, ensuring that you have a personalized, user-friendly platform at your fingertips. This article explores the key features of the Citibank mobile app that empower you to take control of your financial journey.

Effortless Account Management

With the Citibank mobile app, managing your account has never been easier. Here are some standout features:

- Secure and Quick Login: Access your account swiftly and securely using biometric authentication, such as fingerprint recognition.

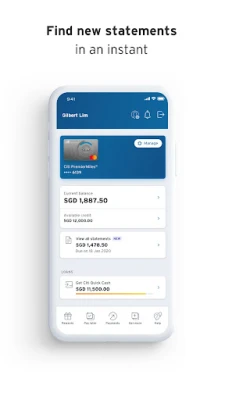

- Comprehensive Dashboard: Upon logging in, view your credit card and bank statements, urgent actions, and recent transactions all in one place.

- Personalized Offers: Discover tailored notifications and exclusive upgrades designed just for you.

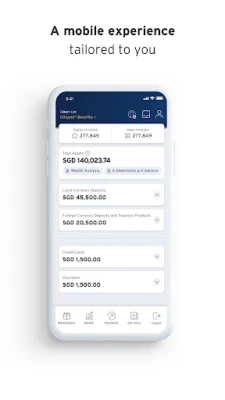

- Organized Account Overview: Your accounts are neatly categorized, allowing you to effortlessly track your savings, spending, and investments.

- Investment Insights: Get a quick overview of your investments and access various investment options with ease.

Streamlined Payments and Transfers

Making payments and transferring funds is a breeze with the Citibank mobile app. Here’s how:

- Flexible Payment Options: Use the ‘Pay Later’ feature on your dashboard to convert credit card transactions and statement balances into manageable monthly installments through our installment loan program.

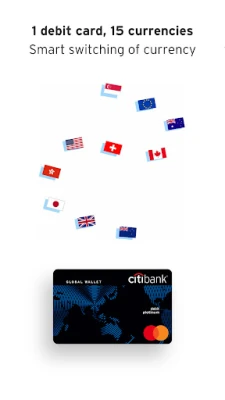

- Instant Currency Exchange: Activate Citibank Global Wallet with a single tap to exchange foreign currencies instantly.

- Exclusive Credit Card Offers: Access all your credit card benefits and learn how to maximize your Citi privileges.

- Citi Quick Cash: Convert your available credit limit from your Citi Credit Card or Citibank Ready Credit Account into a personal installment loan, payable with your monthly statement.

- Citi PayAll: Earn Citi Miles or Citi Reward Points when you pay for rent, education, taxes, utility bills, and condominium management fees using your Citi credit card. Note that fees may apply.

- Utilize Your Points: Offset purchases made on your Citi Credit Card using your accumulated Citi Points or Miles.

24/7 Assistance at Your Fingertips

Need help navigating the app? Citibank has you covered:

- Smart FAQs: Our intelligent FAQ system predicts your queries as you type, providing quick and relevant answers to enhance your experience.

Your Feedback Matters

At Citibank, customer feedback is invaluable. It drives our commitment to improving the mobile banking experience. If you have suggestions or comments, please reach out to us at customerservice@citibank.com.sg.

Important Disclaimers

Citibank's full disclaimers, terms, and conditions apply to all individual products and banking services. For more information, please visit www.citibank.com.sg.

The Citibank SG Mobile app is exclusively for customers of Citibank Singapore Limited. The content provided is tailored for the territory where Citibank Singapore Limited operates and is licensed.

Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation for up to S$100,000 in aggregate per depositor per Scheme member by law. Please note that foreign currency deposits, dual currency investments, structured deposits, and other investment products are not insured. For further details, visit www.sdic.org.sg.

Experience the future of banking with Citibank's mobile app, where convenience meets innovation, allowing you to manage your finances effortlessly.

Rate the App

User Reviews

Popular Apps

Editor's Choice