Latest Version

2.39.0

August 23, 2024

JPMorgan Chase

Finance

Android

0

Free

com.chase.intl

Report a Problem

More About Chase UK

Maximize Your Savings: Unlock 1% Cashback and More with Chase

In today's fast-paced world, every penny counts. With Chase, you can turn your everyday spending into rewarding savings. Discover how you can earn 1% cashback on your debit card purchases, enjoy competitive interest rates, and access a suite of features designed to enhance your banking experience.

Earn 1% Cashback on Everyday Purchases

Why not make your daily expenses work for you? With Chase, you can earn 1% cashback on all your debit card spending. Whether it's your morning coffee, weekly grocery shopping, or planning your next holiday, every transaction adds up. This cashback offer is available for the first 12 months for new customers, allowing you to maximize your rewards while enjoying your usual purchases.

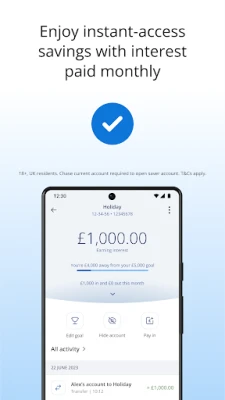

Instant-Access Savings with Monthly Interest

Open a Chase Saver Account and enjoy the benefits of a competitive interest rate with instant access to your funds. This account allows you to grow your savings effortlessly while maintaining the flexibility to withdraw your money whenever you need it. Interest is paid monthly, ensuring that your savings continue to grow over time.

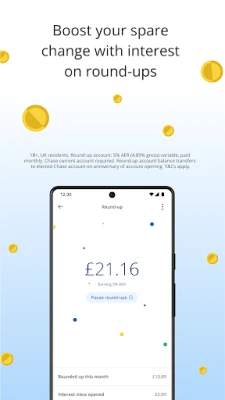

Boost Your Savings with 5% Interest on Round-Ups

Take your savings to the next level with Chase's innovative round-up feature. By rounding up your everyday spending to the nearest pound, you can effortlessly set aside spare change. Chase enhances your savings by offering a 5% AER (4.89% gross) variable interest boost on your round-up balance, paid monthly. This feature makes saving easy and automatic, allowing you to watch your savings grow without any extra effort.

24/7 Customer Support at Your Fingertips

Need assistance? Chase provides round-the-clock support through their user-friendly app. With just a few taps, you can connect with a representative who can answer your questions and help you resolve any issues, ensuring that you have the support you need whenever you need it.

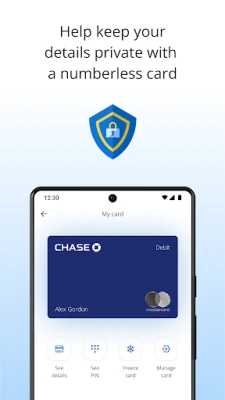

Experience the Convenience of a Numberless Card

Security and convenience go hand in hand with Chase's numberless card. All your card details are securely stored in the app, protecting you from potential fraud. You can easily freeze and unfreeze your card, customize security controls, and enjoy a range of features designed to make your payments smart and secure.

Start Spending Immediately with In-App Card Details

There's no need to wait for your physical card to arrive. As soon as your account is open, you can start spending online using your in-app card details or add your card to Google Wallet. This instant access allows you to take advantage of your new account right away.

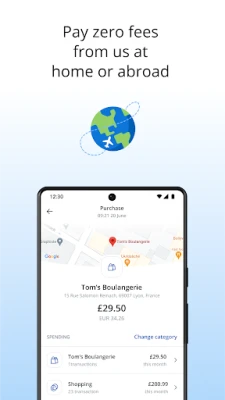

No Hidden Fees or Charges

Traveling abroad? Enjoy the freedom of spending and withdrawing cash without worrying about hidden fees. Chase offers a transparent exchange rate with no extra charges or mark-ups, making it the perfect banking solution as you explore the world.

Robust Protection for Your Peace of Mind

Your financial security is a top priority at Chase. With active fraud monitoring, your account is continuously monitored for any unusual activity. Additionally, your deposits are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000, providing you with peace of mind as you manage your finances.

Eligibility Requirements

To bank with Chase, you must meet the following criteria:

- Be 18 years or older

- Be a resident of the UK

- Have a smartphone and a UK mobile number

Legal Information

For new customers, the 1% cashback offer is available for the first 12 months, with a maximum of £15 per month for applications made from 9 May 2023. Cashback exceptions may apply. For more details, visit Chase Cashback FAQs.

Round-up account balance transfers to your chosen Chase current or saver account occur on the anniversary of your account opening. Terms and conditions apply; visit Chase Round-Ups for more information.

Chase is a registered trademark and trading name of J.P. Morgan Europe Limited, authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority. Your eligible deposits with Chase are protected up to £85,000 by the FSCS, the UK's deposit guarantee scheme.

For more information about Nutmeg and its investment services, please visit the relevant sections on the Chase website.

Copyright © 2022 Nutmeg Saving and Investment Limited. Nutmeg® is a registered trademark of Nutmeg Saving and Investment Limited, authorized and regulated by the Financial Conduct Authority.

Start maximizing your savings today with Chase and enjoy the benefits of cashback, competitive interest rates, and unparalleled support!

Rate the App

User Reviews

Popular Apps

Editor's Choice