Latest Version

06130000.5.0

April 14, 2025

Central Bancompany

Finance

Android

0

Free

com.dragonflyft.uobapp.centralbank

Report a Problem

More About Central Bank - Business

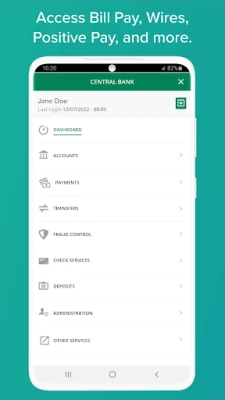

Unlocking the Power of Business Banking: Essential Features for Modern Enterprises

In today's fast-paced business environment, having a reliable banking solution is crucial for success. Business banking offers a suite of features designed to streamline financial management, enhance security, and improve overall efficiency. This article explores the key features of business banking that can help you take control of your finances and drive your business forward.

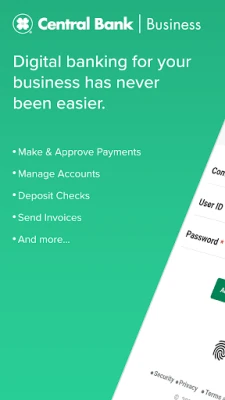

Biometric Login: Secure Access at Your Fingertips

With the rise of digital banking, security is more important than ever. Business banking platforms now offer biometric login options, allowing you to securely access your accounts using Face ID or Touch ID. This advanced technology not only simplifies the login process but also provides an added layer of security, ensuring that only authorized users can access sensitive financial information.

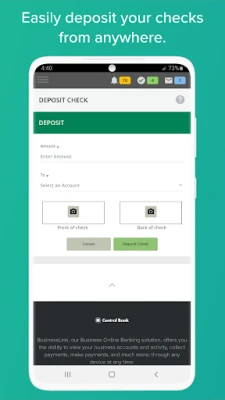

Business Mobile Check Deposit: Convenient Fund Management

Gone are the days of visiting the bank to deposit checks. The Business Mobile Check Deposit feature allows you to deposit funds directly into your account by simply taking a picture of your check. This convenient option saves time and eliminates the need for physical trips to the bank, making it easier than ever to manage your cash flow.

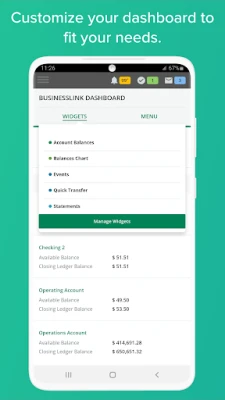

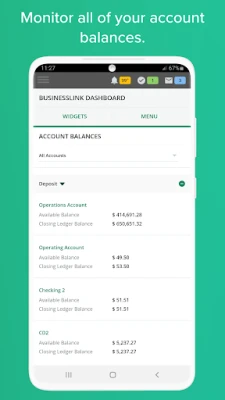

Account Management: Stay Informed and Organized

Effective financial management starts with having a clear view of your accounts. Business banking provides robust account management tools that enable you to monitor your account balances, transaction history, and overall activity. By staying informed, you can make better financial decisions and keep your business on track.

Retrieve Check Images: Easy Access to Financial Records

Need to reference a check you’ve sent or deposited? With the ability to retrieve check images, you can easily access copies of your checks whenever you need them. This feature simplifies record-keeping and ensures that you have all the necessary documentation at your fingertips.

Enhance Your Fraud Protection: Monitor Your Financial Activities

Fraud protection is a top priority for any business. Business banking solutions offer enhanced fraud protection features that allow you to oversee all your financial accounts and cash flow activities. You can monitor balances, transfers, payments, and deposits in real-time. Additionally, you can set controls on payees and payments, requiring secondary user approval for added security.

Go Paperless: Access Your Financial History Anytime

Embrace sustainability and efficiency by going paperless. Business banking allows you to view up to seven years of statement history online. This feature not only reduces clutter but also makes it easy to access your financial records whenever you need them, streamlining your accounting processes.

Manage Your Funds: Approve Transactions with Ease

Managing your funds has never been easier. With business banking, you can approve wire transfers and Automated Clearing House (ACH) payments directly from your mobile device or computer. This level of control ensures that you can handle transactions quickly and efficiently, keeping your business operations running smoothly.

Make Loan Payments: Simplify Your Financial Obligations

Keeping track of loan payments can be challenging, but business banking simplifies this process. You can manage, view balances, and schedule payments for installment loans, mortgage loans, and lines of credit all in one place. This feature helps you stay organized and ensures that you never miss a payment.

Set Up Account Alerts: Stay Updated in Real-Time

In the world of business, timely information is key. With account alerts, you can receive real-time updates for pending deposits, account benchmarks, overdrawn accounts, and transactions exceeding a specific amount. These alerts keep you informed and allow you to take immediate action when necessary.

Optimal Experience: Ensure Compatibility with Your Device

For the best experience, ensure that your device runs on Android version 8.0 or higher. Using an outdated version may limit your access to new features. If you encounter any issues, you can always navigate to the mobile-friendly website through your device's browser for assistance.

In conclusion, business banking offers a comprehensive suite of features designed to enhance your financial management and security. By leveraging these tools, you can streamline your operations, protect your assets, and focus on what truly matters—growing your business.

Member FDIC. Mobile Banking is free, but data and text rates from your mobile carrier may apply. Terms and conditions apply.

Rate the App

User Reviews

Popular Apps

Editor's Choice