Latest Version

3.27.0

September 14, 2025

Central Bank & Trust

Finance

Android

0

Free

com.centralbanktrust.grip

Report a Problem

More About CB&T Wyoming

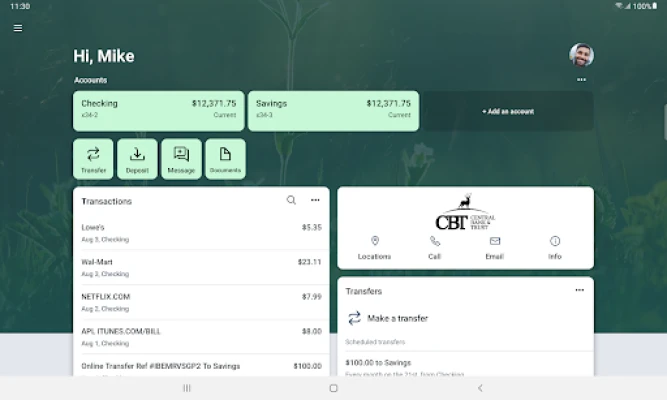

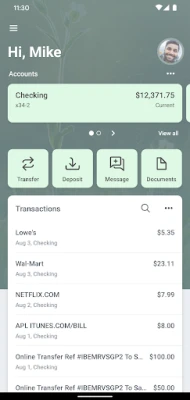

Streamline Your Finances: Essential Features for Organized Transactions

In today's fast-paced world, managing your finances efficiently is crucial. With the right tools, you can keep your transactions organized and gain better control over your financial health. Here’s how you can enhance your financial management with essential features that simplify your banking experience.

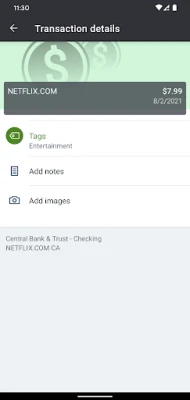

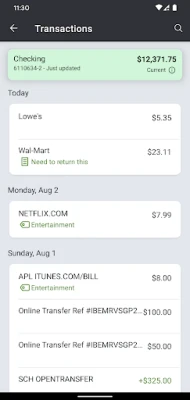

Organize Transactions with Tags, Notes, and Photos

One of the most effective ways to maintain clarity in your financial transactions is by utilizing tags, notes, and photos. By adding tags to your transactions, you can categorize your spending, making it easier to track where your money goes. For instance, you can tag expenses as "groceries," "utilities," or "entertainment," allowing for a quick overview of your spending habits.

Additionally, attaching notes to each transaction provides context. Whether it’s a reminder of why you made a purchase or details about a specific payment, these notes can be invaluable for future reference. Furthermore, capturing photos of receipts and checks ensures that you have a digital record, reducing clutter and making it easier to manage your finances.

Set Up Alerts for Balance Monitoring

Staying informed about your account balance is essential for avoiding overdrafts and managing your budget effectively. By setting up alerts, you can receive notifications when your balance falls below a specified amount. This proactive approach helps you take immediate action, whether it’s transferring funds or adjusting your spending habits.

Make Payments Effortlessly

Whether you need to pay a company for services or send money to a friend, having a streamlined payment process is vital. With modern banking apps, you can make payments quickly and securely. This feature not only saves time but also enhances convenience, allowing you to manage your financial obligations without hassle.

Seamlessly Transfer Money Between Accounts

Managing multiple accounts can be challenging, but transferring money between them should be straightforward. With the right banking tools, you can transfer funds effortlessly, ensuring that your accounts are balanced and your financial goals are met. This feature is particularly useful for budgeting, as it allows you to allocate funds where they are needed most.

Deposit Checks Instantly

Gone are the days of visiting the bank to deposit checks. With mobile banking technology, you can deposit checks in a snap by simply taking a picture of the front and back. This feature not only saves time but also provides a convenient way to manage your finances from anywhere, ensuring that your funds are available when you need them.

Access and Save Monthly Statements

Keeping track of your financial history is essential for effective budgeting and planning. By viewing and saving your monthly statements, you can analyze your spending patterns and make informed decisions about your finances. Digital statements are not only eco-friendly but also easily accessible, allowing you to review your financial activity at any time.

Locate Branches and ATMs Near You

Finding a nearby bank branch or ATM is crucial for managing your cash needs. Most banking apps provide a feature to find branches and ATMs in your vicinity. This functionality ensures that you can access your funds whenever necessary, enhancing your overall banking experience.

Aggregate Your Financial Accounts

Managing multiple financial accounts can be overwhelming. However, by aggregating your financial accounts into one platform, you can gain a comprehensive view of your financial situation. This feature allows you to track all your accounts in one place, making it easier to monitor your overall financial health and make informed decisions.

Conclusion

Incorporating these essential features into your financial management routine can significantly enhance your ability to stay organized and in control of your finances. From tagging transactions to instant check deposits, these tools empower you to manage your money effectively. Embrace these innovations and take charge of your financial future today!

Rate the App

User Reviews

Popular Apps

Editor's Choice