Latest Version

1.21

January 06, 2025

PayDaySay

Finance

Android

0

Free

com.payday.advance.money.loan

Report a Problem

More About Cash Advance: Borrow Money App

Unlock Instant Cash: Your Guide to Easy Money Loans with Payday Say

In today's fast-paced world, unexpected expenses can arise at any moment. Whether it's a medical bill, car repair, or an urgent home repair, having access to quick funds is essential. With the Payday Say app, obtaining an instant loan has never been easier. This article explores how you can secure a payday advance quickly and conveniently.

Why Choose an Instant Cash Advance?

When you find yourself in need of immediate funds, an instant cash advance can be a lifesaver. Here are some compelling reasons to consider using the Payday Say app for your financial needs:

- 24/7 Accessibility: Get funding anytime, anywhere, without the hassle of traditional banking hours.

- Quick and Secure Process: Enjoy a streamlined application process that prioritizes your security.

- Soft Credit Inquiry: Avoid the stress of hard credit checks that can impact your credit score.

- No Paperwork Required: Experience a hassle-free borrowing process with minimal documentation.

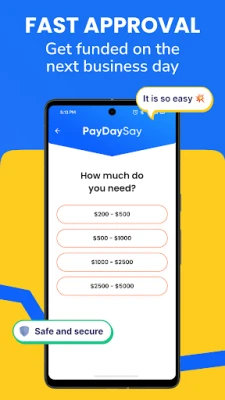

- Flexible Loan Options: Access small cash advances or personal loans tailored to your needs.

How to Get Money Fast with Payday Say

Need cash urgently? Skip the lengthy processes at lending stores or local banks. With the Payday Say app, you can apply for a quick loan from the comfort of your home. Here’s how it works:

- Download the Payday Say app and create an account.

- Submit your basic personal, banking, and financial information.

- Receive a review of your application from a payday lender.

- If approved, funds will be deposited directly into your account.

The approval rate for online payday loans is high, making it a viable option even for those with less-than-perfect credit histories. The Payday Say app specializes in providing loans for individuals with bad credit, ensuring that you can access the funds you need without unnecessary delays.

Understanding Loan Terms and Conditions

When considering a payday advance, it’s crucial to understand the terms associated with your loan. Here’s what you need to know:

- Repayment Period: The minimum loan repayment period is 65 days, while the maximum can extend up to 2 years, depending on the lender.

- Annual Percentage Rate (APR): The maximum APR can reach 35.99%, but this varies based on the lender and your credit profile.

- Unsecured Loans: Most loans offered through the app are unsecured, meaning you won’t need to provide collateral.

It’s important to note that Payday Say does not directly lend money; instead, it connects you with lenders who will provide the funds. Each lender is required to disclose the APR and terms before you finalize your agreement. Be sure to review these details carefully to avoid any surprises.

What Happens If You Can’t Repay on Time?

If you find yourself unable to repay your loan on time, it’s essential to communicate with your lender. Most lenders are willing to work with you to establish a new repayment schedule, ensuring that you can manage your financial obligations without undue stress.

Example of Instant Payday Advance Costs

To give you a clearer picture of what to expect, consider this representative example:

- Loan Amount: $500

- Term: 2 months

- APR: 25%

- Monthly Repayments: $260.99

- Total Amount Due: $521.23

- Total Interest Payable: $21.98

Get Started with Your Instant Cash Advance Today!

If you’re looking for a no credit check loan or a personal loan, the Payday Say app is your solution. Many consumers prefer this option to avoid hard credit inquiries that can negatively impact their scores. With a soft credit pull, you can access the funds you need without worrying about your FICO score.

Don’t wait until it’s too late! Apply for your payday cash advance now and take control of your financial situation. The Payday Say app is designed to make borrowing easy and efficient, so you can focus on what truly matters.

Seize the opportunity to secure an instant cash advance today!

Rate the App

User Reviews

Popular Apps

Editor's Choice