Latest Version

2.0.3

January 19, 2025

C6 Bank

Finance

Android

0

Free

com.c6bank.app.yellow

Report a Problem

More About C6 Yellow

Unlocking Financial Freedom: The Benefits of C6 Yellow Account for Teens

In today's digital age, financial literacy is essential for young individuals. The C6 Yellow Account offers a unique opportunity for teenagers to manage their finances responsibly while enjoying a range of benefits. This article explores the features of the C6 Yellow Account, the process of opening one, and how it empowers young users to take control of their financial future.

What is the C6 Yellow Account?

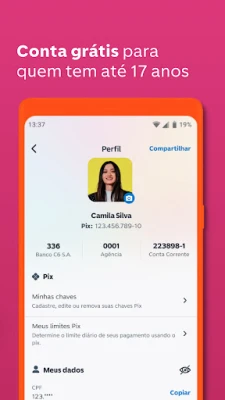

The C6 Yellow Account is a free account designed specifically for individuals aged up to 17 years and 6 months. It provides a safe and user-friendly platform for teens to learn about money management while enjoying the perks of a debit card. With customizable options, this account allows young users to express their individuality through their card design.

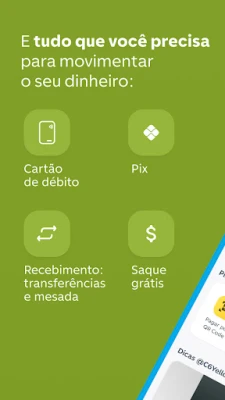

Key Features of the C6 Yellow Account

Free Account Management

Opening a C6 Yellow Account is completely free, making it an accessible option for families looking to introduce their teens to banking. There are no hidden fees, ensuring that young users can focus on learning about finances without worrying about costs.

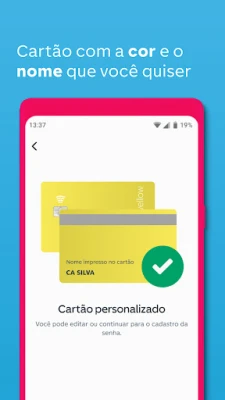

Customizable Debit Card

One of the standout features of the C6 Yellow Account is the ability to personalize the debit card. Teens can choose their preferred color and even add their name, making the card a reflection of their personality. This customization fosters a sense of ownership and responsibility.

Allowance Management

The C6 Yellow Account allows parents or guardians to send money directly to their teen's account as an allowance. This feature promotes financial responsibility, as teens can learn to budget and manage their funds effectively. Parents can monitor transactions, ensuring that their children are making wise spending choices.

Free Withdrawals at Banco24Horas

Teens can enjoy the convenience of free withdrawals at Banco24Horas ATMs. This feature ensures that they have easy access to cash when needed, without incurring additional fees. It encourages responsible cash management while providing flexibility in their spending habits.

Free Pix Transfers

The C6 Yellow Account supports free Pix transfers, allowing users to send and receive money instantly. This feature is particularly beneficial for splitting bills with friends or receiving payments for small jobs. It introduces teens to the concept of digital transactions, enhancing their understanding of modern banking.

Transaction Notifications

Every transaction made with the C6 Yellow Account is accompanied by an SMS notification sent to the responsible adult. This feature ensures that parents are kept in the loop regarding their teen's spending habits, fostering open communication about finances. Additionally, users can request account statements through the C6 Bank app, providing transparency and accountability.

How to Open a C6 Yellow Account

Opening a C6 Yellow Account is a straightforward process that requires the involvement of a legal guardian. Here’s how to get started:

- Legal Guardian Requirement: The account can only be opened by a legal guardian who already has an account with C6 Bank.

- Requesting the Account: The guardian must log into their C6 Bank account and navigate to the "C6 Yellow" section in the app. From there, they can follow the prompts to initiate the account opening process.

- New Users: If the guardian does not have a C6 Bank account, they can easily download the C6 Bank app from their mobile app store and follow the registration steps.

Important Note: The C6 Yellow Account is exclusively available for individuals aged 17 years and 6 months or younger who possess a CPF (Cadastro de Pessoas Físicas).

Download the C6 Yellow App Today!

Empower your teen with the tools they need to succeed financially. Download the C6 Yellow app and take the first step towards financial independence. With its user-friendly interface and robust features, the C6 Yellow Account is the perfect introduction to banking for young individuals.

In conclusion, the C6 Yellow Account not only provides essential banking services but also fosters financial literacy among teens. By offering a customizable debit card, free withdrawals, and instant money transfers, it equips young users with the skills they need to navigate their financial futures confidently. Start your journey today and watch your teen thrive in their financial endeavors!

Rate the App

User Reviews

Popular Apps

Editor's Choice