Latest Version

1.5.0

May 13, 2025

BwaTech

Finance

Android

0

Free

sa.bwatech.bwa.invest

Report a Problem

More About Bwa Invest

Simplifying Investment Funds: Making the Market Accessible for Retail Investors

In today's fast-paced financial landscape, the investment funds market can often seem overwhelming, especially for average retail investors. The complexity of various investment options, coupled with the jargon often used in the industry, can create barriers that prevent individuals from making informed decisions. This article aims to demystify the investment funds market and provide valuable insights that empower retail investors to navigate their investment journeys with confidence.

Understanding the Investment Funds Market

The investment funds market encompasses a wide range of financial products designed to pool money from multiple investors to purchase securities. These funds can include mutual funds, exchange-traded funds (ETFs), and hedge funds, each with its own unique characteristics and investment strategies. For retail investors, understanding these differences is crucial in making informed investment choices.

Breaking Down the Complexity

One of the primary challenges retail investors face is the complexity of investment options available. With thousands of funds to choose from, it can be daunting to determine which ones align with individual financial goals and risk tolerance. To simplify this process, consider the following strategies:

- Educate Yourself: Take the time to learn about different types of investment funds, their structures, and how they operate. Online resources, webinars, and financial literacy programs can provide valuable information.

- Utilize Comparison Tools: Many financial websites offer comparison tools that allow investors to evaluate different funds based on performance, fees, and risk levels. These tools can help streamline the decision-making process.

- Seek Professional Guidance: Financial advisors can offer personalized advice tailored to your specific financial situation. They can help clarify complex concepts and recommend suitable investment options.

Value-Added Services for Retail Investors

To further simplify the investment decision-making process, many financial institutions and platforms are now offering value-added services designed specifically for retail investors. These services can enhance the overall investment experience and provide additional support:

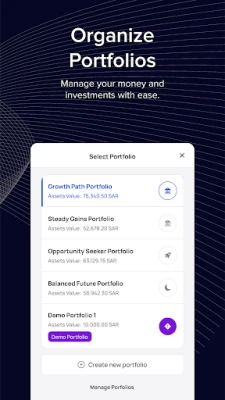

1. User-Friendly Platforms

Modern investment platforms are designed with the user experience in mind. Intuitive interfaces, educational resources, and easy navigation make it simpler for retail investors to manage their portfolios and execute trades. Look for platforms that offer mobile access, allowing you to monitor your investments on the go.

2. Robo-Advisors

Robo-advisors have gained popularity in recent years as a cost-effective solution for retail investors. These automated platforms use algorithms to create and manage investment portfolios based on individual risk profiles and financial goals. By leveraging technology, robo-advisors can provide personalized investment strategies without the high fees associated with traditional financial advisors.

3. Educational Resources

Many investment platforms now offer a wealth of educational resources, including articles, videos, and webinars. These materials can help retail investors understand market trends, investment strategies, and risk management techniques. By staying informed, investors can make more confident decisions.

Empowering Retail Investors

Ultimately, the goal of simplifying the investment funds market is to empower retail investors. By providing accessible information and valuable services, individuals can take control of their financial futures. Here are some key takeaways for retail investors:

- Set Clear Financial Goals: Define your investment objectives, whether it's saving for retirement, funding a child's education, or building wealth. Clear goals will guide your investment choices.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversification can help mitigate risk and enhance potential returns. Consider a mix of asset classes, including stocks, bonds, and alternative investments.

- Stay Informed: Keep up with market trends and economic news. Understanding the broader financial landscape can help you make timely and informed investment decisions.

Conclusion

The investment funds market may seem complex, but with the right tools and resources, retail investors can navigate it successfully. By simplifying the investment process and providing value-added services, financial institutions can help individuals make informed decisions that align with their financial goals. As you embark on your investment journey, remember that knowledge is power, and taking the time to educate yourself will pay dividends in the long run.

Rate the App

User Reviews

Popular Apps

Editor's Choice