Latest Version

6.8.2

December 24, 2024

NetSpend

Finance

Android

0

Free

com.netspend.mobileapp.brinksarmored

Report a Problem

More About Brink's Armored Account

Maximize Your Financial Flexibility with Brink's Armored™ Account

In today's fast-paced world, managing your finances efficiently is crucial. The Brink's Armored™ Account offers a range of features designed to enhance your financial experience. From earning rewards to seamless money transfers, this account is tailored to meet your needs. Let’s explore the key benefits and important information you need to know.

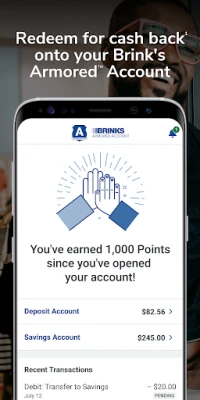

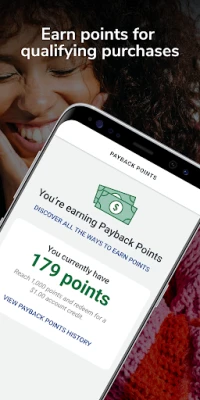

Earn Rewards with Every Purchase

With the Brink's Armored™ Account, you can earn one point for every dollar spent on qualifying signature purchase transactions. This means that your everyday spending can translate into valuable rewards. Keep in mind that certain restrictions apply, so be sure to review the program's terms and conditions for complete details on point earning and redemption. This offer is not affiliated with Pathward®, N.A., or Mastercard, and is subject to legal restrictions.

Access to No-Cost ATM Withdrawals

Finding an ATM that suits your needs is easy with the Brink's Money Network. You can enjoy one no-cost ATM withdrawal per month at any Brink’s Money Network ATM. The first withdrawal is free, and any ATM-owner surcharge fee will be credited back to your account. To locate the nearest ATM, simply visit your Online Account Center. Note that other ATM withdrawals may incur additional fees, so always check your Deposit Account Agreement for details.

Track Your Finances with Ease

Keeping tabs on your financial activity is essential. The Brink's Armored™ Account allows you to view your transaction history and current balance at any time. This feature ensures that you stay informed about your spending habits and account status, empowering you to make better financial decisions.

Effortless Money Transfers

Sending money to friends and family has never been easier. With the Brink's Armored™ Account, you can transfer funds without incurring an Account-to-Account Transfer Fee when done online. However, if you choose to use a Customer Service Agent, a fee of $4.95 will apply. Always be aware of the availability of funds, as this can affect your transactions. For more information, refer to your Deposit Account Agreement.

Convenient Savings Account Options

Opening a Savings Account linked to your Brink's Armored™ Account is a straightforward process. There is no minimum balance required to open this optional account, making it accessible for everyone. You can withdraw funds from your Savings Account through your Brink’s Armored™ Account, with a maximum of six transfers allowed per calendar month. Your savings are protected, as all funds deposited are insured by the FDIC through Pathward, N.A., up to the current limit of $250,000.00.

Important Information for Account Opening

When opening a Brink's Armored™ Account, it’s essential to understand the identification requirements mandated by the USA PATRIOT Act. This legislation aims to combat terrorism funding and money laundering. You will need to provide your name, address, date of birth, and government ID number. Additional documentation, such as a driver's license, may be requested to verify your identity. If your identity cannot be confirmed satisfactorily, your account may not be opened or could be closed if previously funded. Be aware that your account is subject to fraud prevention measures at any time, with or without prior notice.

Conclusion: A Smart Choice for Your Financial Needs

The Brink's Armored™ Account is designed to provide you with flexibility, security, and rewards. With features like point earning on purchases, no-cost ATM withdrawals, easy money transfers, and a convenient savings option, it stands out as a smart choice for managing your finances. Ensure you understand the terms and conditions associated with your account to maximize its benefits. Start your journey towards better financial management today!

For more information, visit the official Brink's website or contact customer service for assistance. Your financial future is in your hands, and the Brink's Armored™ Account is here to help you navigate it with confidence.

Rate the App

User Reviews

Popular Apps

Editor's Choice